McDonald’s Corporation (NYSE:MCD) caught many eyeballs after it announced the retirement of Sheila A. Penrose from its Board. Meanwhile, the foodservice retailer disclosed that key executives from Marriott International, Inc. (NASDAQ:MAR), Johnson & Johnson (NYSE:JNJ), and Salesforce, Inc. (NYSE:CRM) will soon act as directors in the company.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

It is worth noting here that shares of the $193.5-billion burger specialists slipped 1.4% to close at $262.95 on Monday. The last trading price of MCD is close to the upper end of the stock’s 52-week price range of $217.68-$271.15.

Inside the Headlines

McDonald’s noted that the retirement of Sheila A. Penrose will be effective September 30, 2022. On her departure, MCD’s Chairman of the Board, Enrique Hernandez, Jr., said, “For over 15 years, Sheila has been a deeply committed and highly valued member of our Board.”

“Through her leadership of the Sustainability and Corporate Responsibility Committee, Sheila has overseen McDonald’s critical progress against our ambitious climate, responsible sourcing and diversity, equity and inclusion goals, positioning us as a leader in the industry,” Hernandez added.

Meanwhile, McDonald’s announced that Anthony Capuano, the CEO of Marriott; Jennifer Taubert who serves as the Executive Vice-President and Worldwide Chairman of Pharmaceuticals at JNJ; and Amy Weaver, the President and CFO of CRM, will start working as directors from October 1.

On the appointment of the new directors, MCD’s President and CEO, Chris Kempczinski, said, “…I’m excited to welcome Tony, Jennifer and Amy to McDonald’s. They are inspiring leaders with a demonstrated track-record leading large, complex organizations. Their experience stewarding some of the world’s most respected global brands will benefit McDonald’s greatly and position the Company for continued growth.”

Is MCD Stock a Buy?

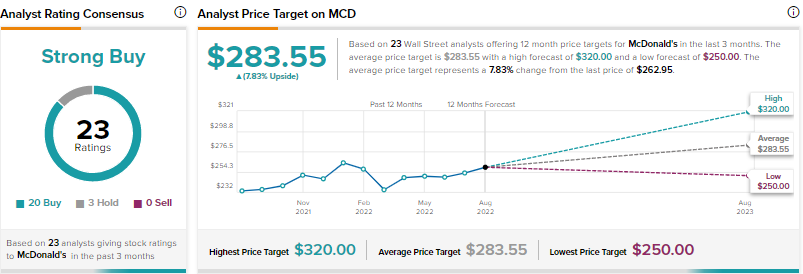

On TipRanks, analysts are unanimously optimistic about the prospects of MCD, which commands a Strong Buy consensus rating based on 20 Buys and three Holds. MCD’s average price target of $283.55 suggests 7.83% upside potential from the current level.

Also, the company’s financial performance has been impressive, with better-than-expected earnings in three quarters versus earnings miss in one. The average earnings surprise was +3.95% for the last four quarters. The consensus estimate for the third quarter is $2.60 per share, above the previous quarter’s reported figure of $2.55 per share.

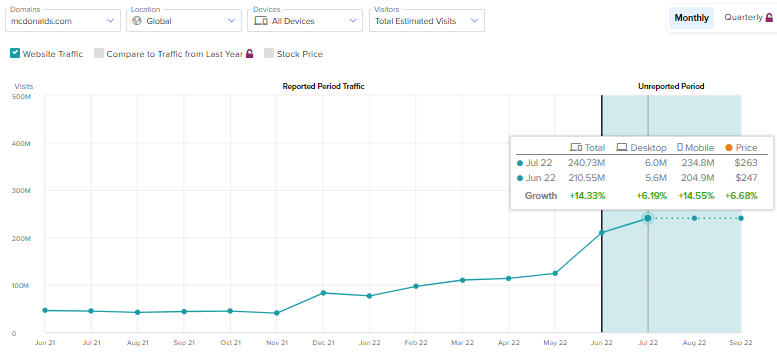

It is worth noting here that the traffic to MCD’s websites increased 14.33% month-over-month in July 2022. Also, website visits have expanded 181.93% so far this year.

Read full Disclosure