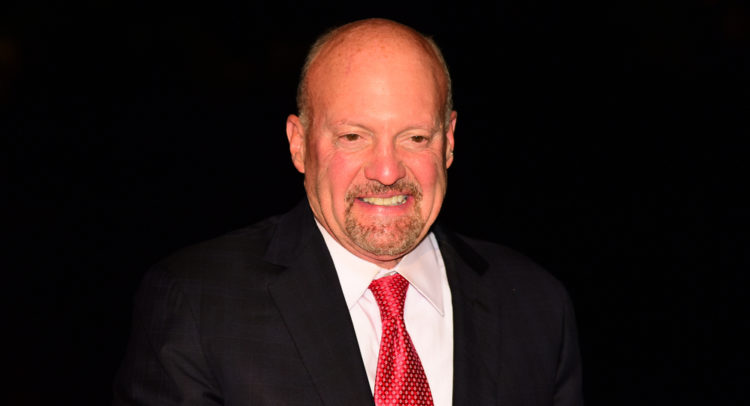

Popular host of Mad Money on CNBC, Jim Cramer, has been firing tweets at expert hedge fund manager Cathie Wood’s recent investment choices in her ARK Invest line of funds.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

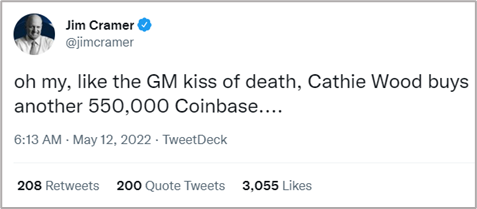

Cathie Wood added an additional 546,579 shares of crypto exchange Coinbase Global (COIN) to three of her funds on Wednesday.

Coinbase’s disappointing Q1FY22 results on Tuesday were followed by a massive 26.4% slump in stock the following day, which Cathie Wood used as an attractive buying opportunity.

Cathie also bought shares of fintech platform Block (SQ), online sports gambling company DraftKings (DKNG), and 3-dimensional platform Matterport (MTTR). Cramer even went on to state that Cathie’s flagship fund ARKK has no humility, for the series of purchases made.

Cramer also bashed Cathie’s decision to sell $12.7 million worth of Tesla (TSLA) shares to buy nearly $6.1 million worth of General Motors (GM) stock for the Ark Autonomous Technology fund.

Cramer’s tweet was hounded by several replies reminding him of the time when he was hopelessly bullish on COIN stock back in 2021. A few even applauded Cathie for standing by her conviction. Many brutally trolled him for his wrong investment choices, including his bullish take on Bear Stearns in 2008, just before its colossal collapse.

“A five year time horizon is a total cop-out, just an unfair, hokum way to attract money and I despise it. Where was the 5 year in Draft Kings or Palantir or Teledoc. Do some homework and stop selling selling and selling, New word for ARKK lexicon: Wrong,” Cramer quoted, dissenting Cathie’s investment thesis.

While some agreed with Cramer’s views, a few stood by Cathie’s investment philosophy, and only time will tell which way the tides will turn!

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure