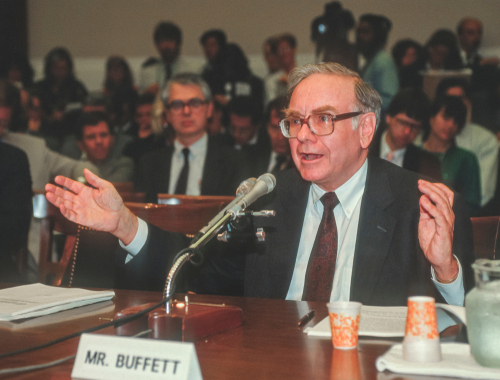

The maestro of value investing, Warren Buffett, has taken a major stake in HP (HPQ).

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

Mr. Buffett said in February, “Whatever our form of ownership, our goal is to have meaningful investments in businesses with both durable economic advantages and a first-class CEO.”

Based on his principles, Warren Buffett’s Berkshire Hathaway (BRK.B) recently purchased a more than 11% stake in HP, marking another move into the computing space. According to the latest filing, Berkshire Hathaway bought almost 121 million HPQ shares, valued at $4.2 billion.

As a result of the purchase, Berkshire becomes HP’s single largest shareholder. HPQ rose 14.8% on Thursday.

Aside from the HP stake, Buffett has made a number of other investments this year. Just last month, Berkshire Hathaway agreed to buy Alleghany Corporation (Y) for $11.6 billion in cash and boosted its stake in oil-and-gas producer Occidental Petroleum (OXY) to 15%.

Why did Warren Buffett choose HP?

HP is a classic value stock with a measurable competitive advantage that generates a lot of cash. Under CEO Enrique Lores’ leadership, HP has performed nicely as his operational turnaround continues to bear fruit.

HP recently reported fiscal first-quarter results that were significantly higher than expected, owing to robust sales of PCs and printers. In addition, the corporation returned $1.8 billion to stockholders in the form of dividends and share repurchases.

Furthermore, HP raised its full-year adjusted EPS outlook to a range of $4.18 to $4.38 versus the consensus expectation of $4.17 per share. The corporation did warn, though, that Russia’s invasion of Ukraine could negatively impact the second quarter.

Notably, HPQ has been a dividend payer as well as a dividend grower. The most recent dividend raise was in November when the quarterly payout was increased by 29% to 25 cents per share.

Overall, HP stock has a Hold consensus rating based on 1 Buy, 5 Holds, and 2 Sells. The average HP price forecast of $36 implies 9% downside potential.

Buffett’s Other Significant Holdings

Apple (AAPL), financial equities, and consumer staples firms have accounted for a large portion of Warren Buffett’s portfolio.

Apple is Buffett’s largest investment, accounting for 47.6% of his total portfolio. Berkshire Hathaway owned 5.6% of the company as of the end of December 2021. Bank of America Corporation (BAC) is Buffett’s second-largest holding, accounting for 13.6% of his portfolio as of Q1 2022.

Let’s take a look at how Apple and Bank of America have performed so far:

Apple

Apple’s business revolves mostly around the iPhone. However, its Services and Wearables segments are now cash cows, which should drive additional top-line growth for the company.

Further, the company’s long-term growth prospects are bolstered by its concentration on rapidly emerging attractive business opportunities, including driverless vehicles and augmented reality/virtual reality (AR/VR) technology.

In the last three months, 23 analysts have given Apple a Buy rating, and five analysts have assigned it a Hold. With a Strong Buy analyst rating consensus and an average AAPL price target of $193.36, the implied upside is 12.3%.

Moreover, APPL has a “Perfect 10” Smart Score rating, supported by positive sentiment by bloggers and investors, increased purchases by hedge funds, and 7.7% asset growth over the past twelve months.

APPL has also gained 33% in the last year, with earnings exceeding expectations in the most recent quarter.

Bank of America

Bank of America has been in business for nearly a century and has branches throughout the country.

Bank of America, which is very asset sensitive, is well-positioned to benefit from the multiple interest rate hikes on the horizon. Furthermore, Bank of America has significantly increased its deposit base, allowing it to grow margins when interest rates rise. In addition, its attempts to digitize banking processes are gaining momentum.

Ten analysts have given Bank of America a Buy rating in the last three months, while five have assigned it a Hold. With a Moderate Buy analyst rating consensus and an average BAC price target of $51.23, the implied upside is 30%.

The stock has risen 1% year-over-year, with earnings beating expectations over the past seven quarters. The company also consistently pays dividends and has a payout ratio of 22.67% and a dividend yield of 2.01%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure