Peloton Interactive (PTON) was quite in vogue as a top fitness play during the pandemic. Featuring more than 6.2 million members, PTON stock saw a rise of around 440% in 2020.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

However, after clocking an all-time high in January 2021, PTON stock continued on a steep decline. As analysts remain uncertain about the company’s future, recent buyout buzz caused quite a stir in this stock.

So far, reports have mentioned Amazon (AMZN) and Nike (NKE) as potential buyers. However, these talks are just preliminary, and Peloton has yet to establish a formal sale process.

I remain neutral on PTON stock, for a number of reasons.

Peloton Preparing for Sale

In early February, Reuters broke the news that Amazon may have gathered advice on a potential bid for this maker of fitness hardware products. As a result, PTON stock soared higher, posting solid gains.

This news was followed by the announcement that Peloton would be undertaking a restructuring. As part of this restructuring, the company’s CEO and co-founder John Foley would be stepping down. This further triggered an immediate positive reaction from the market.

Peloton was quick to appoint a new CEO, Barry McCarthy, who also happens to be a former executive with Netflix (NFLX) and Spotify (SPOT). He worked as a CFO at the previous two companies.

However, this restructuring, which resulted in the shedding of approximately 2,800 jobs, doesn’t necessarily signal that Peloton is that eager to sell. Typically, companies that are in the process of fixing things and turning over management aren’t doing so to force a sale.

Since this initial stock price surge in early February, Peloton has given up most of its gains. It appears the market is now viewing PTON stock as a turnaround story, rather than a takeover candidate.

Will Peloton Be Taken Over?

As of right now, it appears speculation has died down on takeover bids materializing. While Peloton’s platform could be enticing to major players like Amazon or Nike, the question is what the right price would be.

Additionally, analysts believe that Peloton is not likely to consider a sale unless there is significant internal pressure. Foley’s management team featured immense ability to conquer its long-term goals.

Other experts argue that Big Tech’s regulations in Washington D.C. might chill the probability of Amazon or another large company closing this deal. For instance, the Federal Trade Commission recently charged to block an acquisition by Nvidia.

Thus, Nike could be a candidate with the ability and means to complete a deal. Whether Nike would want to enter into a bidding war with other players is an entirely different question, but right now, it appears there’s little interest (at least what’s being publicly discussed).

Peloton’s subscription-as-a-service business model is certainly compelling to many potential acquirers. However, this is a difficult company to integrate into any conglomerate, and would require a perfect partner. There are many who were skeptical of this news initially, and they appear to be right at this point in time.

Wall Street’s Take

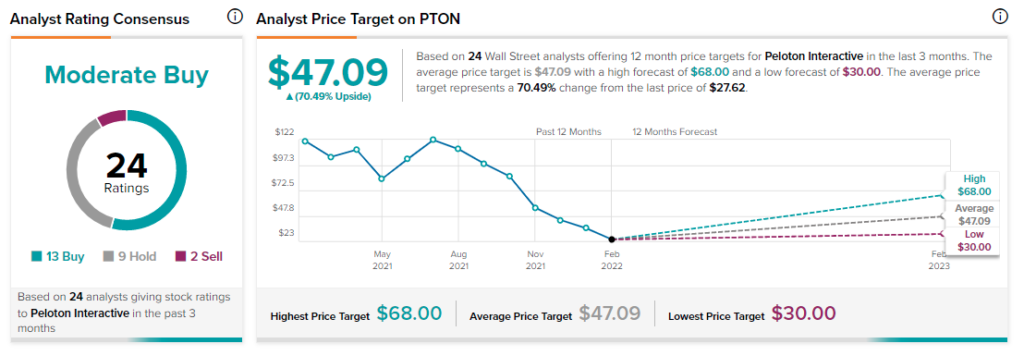

As per TipRanks’ analyst rating consensus, Peloton is a Moderate Buy. Out of 24 analyst ratings, there are 13 Buy recommendations, nine Hold recommendations, and two Sell recommendations.

The average Peloton price target is $47.09. Analyst price targets range from a high of $68 per share to a low of $30 per share.

Bottom Line

Takeover talk is always exciting, and Peloton is a great example of what can happen when investors get carried away with the possibilities. Ultimately, Peloton is a difficult company for acquirers to integrate.

That said, as a “fixer-upper,” perhaps there’s some value in Peloton worth considering. This company’s management team is sharpening its pencil, looking to drive profitability.

Whether these moves will improve the company’s fundamentals, or whether churn eats away at Peloton’s lead, remains to be seen.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.