TipRanks’ website traffic screener tracks changes in consumer behavior and helps gauge the impact of those changes on a company’s financials and stock price. Furthermore, the tool tracks all of a company’s domains and subdomains (which are sections of the company’s main website and relevant to its financials), which is unique to TipRanks.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Using this website traffic tool, let’s look at the 10 most-visited high-end luxury brands’ websites in June. Learn how Website Traffic can help you research your favorite stocks.

This is important, as looking at websites that scored the most visits compared to the prior year could be a solid starting point to identify top businesses that are outgrowing others.

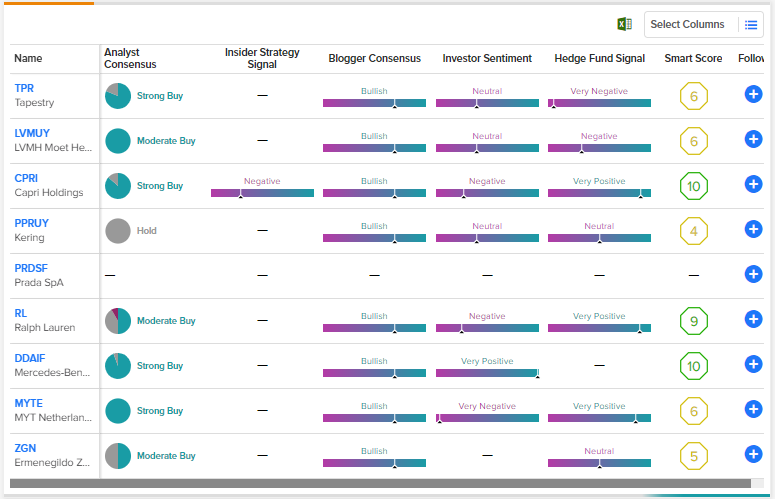

Moreover, we have combined web visits with TipRanks’ other valuable datasets, such as analysts’ recommendations and insider and hedge fund signals, to shed more light on these high-end luxury companies’ business growth.

Top 10 Most-Visited Websites in June 2022

Ermenegildo Zegna (NYSE:ZGN)

Rank: #10

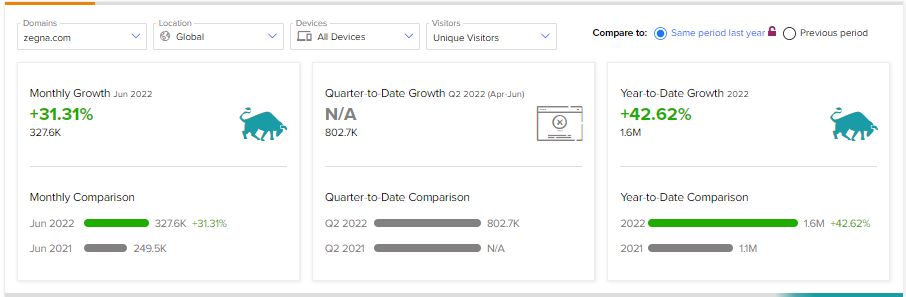

Year-over-year Traffic Growth: 31.31%

Italian luxury fashion house Ermenegildo Zegna designs and sells luxury menswear and accessories under the Zegna brand. Meanwhile, through its Thom Browne brand, it sells women’s wear, menswear, and accessories.

Despite macro and geopolitical headwinds, the company continued to exhibit significant appeal among consumers and started 2022 on a solid note. Meanwhile, TipRanks’ website traffic tool shows that the number of visits to zegna.com increased 31.31% year-over-year in June 2022. Moreover, traffic has grown by 42.62% year-to-date, setting the stage for further solid financial performance.

ZGN stock sports a Moderate Buy rating consensus on TipRanks based on one Buy and one Hold recommendation. Further, the analysts’ average price target of $11.80 indicates 6.79% upside potential over the next 12 months. While analysts are cautiously optimistic, hedge funds sold ZGN 289.2K shares in the last three months.

ZGN stock has a Neutral Smart Score of 5 out of 10, due to the uncertainty around the speed of recovery in China and ongoing macro headwinds.

MYT Netherlands (NYSE:MYTE)

Rank: #9

Year-over-year Traffic Growth: 37.51%

MYT Netherlands is the parent company of Mytheresa Group, which operates a luxury multi-brand digital platform. TipRanks’ website traffic tool shows that the number of visits to mytheresa.com was up 37.51% year-over-year in June 2022. Meanwhile, traffic has increased by 8.12% year-to-date.

The improvement in web traffic indicates that MYT continues to benefit from the shift in luxury shopping towards online platforms. Further, MYT’s management is confident in its ability to deliver profitable growth in the short and long term.

MYTE stock has received four Buy recommendations for a Strong Buy rating consensus. Moreover, the analyst consensus price target of $15.50 implies 27.26% upside potential.

Along with analysts, MYTE stock has positive indicators from hedge funds and financial bloggers. Hedge funds added 190K shares of MYTE stock in the last three months. However, TipRanks’ investors are negative on MYTE stock, and 2.8% of these investors have lowered their holdings in one month. MYTE stock has a Neutral Smart Score of 6 out of 10.

Mercedes-Benz Group (DMLRY) (DDAIF)

Rank: #8

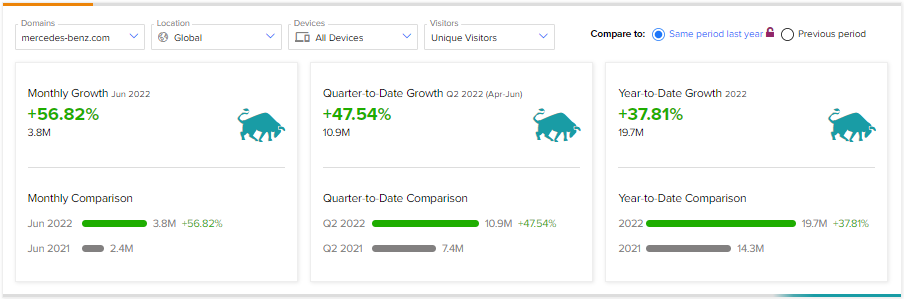

Year-over-year Traffic Growth: 56.82%

Mercedes-Benz AG is a German automaker and the world’s leading supplier of premium and luxury cars and vans. TipRanks’ website traffic tool shows that the number of visits to Mercedes-benz.com was up 56.82% year-over-year in June 2022. Further, traffic has risen by 37.81% year-to-date.

The increase in website visits indicates that the company’s unit sales could improve. Management stated that geopolitical and supply constraints continue to impact unit sales and the overall auto market. However, it expects a slight year-over-year increase in car unit sales compared to the prior year.

Mercedes-Benz ADR DDAIF has received 17 Buy and one Hold recommendations for a Strong Buy rating consensus. Further, analysts’ average price target of $89.40 implies 60.88% upside potential.

With positive signals from analysts, bloggers, and retail investors, Mercedes-Benz ADR (American depositary Receipt) DDAIF sports a maximum Smart Score of 10. Meanwhile, its unsponsored ADR (the U.S. traded instrument of a foreign company without its formal approval) DMLRY has an Outperform Smart Score of 8 out of 10.

Ralph Lauren (NYSE:RL)

Rank: #7

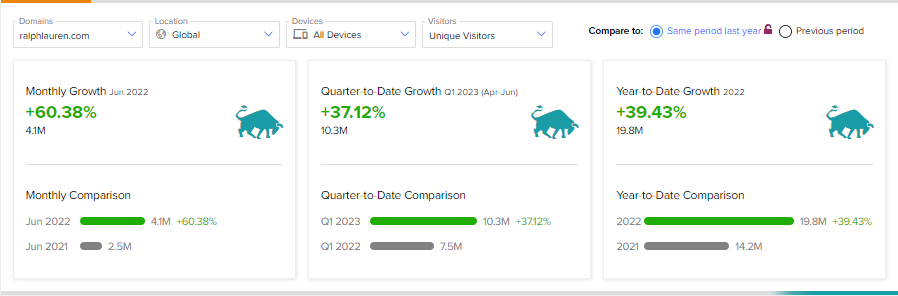

Year-over-year Traffic Growth: 60.38%

Ralph Lauren offers premium lifestyle products, including apparel, accessories, hospitality, and fragrances. TipRanks’ website traffic tool indicates that the company is navigating the dynamic macro environment well. Per the tool, visits to ralphlauren.com were up 60.38% year-over-year in June 2022. Moreover, traffic has increased by 39.43% year-to-date.

RL stock has six Buy, five Hold, and one Sell recommendations for a Moderate Buy rating consensus. Further, analysts’ average price target of $118.64 implies 22.38% upside potential.

Analysts’ cautious stance reflects the near-term headwinds from government-mandated lockdowns in China and uncertainty related to the recovery in each of its markets. Nevertheless, management is upbeat and expects to deliver high-single-digit revenue growth in FY23.

RL stock has positive indicators from hedge funds and retail investors. Moreover, TipRanks’ investors are also optimistic about the stock. Overall, RL stock has an Outperform Smart Score of 9 out of 10.

Prada S.p.A (PRDSF)

Rank: #6

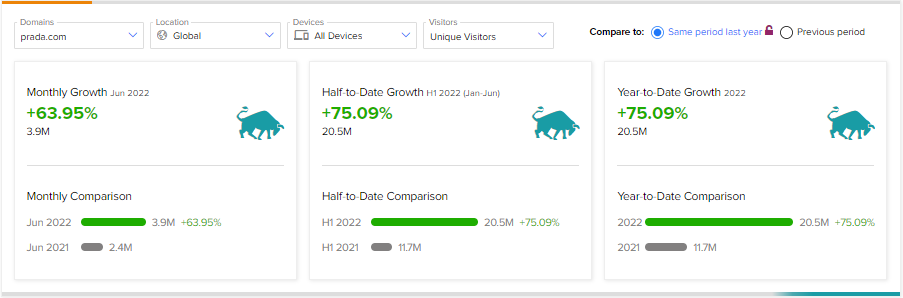

Year-over-year Traffic Growth: 63.95%

The Prada Group, through its multiple luxury brands (Prada, Miu Miu, Church’s, Car Shoe, and Pasticceria Marchesi), manufactures and distributes apparel, leather goods, footwear, eyewear, and fragrances across the world.

According to TipRanks’ website traffic tool, the number of visits to prada.com was up 63.95% year-over-year in June 2022. Moreover, traffic has increased by 75.09% in the first half of 2022.

The increase in website traffic suggests that the momentum in online sales has continued in 2022. It’s worth mentioning that Prada recorded stellar online sales in FY21. Furthermore, it witnessed strong performance across all its product categories.

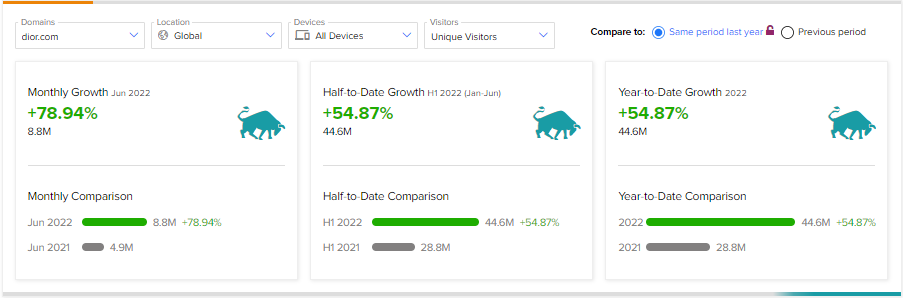

Christian Dior (GB:0NPL)

Rank: #5

Year-over-year Traffic Growth: 78.94%

Christian Dior is a French company offering luxury lifestyle products, including fashion, leather goods, wines and spirits, cosmetics, perfumes, watches, and jewelry, worldwide. Dior started 2022 on a solid note, with the U.S. and European regions registering double-digit growth.

The TipRanks’ website traffic tool indicates that the momentum in its business has carried over in Q2. According to the tool, visits to dior.com were up 78.94% year-over-year in June 2022. Moreover, traffic has increased by 54.87% year-to-date.

The spike in web visits suggests that the underlying demand trends remain strong despite the adverse macro and geopolitical environment. Christian Dior delivered strong organic sales in Q1. Meanwhile, solid traffic trends indicate that Q2 could be no different.

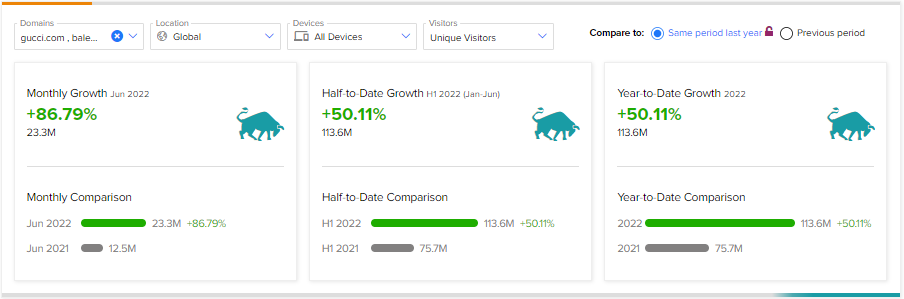

Kering (PPRUY)

Rank: #4

Year-over-year Traffic Growth: 86.79%

Kering is a France-based luxury house that owns multiple renowned brands, including Gucci, Saint Laurent, Bottega Veneta, and Balenciaga, to name a few.

The TipRanks’ website traffic tool indicates that after the solid Q1, demand trends have remained resilient. Per the tool, visits to kering.com and its 11 other websites were up 86.79% year-over-year in June 2022. Moreover, traffic has increased by 50.11% year-to-date.

The strong traffic trends indicate that the Kering group could deliver healthy growth in Q2. However, its exposure to China and government-mandated lockdowns could remain a drag.

Kepler Capital analyst Marco Baccaglio has rated Kering stock a Hold. However, hedge funds have added 890.5K PPRUY shares in the last three months. PPRUY stock has received a Neutral Smart Score of 4 out of 10.

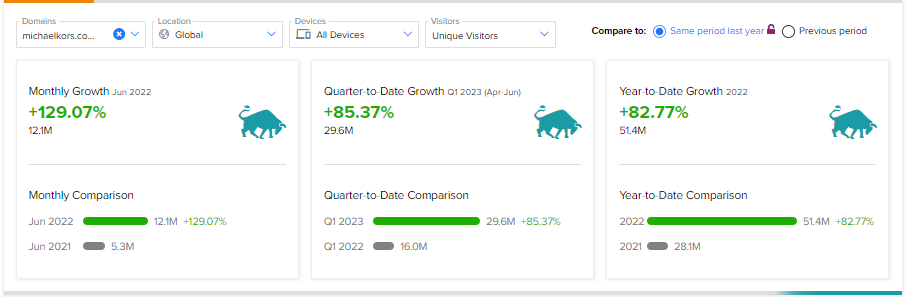

Capri Holdings (NYSE:CPRI)

Rank: #3

Year-over-year Traffic Growth: 129.07%

Capri Holdings is a luxury fashion group comprising iconic brands like Versace, Michael Kors, and Jimmy Choo. Thanks to the strong demand, CPRI delivered its highest revenue, gross margin, and EPS in its history in FY22. Furthermore, TipRanks’ website traffic tool shows that FY23 has started on a solid note for the company.

According to TipRanks’ website traffic tool, the number of visits to its three websites (michaelkors.com, Versace.com, and jimmychoo.com) was up 129.07% year-over-year in June 2022. Moreover, traffic has increased by 82.77% year-to-date.

CPRI’s management is upbeat and expects to deliver record revenue and EPS in FY23. Also, barring near-term macro headwinds, it expects to deliver double-digit growth in the long term.

CPRI stock has a Strong Buy rating consensus on TipRanks based on 13 Buy and two Hold recommendations. Further, analysts’ average price target of $69.67 implies 45.97% upside potential.

Besides for analysts, hedge funds and bloggers also maintain a positive view of CPRI stock. Hedge funds have increased their holdings in CPRI stock by 769.6K shares in the last quarter. However, insiders have sold CPRI stock worth 188.7K during the same period. Nevertheless, CPRI stock has a maximum Smart Score of 10 out of 10.

LVMH Moët Hennessy Louis Vuitton (LVMUY)

Rank: #2

Year-over-year Traffic Growth: 131.17%

LVMH Moët Hennessy Louis Vuitton is the world’s leading luxury fashion holding company that owns several iconic brands such as Louis Vuitton, Moët & Chandon, Hennessy, DKNY, Fendi, Sephora, Givenchy, and Marc Jacobs, to name a few.

LVMH registered solid organic sales with double-digit growth across all business groups, excluding wines and spirits. The wine and spirits business is taking a hit from supply constraints.

Per the TipRanks’ website traffic tool, the number of visits to moet.com and its nine other websites jumped 131.17% year-over-year in June 2022. Further, visits increased by 56.55% in the first half of this year. The solid web traffic trends indicate that momentum in its business groups could sustain in Q2.

Kepler Capital analyst Marco Baccaglio has rated LVMUY stock a Buy. However, hedge funds have reduced their holdings by 162K LVMUY shares in the last quarter. It sports a Neutral Smart Score of 6 out of 10.

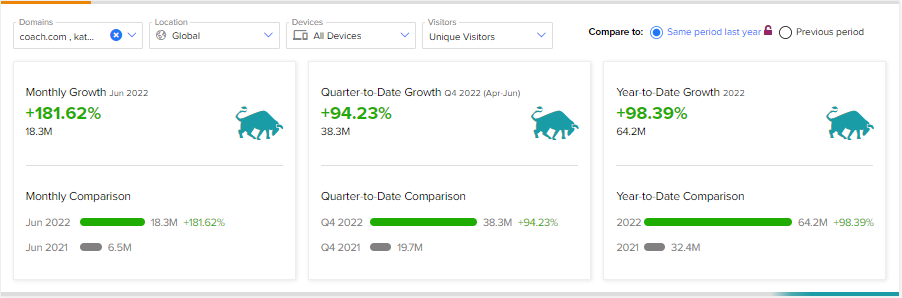

Tapestry (NYSE:TPR)

Rank: #1

Year-over-year Traffic Growth: 182.62%

Tapestry is a luxury fashion holding company that operates through three primary brands – Coach, Kate Spade, and Stuart Weitzman. It continues to benefit from increased customer demand across its brands, which is well reflected in the spike in its website visits.

According to TipRanks’ website traffic tool, the number of visits to coach.com and its two other websites (katespade.com and stuartweitzman.com) was up 181.62 year-over-year in June 2022. Moreover, traffic has increased by 98.39% year-to-date.

Thanks to the stellar demand, Tapestry expects to return about $1.9 billion to shareholders in FY22.

TPR stock has a Strong Buy rating consensus on TipRanks based on 13 Buy and three Hold recommendations. Further, their price target of $44.56 implies 31.25% upside potential.

While analysts are bullish, hedge funds have lowered their exposure to TPR stock. Hedge funds have sold 849.4K TPR shares in the last three months. Overall, TPR stock has a Neutral Smart Score of 6 out of 10.

Bottom Line

The website visit trends for these luxury fashion houses indicate they continue to attract customers despite the challenging macro and geopolitical environment. However, in the near-term, exposure to China and supply constraints could impact the June quarter’s performance.

Built with the help of TipRanks’ stock comparison tool, here is the summary of how these stocks stack up on TipRanks’ valuable datasets.

Continue to watch this space for updated website visit data for these high-end luxury companies.

Learn how website traffic can help you research your favorite stocks.