Australian consumers continue to spend up, bolstering retail operators amid recession fears. Harvey Norman Holdings Ltd (ASX:HVN), Lovisa Holdings Ltd. (ASX:LOV), and Universal Store Holdings Ltd. (ASX:UNI) are among analysts’ favourite ASX retail shares, according to TipRanks insights.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

Retail sales rise for eighth straight month in August

Australian retail sales increased 0.6% in August, marking eight consecutive months of growth in the sector, according to the latest Australian Bureau of Statistics report. Food and department stores were among the strongest retail segments in August.

The report shows resilient consumer spending amid rapidly rising interest rates. Despite growing recession worries, analysts remain excited about the prospects of a number of ASX retail shares for long-term portfolios.

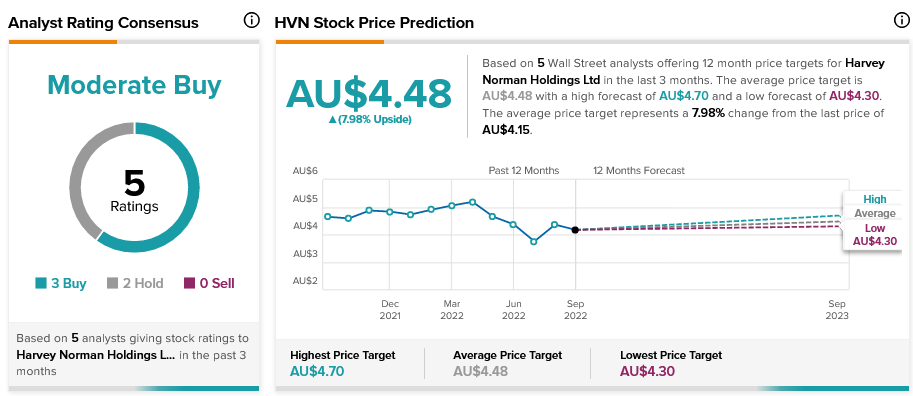

Harvey Norman share price prediction

The multinational retailer sells electronics, kitchen appliances, furniture, and bedding. Harvey Norman plans to open more stores in Australia and abroad as it continues to expand. Harvey Norman shares have gained about 10% over the past three months. However, the stock is still down about 15% year-to-date and a number of analysts believe this is an opportunity to buy the dip.

According to TipRanks’ analyst rating consensus, Harvey Norman stock is a Moderate Buy based on four Buys and two Holds. The average Harvey Norman share price prediction of AU$4.48 implies about 8% upside potential.

Harvey Norman stock scores a nine out of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Lovisa share price forecast

The fashion jewellery retailer’s shares have been on the rise recently, gaining more than 55% over the past three months. Analysts remain bullish on the stock’s prospects.

According to TipRanks’ analyst rating consensus, Lovisa stock is a Moderate Buy based on six Buys, one Hold, and one Sell. The average Lovisa share price forecast of AU$23.01 implies nearly 5% upside potential, a sign that the stock is almost exceeding expectations.

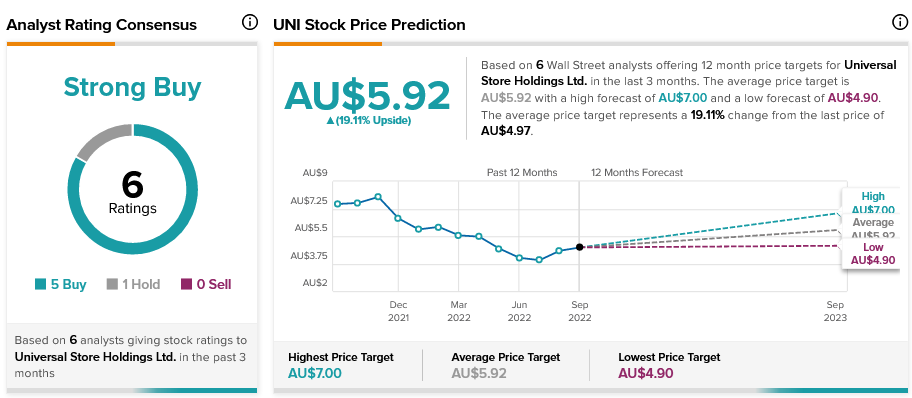

Universal Store share price target

The retailer sells youth casual appeal and footwear. Its brands include Perfect Stranger, Tommy Jeans, Champion, Thrills, and Barney Cools. Universal Store shares have climbed more than 20% over the past three months, but they are still down nearly 25% from where they began the year.

According to TipRanks’ analyst rating consensus, Universal Store stock is a Strong Buy based on five Buys versus one Hold. The average Universal Store share price forecast of AU$5.92 implies over 19% upside potential.

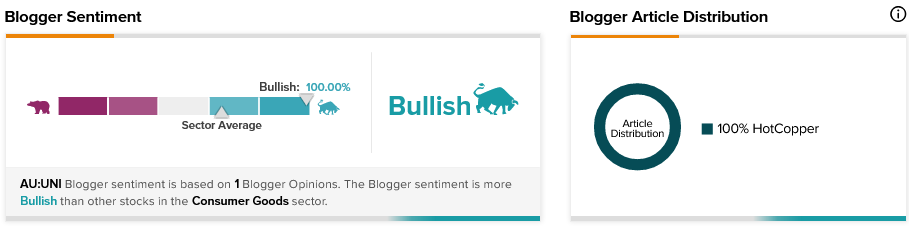

Universal Store stock is receiving favourable mentions on financial blogs. TipRanks data shows that financial blogger opinions are 100% Bullish on Universal Store, compared to a sector average of 65%.

Closing remarks

Although a recession may deal a blow to retail businesses, some retail stocks are better placed than others to weather an economic downturn. Moreover, recessions are temporary, meaning those investing in quality companies for the long-term should ride-out shorter-term setbacks.