While Harvey Norman Holdings’ (HVN) profit took a dip in fiscal 2022 due to COVID-19 restrictions, the retailer has finished the period on a firm footing.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

The company’s most recent financials, provided a strong balance sheet and good cash flow. As the pandemic impacts continue to recede, there is an opportunity for Harvey Norman to recapture lost store sales.

Harvey Norman is a multinational retailer, selling a broad array of products, in categories such as furniture, electronic goods, bedding, and kitchen appliances. The COVID-19 pandemic caused Harvey Norman shares to fall sharply, but TipRanks insights show the stock has much brighter prospects.

Harvey Norman’s store network expansion

Harvey Norman’s business model sees it run some of its brand stores directly, while other outlets are operated through franchise arrangements. The retailer’s major brands are Domayne, Joyce Mayne, and Harvey Norman.

Harvey Norman plans to open more stores both domestically and abroad. On the international front, the company plans to launch directly operated stores in Malaysia, Croatia, and New Zealand. The retailer also continues to advance its omni-channel strategy.

Is Harvey Norman stock a good investment?

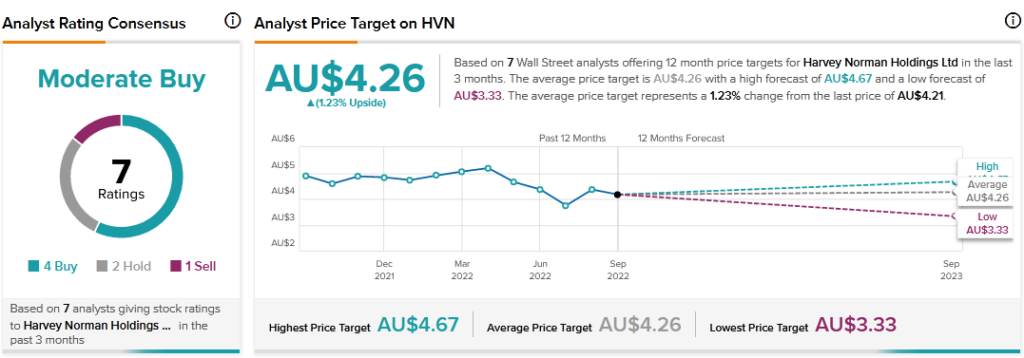

The retailer’s shares have declined around 15% over the past year. However, the future looks more promising. According to TipRanks’ analyst rating consensus, HVN stock is a Moderate Buy based on four Buys, two Holds, and one Sell. The average Harvey Norman price target of $4.26 implies the stock is fully valued at current levels.

Harvey Norman scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

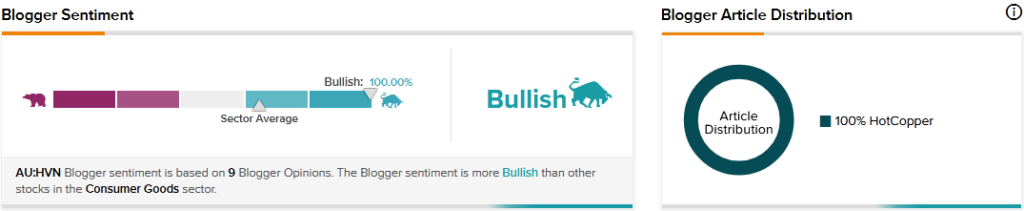

Harvey Norman stock is seeing favourable mentions on financial blogs. TipRanks data shows that financial blogger opinions are 100% Bullish on HVN, compared to a sector average of 65%.

Final thoughts

The future looks promising for Harvey Norman, with its strengthening balance sheet fuelling expansion plans, and the easing of pandemic restrictions removing major trading barriers. Moreover, Harvey Norman’s enhancing digital sales strategy is also encouraging.