Merck & Company (NYSE:MRK) and Exxon Mobil (NYSE:XOM) are two “Strong Buy” stocks that should top the investor’s list when searching for Dividend Achievers. These stocks are members of the NASDAQ US Dividend Achievers 50 Index. The stocks in the index have a history of raising annual regular dividend payments for at least ten consecutive years. They can provide a sustainable source of passive income for the investor’s portfolio.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Here’s why Merck and Exxon are at the top of our list of dividend stocks.

Merck (NYSE:MRK) Stock

Merck has reported impressive earnings results for the second quarter of 2022. The pharmaceutical giant is seeing strength in the oncology and vaccine businesses, largely due to the solid uptake of KEYTRUDA and GARDASIL globally. Moreover, the upbeat sales guidance for 2022 instills optimism among investors.

The company is witnessing considerable progress in its product pipeline, which should bode well for the stock. In this regard, Merck recently announced receipt of Health Canada’s approval for its anti-PD-1 therapy, KEYTRUDA (pembrolizumab), for the adjuvant treatment of adult and pediatric patients suffering from stage IIB or IIC melanoma following complete resection.

This major pharmaceutical company provides a dividend yield of 3.15%, surpassing the sector average of 1.57%. Merck also flaunts an impressive dividend payout ratio of 45.04%.

Is Merck a Buy, Sell or Hold?

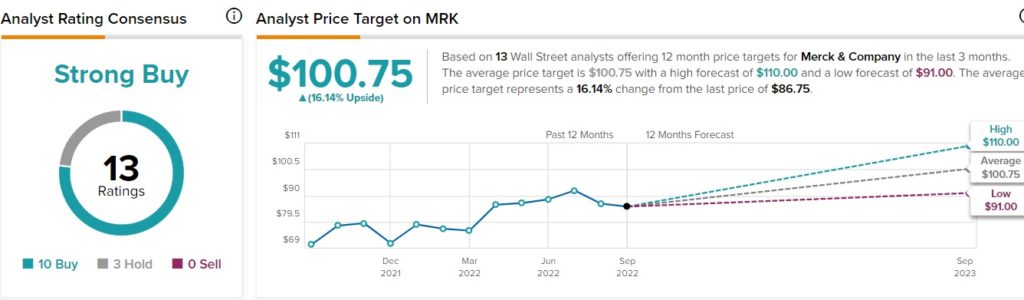

Merck stock appears to be a tempting option to invest in right now. According to TipRanks, the Street is optimistic about MRK stock and has a Strong Buy consensus rating based on 10 Buys and three Holds.

Further, Merck stock’s average price forecast of $100.75 implies a 16.1% upside potential to current levels.

TipRanks data shows that financial bloggers are 94% Bullish on MRK stock, compared to the sector average of 69%.

Finally, according to a TipRanks tool, MRK stock carries a “Perfect 10” Smart Score, which highlights its ability to outperform.

Exxon Mobil (NYSE:XOM) Stock

XOM delivered impressive second-quarter 2022 results on the back of high oil prices, increased production, realizations, and margins, as well as tightened cost control initiatives.

Exxon distributed $7.6 billion to shareholders, including dividends worth around $3.7 billion in the second quarter of 2022. The energy company offers a dividend yield of 3.68% along with a healthy dividend payout ratio of 35.73%.

Is XOM a Buy, Sell or Hold?

Exxon stock seems very appealing to scoop up at the moment. Wall Street is optimistic about the prospects of XOM stock and has a Strong Buy consensus rating based on 10 Buys and two Holds. Also, XOM stock’s average price target of $112.13, signals 18.2% upside potential from its current level.

XOM stock scores 9 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform the market. Moreover, financial bloggers are 83% Bullish on Exxon stock, compared to the sector average of 72%.

As per TipRanks, retail investors, too, look bullish on the stock, as they increased their holdings in XOM stock by 2.6% in the last 30 days.

Final Thoughts

Merck and Exxon have strong underlying fundamentals and can provide sustainable dividend payouts. These dividend growth stocks stand out because they have the capacity to raise dividends for a long consecutive period. With 15.7% and 53.9% year-to-date gains, respectively, MRK and XOM have very conveniently outperformed the NASDAQ US Dividend Achievers 50 Index’s 4.5% decline. Thus, considering the current market uncertainties, investors can invest their money in these stocks.

Read full Disclosure