Merck & Company (NYSE: MRK) has reported impressive earnings results for the second quarter of 2022. However, shares of the company declined 1.4% on Thursday, largely due to the overall pessimism in the market over the drug pricing bill.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The pharmaceutical giant saw its adjusted earnings rise to $1.87 per share in the second quarter of 2022 from 61 cents per share in the year-ago quarter. The metric also surpassed analysts’ estimates of $1.70 per share.

Merck’s revenues for the reported quarter came in at $14.59 billion, up 28% year-over-year reported and 31% on a constant currency (cc) basis. The figure easily surpassed expectations of $13.90 billion. Strength in the popular cancer immunotherapy drug, KEYTRUDA, largely supported the company’s top line.

Strong performances from Merck’s oncology, vaccines, and hospital acute care products helped the Pharmaceutical segment record 28% year-over-year growth (up 16% excluding LAGEVRIO sales) to $12.76 billion in the reported quarter.

Within oncology, KEYTRUDA witnessed a 26% year-over-year surge in sales to $5.3 billion. A 28% rise in Lenvima alliance revenue was seen in the June quarter, due to the solid demand in the United States. Oncology also garnered support from an 11% year-over-year jump in Lynparza alliance revenue.

A 36% year-over-year rise in GARDASIL/GARDASIL 9 revenues to $1.7 billion, largely attributed to solid global demand, particularly in China, supported growth in vaccines. The pharmaceutical giant also saw strength in hospital acute care revenues on the back of solid demand for BRIDION and ZERBAXA in the reported quarter.

However, the upside in the pharmaceutical revenue growth was partly offset by lower combined sales of ISENTRESS/ISENTRESS HD, and JANUVIA and JANUMET.

Animal Health revenues of $1.5 billion in the second quarter of 2022 remained flat (up 5% at cc) in comparison to the year-ago period. The upside was majorly triggered by higher demand for ruminant and poultry products across the globe, along with strength in BRAVECTO (fluralaner).

The company’s adjusted gross margin was down 180 basis points from the year-ago quarter to 74.7% in the second quarter of 2022. LAGEVRIO, which has a lower gross margin due to profit sharing with Ridgeback, and higher inventory write-offs and manufacturing costs, weighed on the metric in the reported quarter.

Merck Revises 2022 Guidance

Merck has upwardly revised its sales guidance for the full-year 2022. The pharmaceutical giant predicts revenues in the $57.5-$58.5 billion range from the previously provided outlook of $56.9 to $58.1 billion.

The company has also tightened its adjusted earnings outlook for 2022. Merck now predicts adjusted earnings per share between $7.25 and $7.35 against the $7.24 and $7.36 anticipated earlier.

Drug Pricing Bill Spells Trouble

According to a Reuters report, U.S. Democratic Senator Joe Manchin and Senate Democratic leader Chuck Schumer have given their nod to a bill, which aims to control drug prices. The bill, if passed, will mandate a cap on out-of-pocket drug costs for Medicare recipients at $2,000 a year. It will also aim at providing free vaccinations to seniors.

Commenting on the possible impacts of the bill, the Chief Executive Officer and President of Merck, Robert M. Davis, stated that the bill, if passed, can have an adverse impact on innovation in the industry. However, he believes that Merck can weather the storm, and it should not impact the sales of its key drugs and vaccines.

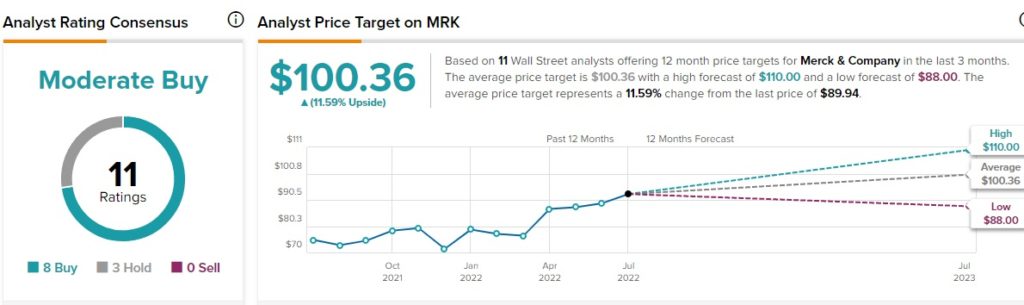

Wall Street Is Cautiously Optimistic about MRK Stock

According to TipRanks, the Street is cautiously optimistic about MRK stock and has a Moderate Buy consensus rating based on eight Buys and three Holds. Merck’s average price forecast of $100.36 implies 11.6% upside potential to current levels.

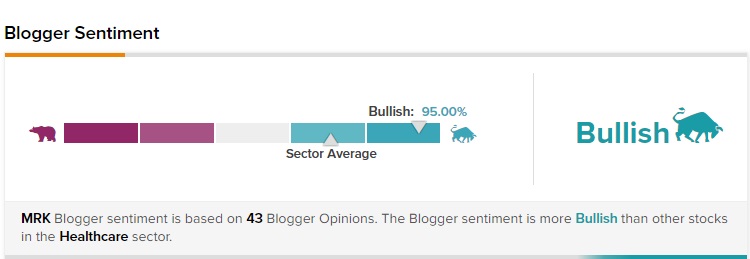

TipRanks data shows that financial bloggers are 95% Bullish on MRK, compared to the sector average of 71%.

Key Takeaways for MRK Investors

Merck is seeing strength in its oncology and vaccine businesses, largely due to the solid uptake of KEYTRUDA and GARDASIL globally. Moreover, the upbeat sales guidance for 2022 could spark optimism among investors. The company is witnessing considerable progress in its product pipeline, which should bode well for the stock. Considering these key catalysts, investors can consider MRK stock, which has grown 19% so far this year.

Read full Disclosure