Aris Water Solutions, Inc. (NYSE: ARIS) is an environmentally focused company that acts as a midstream-service provider for the oil and gas industry. Its comprehensive infrastructure helps in handling and recycling produced water as well as supplying treated water to the oil/natural gas operators.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

This Houston, TX-based company was incorporated in May 2021 and made its debut on the NYSE in October 2021 through the initial public offerings (IPO) of the shares of Solaris Midstream Holdings, LLC.

At this juncture, a quick recap of the IPO is desirable, considering the nascent stage of Aris Water. The company issued approximately 17.65 million shares of Class A common shares to the public at $13 per share, below its expected price band of $16-$18 per share. An additional 2.65 million shares were issued to the underwriters at the public offer price of $13. Par value of each share sold was $0.01.

From the IPO, Aris Water raised approximately $246.4 million of net proceeds, lower than its intended amount of $300 million. The proceeds were used to get hold of a 38% stake in Solaris Midstream. Exiting the first quarter of 2022, Aris Water had a 41% interest in Solaris Midstream.

Since the IPO, Aris Water has shown some remarkable improvements that are welcoming for its investors. A brief discussion is provided below.

A Surge in Share Price & Market Capitalization

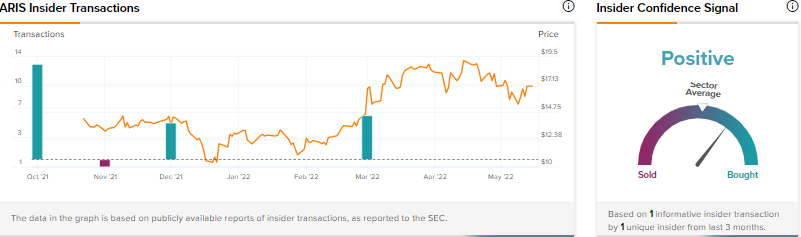

Despite weak demand resulting in a low IPO price, Aris Water opened the trading at $15.85 on October 22, 2021. Since then, the journey has been a roller-coaster ride for Aris Water, with an uptrend visible from March this year.

On Friday (May 13th), the company’s closing price was $16.96, representing an increase of 18.6% since October 22, 2021. Its shares have touched the lowest level of $10.06 and the highest level of $19.68 during this period. Presently, the company’s market capitalization stands at $393.96 million.

The uptick in the share price and market capitalization is a positive signal, induced by the company’s journey over the period.

Important Milestones

After going public, Aris Water initiated a quarterly dividend of $0.07 per share (or $0.09 per share on a pro-rata basis) in December 2021. The company’s President and CEO, Amanda Brock, said that the initiation of dividends “reflects the Board and Management’s confidence that we can return cash to our shareholders” and also “invest in high-return growth projects and manage our balance sheet.”

In March, Aris Water announced the strengthening of its association with Texas Pacific Land Corporation (NYSE: TPL). The two companies will work for providing better water solutions (full-cycle) to their customers operating in the Permian Basin.

In May, Chevron U.S.A. Inc., a subsidiary of Chevron Corporation (NYSE: CVX), selected Aris Water for providing water management services, including water handling and recycling, for some of its Delaware Basin-based operations. “This agreement increases Aris’s overall acreage giving Aris the premier dedicated acreage position in the Northern Delaware Basin,” said Brock.

Also, Aris Water impressed its investors with a better-than-expected result for Q1 2022 in May. Its earnings beat in the quarter was 200% while revenue surprise was 6%. The total water volumes grew 45% year-over-year, while recycled produced water was up 290% from the year-ago quarter.

Robust Growth Drivers & Projections

The rising need to protect the environment and operate with low water and carbon footprint is the backbone of Aris Water’s growth prospects in the quarters ahead. Along with this, the company’s expertise in providing cost-efficient solutions, a solid customer base, including some of the top oil and gas players, and healthy rewards to shareholders will help enhance the company’s investment appeal.

For 2022, the company anticipates adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) to be $165-$175 million (up from the prior expectation of $150-$160 million) and capital expenditure to be $140-$150 million (versus $80-$90 million projected earlier).

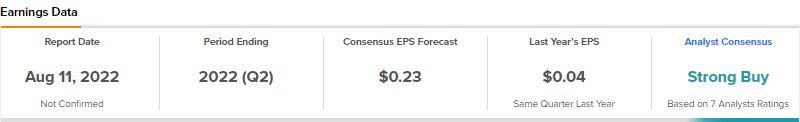

The consensus estimate for the second-quarter earnings is pegged at $0.23 per share, compared with the year-ago tally of $0.04 per share.

TipRanks’ Data

On May 11, Justin Jenkins of Raymond James reiterated a Buy rating on ARIS with a price target of $24 (41.51% upside potential).

Overall, the company has a Strong Buy consensus rating based on six Buys and one Hold. ARIS’ average price target of $21.43 suggests 26.36% upside potential from current levels. Also, the company scores a ‘Perfect 10’on TipRanks’ Smart Score Rating system.

Moreover, the financial bloggers on TipRanks are 100% Bullish and news sentiments are ‘Very Positive’ on ARIS. Also, the insider confidence seems to be Positive. In the last three months, corporate insiders have purchased $89.3 thousand worth of ARIS shares.

Conclusion

Aris Water is not immune to the risks stemming from the volatility in the oil and gas industry, rising costs and expenses, and the requirement of huge capital in the business.

Despite this, the solid growth prospects of this very young midstream company are impressive.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure