Education

About Us

Working with TipRanks

Follow Us

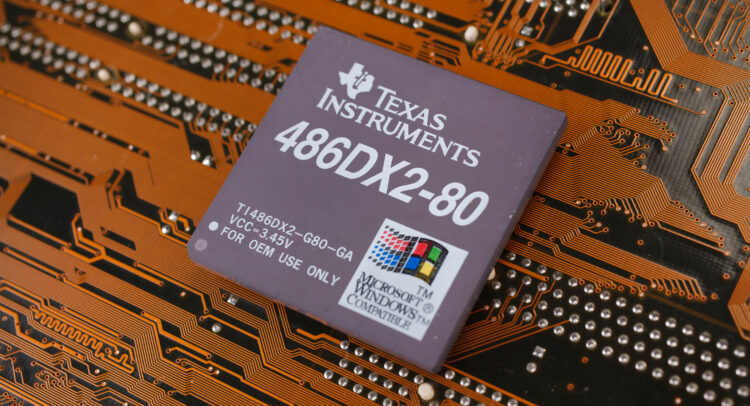

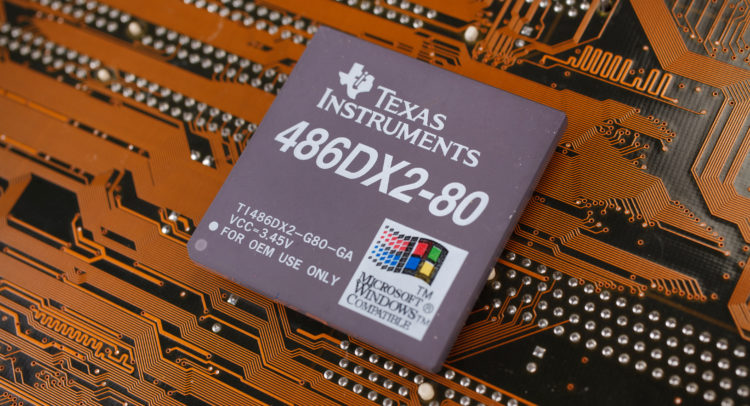

Texas Instruments (TXN)

NASDAQ:TXN

Earnings Data

Report Date

Apr 28, 2026After Close (Confirmed)

Period Ending

2026 (Q1)Consensus EPS Forecast

1.36Last Year’s EPS

1.28Same Quarter Last Year

Moderate Buy

Based on 25 Analysts Ratings

Earnings Call Summary

Earnings Call Sentiment|Positive

The call presented strong year-over-year growth, robust cash generation, large free cash flow improvement, successful capital investment execution (notably in manufacturing/fab build-outs), and substantial data center, industrial and automotive momentum. Offsetting factors include sequential revenue and margin pressure, notable weakness in personal electronics and communications, a modest EPS hit from a goodwill impairment, higher inventory days, and a $14B debt balance. Management guided cautiously but positively for Q1 with above-seasonal revenue guidance driven by bookings and data center strength, while keeping capital allocation discipline.Company Guidance

Revenue Growth Year-over-Year

Q4 revenue of $4.4B, up 10% year-over-year.

Analog and Embedded Strength

Analog revenue grew 14% year-over-year and embedded processing grew 8% year-over-year, supporting overall company growth.

Data Center Rapid Expansion

Data center revenue grew ~70% year-over-year in Q4 and ~64% for 2025, reaching $1.5B and representing 9% of 2025 revenue; data center has grown for seven consecutive quarters.

Industrial and Automotive Scale

Industrial and automotive each generated $5.8B in 2025 (33% of revenue each); industrial up 12% year-over-year and automotive up 6% year-over-year. Industrial, automotive and data center comprised ~75% of 2025 revenue (versus ~43% in 2013).

Strong Profitability and Operating Income

Gross profit of $2.5B (56% margin) in Q4 and operating profit of $1.5B (33% of revenue), with operating profit up 7% year-over-year.

Significant Free Cash Flow Improvement

2025 free cash flow was $2.9B (17% of revenue), an increase of 96% from 2024; 2025 operating cash flow was $7.2B.

Capital Return and Capital Management

In Q4 paid $1.3B in dividends, repurchased $403M of stock, increased dividend per share 4% to $1.42 (22nd consecutive year), and returned $6.5B to shareholders in the past 12 months.

Manufacturing Execution and Capacity

Sherman fab build-out running ahead of schedule with high yields and production lines in operation; Lehigh insourcing and 65nm transition complete with 45nm progression for automotive radar—supporting dependable low-cost 300mm capacity at scale.

Capital Expenditure and Incentives Position

Near end of a six-year elevated CapEx cycle: 2025 CapEx $4.6B; 2026 CapEx guided to $2–3B. Company received $670M CHIPS Act incentives in 2025 and expects up to $1.6B direct funding and 35% ITC for 2026 CapEx.

TXN Earnings History

The table shows recent earnings report dates and whether the forecast was beat or missed. See the change in forecast and EPS from the previous year.

Beat

Missed

TXN Earnings-Related Price Changes

Report Date | Price 1 Day Before | Price 1 Day After | Percentage Change |

|---|---|---|---|

Jan 27, 2026 | $195.35 | $214.77 | +9.94% |

Oct 23, 2025 | $169.56 | $166.55 | -1.78% |

Jul 29, 2025 | $187.10 | $185.28 | -0.97% |

Apr 23, 2025 | $147.49 | $157.17 | +6.56% |

Earnings announcements can affect a stock’s price. This table shows the stock's price the day before and the day after recent earnings reports, including the percentage change.

FAQ

When does Texas Instruments (TXN) report earnings?

Texas Instruments (TXN) is schdueled to report earning on Apr 28, 2026, After Close (Confirmed).

What is Texas Instruments (TXN) earnings time?

Texas Instruments (TXN) earnings time is at Apr 28, 2026, After Close (Confirmed).

Where can I see when companies are reporting earnings?

You can see which companies are reporting today on our designated earnings calendar.

What companies are reporting earnings today?

You can see a list of the companies which are reporting today on TipRanks earnings calendar.

What is TXN EPS forecast?

TXN EPS forecast for the fiscal quarter 2026 (Q1) is 1.36.