According to a report published by Bloomberg, exercise equipment company Peloton Interactive, Inc. (NASDAQ: PTON) has decided to increase its subscription cost and slash the prices of Bike, Bike+ and treadmills.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The price of Bike has been cut by $300 to $1,195, and Bike+ will now cost $1,995, $500 lower than the earlier price. Further, the price of its treadmills will come down by $150.

Meanwhile, Peloton plans to raise its monthly subscription fee to $44 from $39 in the U.S. and to $55 from $49 in Canada to mitigate the impact of reduced equipment prices.

About Peloton

New York-based Peloton offers Internet-connected exercise equipment like stationary bicycles and treadmills. It also provides online classes for a subscription as well as content via its website and app.

Wall Street’s Take

Recently, Morgan Stanley (NYSE: MS) analyst Lauren Schenk maintained a Hold rating on the stock with a price target of $32 (34.1% upside potential).

The analyst said, “Peloton could grow beyond the three million subscribers the management has forecast for the full year by the end of the third quarter, (while) continuing declines in overall web traffic are a concern.”

Overall, the stock has a Moderate Buy consensus rating based on 14 Buys and nine Holds. PTON’s average price target of $47.38 implies 98.5% upside potential. Peloton has lost almost 78% over the past year.

Website Traffic

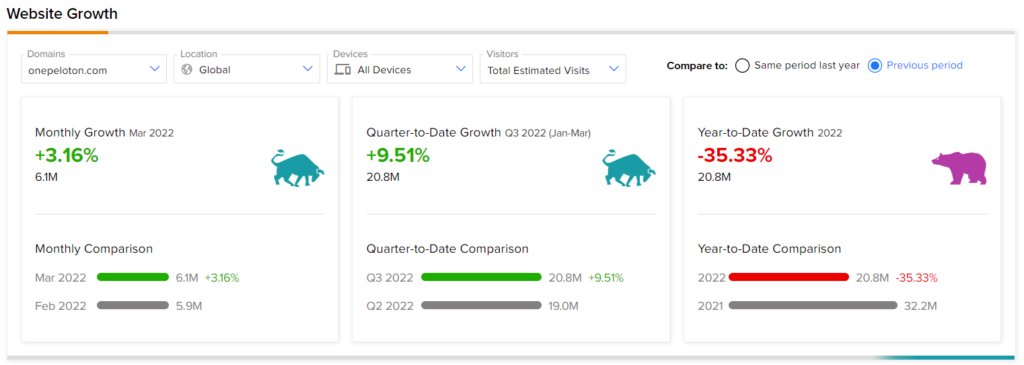

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (NYSE: SEMR), the world’s biggest website usage monitoring service, offers insight into Peloton’s performance.

According to the tool, Peloton’s website traffic registered a 3.2% rise in global visits in March, compared to February. However, the footfall on the company’s website has declined 35.3% year-to-date against the same period last year.

Conclusion

The market did not take the news of the monthly subscription fee hike positively, and the stock plunged 4.6% on Thursday to close at $23.87.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Why Morgan Stanley Didn’t Impress Despite Q1 Beat

Everi Acquires XUVI’s Assets, Also Offers Crypto-to-Cash Solution

State Street Shares Tank 8.5% despite Q1 Beat