After a subdued 2021, Blackstone Group (NYSE: BX) has begun doing what it does best; shopping for well-performing, under-managed companies. Next on its list is a commercial property owner and operator, real estate investment trust (REIT) PS Business Parks (PSB).

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Blackstone is one of the largest investment companies globally with interests in a variety of asset classes spanning real estate, private equity, hedge fund solutions, and credit & insurance.

PSB is a REIT that engages in multi-tenant industrial, industrial-flex, and low-rise suburban office spaces across major coastal markets.

About the PSB Deal

Blackstone has offered to purchase all of the outstanding common stock of PSB for $187.50 per share in cash, which represents a premium of approximately 15% to the volume-weighted average share price over the last 60 days.

The aggregate deal is valued at $7.6 billion and is expected to close in the third quarter of 2022, subject to PSB shareholder approval and other customary requirements. The deal includes a 27-million square foot portfolio of industrial, business park, traditional office, and multifamily properties located primarily in California, Miami, Texas, and Northern Virginia.

Additionally, the agreement also includes a “go-shop” period of 30 days ending May 25, 2022, allowing PSB to look for superior acquisition proposals. If PSB does find a superior bid for the takeover, it can terminate the agreement with Blackstone, subject to a termination fee and other conditions.

Furthermore, after getting the shareholder approval of the acquisition with Blackstone, PSB’s three series of preferred shares and related depositary shares will remain outstanding and listed on the NYSE.

Self-storage REIT Public Storage (PSA) which has a 25.9% stake in PSB, has agreed to vote in favor of the takeover from Blackstone.

Official Comments

Pleased with the deal, David Levine, co-head of Americas Acquisitions for Blackstone Real Estate said, “We are excited to add PS Business Parks’ business park, office, and industrial assets to our portfolio and look forward to leveraging our expertise to provide the best possible service and experience for PSB’s customers.”

Stephen W. Wilson, president and CEO of PSB said, “This transaction is an exceptional outcome for our stockholders and a testament to the incredible company and portfolio of high-quality assets our team has built, acquired, and enhanced over the years.”

Wall Street’s Take

Blackstone reported upbeat first-quarter results on April 21, 2022, with distributable earnings of $1.55 per share beating the consensus estimates of $1.08 per share.

Following the results, Jefferies analyst Gerald O’Hara assigned a Buy rating to BX stock with a price target of $155, which implies 42.7% upside potential.

BX stock has a Moderate Buy consensus rating based on nine Buys and five Holds. The average Blackstone price target of $149.75 implies 37.7% upside potential to current levels. The stock has lost 10.2% year-to-date.

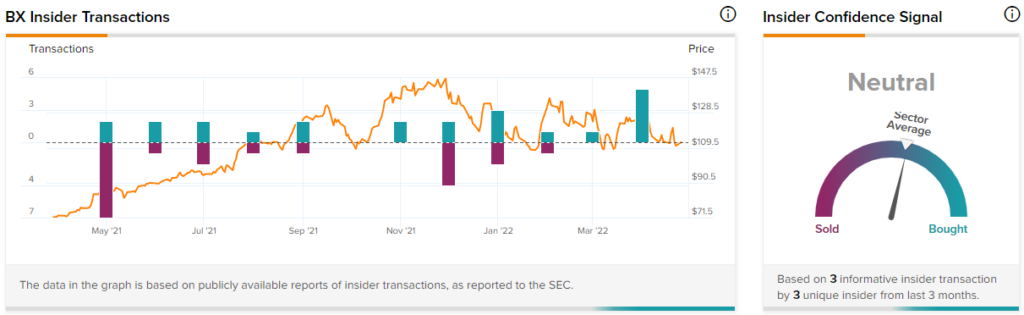

Insider Trading

TipRanks’ Insider Trading Activity shows that insiders are currently Neutral on Blackstone, with corporate insiders selling $3.5 million worth of shares in the last quarter.

Concluding Views

While Blackstone has sprung to action this year, so far, the market volatility, rising interest rate scenario, and uncertain geopolitical environment play a spoiler for asset managers and investment companies.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure

Related News:

Firms Eye Bed Bath & Beyond’s Buybuy Baby Unit; Shares Surge

Airlines Adopt Unique Ways to Survive Pilot Shortage

Does Musk-Twitter Saga Favor Tesla CEO?