Recently, Enphase Energy (NASDAQ: ENPH) has experienced a major advantage over Generac Holdings (NYSE: GNRC) because Europeans, particularly in Germany, which until recently was over 50% dependent on Russian gas, may have been too enthusiastic about renewable energy technologies as an alternative to expensive Russian fossil fuels. This has most likely led to an overvaluation of Enphase compared to Generac’s fossil fuel-powered electricity generators, with their margins shrinking as the impact of the energy crisis wears off.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The chart below illustrates how ENPH and GNRC shares have been affected by the energy crisis caused by the tensions between the U.S./Europe and Russia.

Both stocks are representative of companies with growing sales combined with solid financial positions, but Generac may be a better Buy currently, given what’s discussed below.

Enphase Energy (ENPH)

Headquartered in Fremont, California, Enphase is a global leader in microinverters for solar and AC battery storage systems, all controllable and monitorable through its mobile application software.

In a photovoltaic system, the solar panels collect direct current (DC) from the sun’s rays, while the microinverters convert the DC to alternating current (AC), the form of electricity used in homes.

The company sells its solutions to solar wholesalers and directly to other businesses and homeowners.

The war in Ukraine, with renewed pressure on fossil fuel prices, has proven to be a very important growth driver for Enphase Energy’s revenue, as the company’s products are viewed as a solution to the problem of high energy costs.

In fact, much of the sales growth is coming from Europe, particularly Germany, Belgium, and The Netherlands, where the energy crisis has favored photovoltaic technologies and energy storage systems.

As a result, Enphase Energy saw its revenue jump to a record high of $530 million, up nearly 68% year-over-year, beating analysts’ average forecast by $25 million.

Regarding the outlook for the third quarter of 2022, total sales should continue to be higher and, more precisely, should be between $590 million and $630 million, while analysts are forecasting sales of $610.35 million on average.

However, the company’s sales appear to be impacted by a temporary boom in homeowners’ desire for solar panels and electrification technologies, largely due to record-high utility bills. Naturally, the question is, when geopolitical tensions and problems with natural gas shortages — the triggers for increased demand for Enphase Energy’s technologies — end, can the company keep up its sales growth?

The company’s growth strategies appear to be influenced by Europe’s energy crisis rather than a longer-term vision.

The company continues to evolve through acquisitions, with the next transaction expected to close in the fourth quarter of 2022, when it should acquire GreenCom Networks AG, a German provider of software solutions that, like the Internet of Things (IoT), are driving home electrification.

To fund growth through acquisitions, the company requires a capital loan ($1.31 billion as of June 30, 2022) in addition to $1.25 billion in cash. From a financial strength perspective, the balance sheet looks solid to bear the cost of interest expenses. However, rising borrowing costs could hurt future profit margins as the Federal Reserve tightens.

Against this background, price-to-earnings and price-to-sales ratios of 227.1x and 24.8x, respectively, are not justified, especially given the current profit margins of the company.

Is ENPH Stock a Buy?

On Wall Street, Enphase Energy has a Strong Buy consensus rating based on 12 Buys, four Holds, and zero Sell ratings over the past three months. At $284.21, the average ENPH price target implies downside potential of 10.6%.

It probably wouldn’t be a bad idea to sell some shares of Enphase Energy, as the price may have peaked so far due to the powerful trigger of the energy crisis.

This energy crisis is coming to an end as the EU lays a solid foundation for the benefit of European households and businesses. The EU package against record energy bills includes measures to curb consumption, tax additional multinational energy gains, including renewables, and perhaps even cap gas and oil prices.

With the energy crisis no longer a tailwind for Enphase Energy, the deal with less onerous energy costs will be more beneficial to Generac.

Generac (GNRC)

Headquartered in Waukesha, Wisconsin, Generac offers automatic and remote-controlled emergency power generators and air/liquid-cooled motor generators with variable outputs for residential, commercial, and industrial use.

Currently, Generac’s Residential business accounts for 75% of total revenue, with the U.S. market having the largest impact (88% of the total vs. international markets at 12%), while the Commercial and Industrial segments account for the remaining 25%.

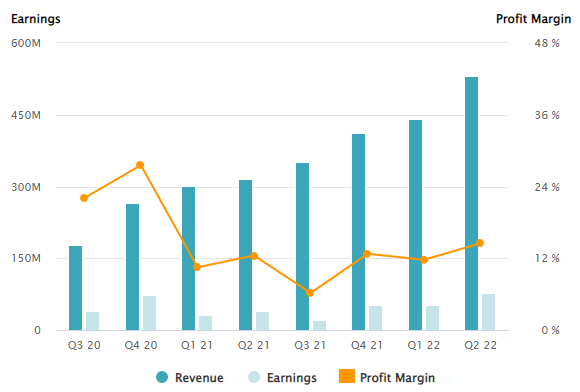

In the second quarter of 2022, Generac’s total revenue rose 40% year-over-year to $1.29 billion, beating analyst forecasts by $30 million.

Record-breaking quarterly revenue growth enabled Generac to hit another record with a non-GAAP EBITDA of $271 million. This represents an EBITDA margin of 21% of net sales (a year-over-year decline of 270 basis points) but reflects EBITDA growth of nearly 25% year-over-year.

The lower margin was due to the impact of higher operating costs from recent acquisitions. The higher costs are likely to be mitigated as the company ramps up its efforts to integrate the new businesses more efficiently. With sales volume on track to gain momentum going forward, any resulting improvement in profitability should translate into very positive impacts on the stock price.

As GNRC’s annual interest expense of $37.3 million on principal loans of $1.51 billion (vs. the ~$467 million in cash on hand) is fully offset by the 12-month operating income of $736 million, the balance sheet looks strong enough to plan for further growth in 2022.

The company expects total sales to grow 36% to 40% this year, to approximately $5.09 billion to $5.24 billion from $3.74 billion in 2021. Meanwhile, analysts forecast revenue of $5.18 billion.

The full-year 2022 non-GAAP EBITDA margin is expected to improve from current levels and range between 21.5% and 22.5%.

The stock has a price-to-earnings ratio of 26.4x and a price-to-sales ratio of 2.9x.

Although Generac Holdings Inc’s P/E ratio and P/S ratio are around two-year lows, shares don’t look cheap. However, given the cost-efficiency catalyst outlined above and the expected strong comeback in demand for the company’s technology as energy costs cool down, it could be worth adding to any current position.

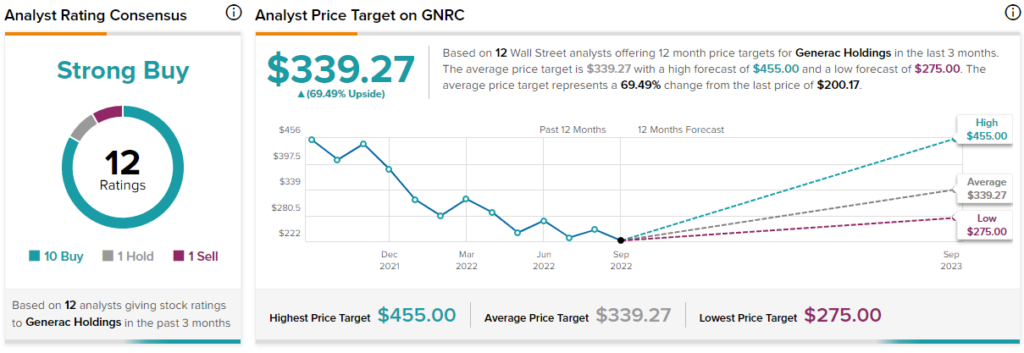

Is GNRC Stock a Buy?

On Wall Street, Generac Holdings has a Strong Buy consensus rating based on 10 Buys, one Hold, and one Sell rating assigned over the past three months. At $339.27, the average GNRC price target implies upside potential of 69.5%.

Conclusion: Selling ENPH to Buy GNRC Could Prove Wise

Enphase Energy may be overvalued, as the company has benefited greatly from European homeowners’ high demand for solar-powered technologies. This momentum is likely to slow down significantly as record-high energy bills and the energy transition boom ease. Accordingly, shares may adjust to a lower valuation. Due to the same factors, Generac Holdings, which has been hit by the energy crisis and transition so far, could move up instead.