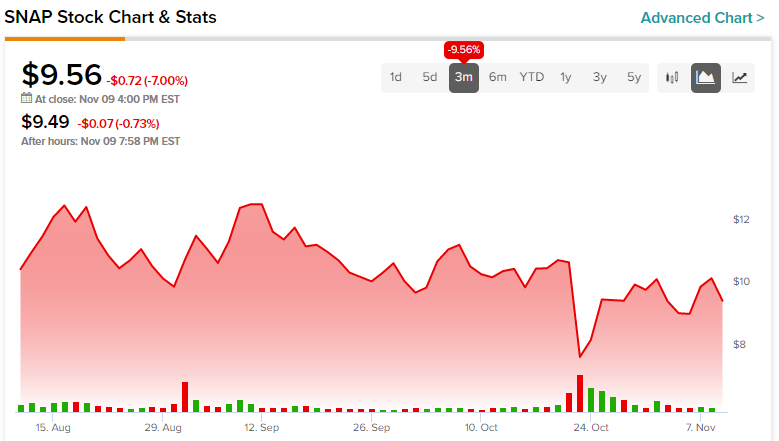

Snap (NYSE: SNAP) stock fell 28% after the release of its third-quarter earnings report a few weeks back. The social media giant continues to struggle with monetizing its growing user base, and questions have been raised about whether it could be consistently profitable. Naturally, the current economic downturn has accentuated these concerns. It’s difficult to ignore Snap’s near-term problems, making it an unattractive bet despite the massive drop in its valuation. Hence, we are bearish on SNAP stock.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

In its recent results, the company reported a 5.7% year-over revenue increase to a healthy $1.13 billion, missing consensus estimates by $10 million. On top of that, its net loss shot up from $72 million in the last quarter to $359.5 million. Additionally, its adjusted EBITDA tanked 58% from the prior-year quarter. Hence, the headline numbers were all underwhelming.

Perhaps more positively, its daily active users (DAU) grew 19% year-over-year in the third quarter. However, its growth was offset by its average revenue per user (ARPU), which dropped by 11%. This steep decline was largely attributed to Apple’s privacy-oriented changes complicating things for advertisers.

Investors are clearly disappointed by Snap and its management, who felt the firm could grow by over 50% for multiple years. The company has not yet shown a sign of reaching these lofty goals, and it’s unclear when or if this will happen. Its stock, however, has taken a massive beating of late and trades at around 3.6x its trailing-12-months sales, roughly 80% lower than its five-year average. However, it trades over 200% higher than the sector median, which suggests it’s still considerably overvalued. Therefore, it’s best to steer clear of the stock at this time, with it expected to shed more value in the coming months.

Snap’s Long-Term Outlook is Uncertain

There’s a lot to like about Snap’s future, but overall, it remains a “show-me” story at best. Snap’s CEO, Evan Spiegel, recently talked about how they may invest in new AR features to help them grow their revenue over time. Its competitors in Instagram and TikTok have followed suit and garnered immense success.

TikTok is vying for Snapchat and Instagram’s spot as the top social media platform among U.S. teens. According to a Piper Sandler survey, the app overtook Snapchat as the leading social media platform for U.S. teens this spring.

However, Snap’s impressive DAU growth is a major positive for the business. Once the macroeconomic headwinds subside, Snap should be able to recover quickly and return revenue streams back to where they were before these setbacks began slowing down progress.

Moreover, its cash position is still strong, but it will need to raise more funds quickly if it wants to avoid a liquidity crisis. It has $3.74 billion in loan notes on its balance sheet, giving it little wiggle room to raise funds. That’s why it was a surprise when Snap announced that they would buy back $500 million in stock for the next 12 months.

Furthermore, Snap’s short video platform, Spotlight, is one of its biggest bets against its competition. The company pointed out a 55% increase in watch times during the third quarter compared to last year. However, it represented a 4% drop on a sequential basis without contributing much to its ARPU.

What is the Price Target for SNAP Stock?

Turning to Wall Street, Snap stock maintains a Hold consensus rating. Out of 28 total analyst ratings, seven Buys, 19 Holds, and two Sell ratings were assigned over the past three months. The average SNAP stock price target is $10.62, implying 11.1% upside potential. Analyst price targets range from a low of $7 per share to a high of $19 per share.

Takeaway: Snap Faces Challenges Ahead

Snap has been hit hard by the recent macroeconomic and geopolitical challenges, but there are still many fundamental issues for its business in monetizing its growing user base. Also, Snap’s revenue growth slowdown has affected its bottom line.

Moreover, it was compelled to lay off 20% of its workforce in the third quarter, canceling multiple projects. Many companies have had to cut back their marketing budgets in the current economic climate. This is not good news for Snap and its peers in the advertising space. On top of that, Apple’s privacy changes continue to negatively impact advertisers. It will take multiple quarters before advertising businesses can effectively cope with the changes brought about by Apple.

The bears are out in full force. The economy may be holding up relatively well, but that could change soon enough with a looming recession on the horizon. In such a scenario, investing in SNAP stock could be even riskier. Until it shows clearer signs of a long-term turnaround and earnings expansion, it’s best to be cautious about investing in it at this time.