Snap (NYSE:SNAP) recently reported earnings for its third quarter of Fiscal Year 2022. Adjusted earnings per share came in at $0.08, which beat analysts’ consensus estimate. In the past nine quarters, the company has beaten estimates six times.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Sales increased 5.7% year-over-year, with revenue hitting $1.128 billion compared to $1.067 billion. However, this was lower than the $1.139 billion that analysts were looking for.

In addition, the company demonstrated operating deleverage since its operating margin fell from -16.94% to -38.6%. As a result, the company’s operating loss ballooned from -$180.8 million in the comparable period to -$435.2 million now. This was partly attributable to a restructuring charge of $155 million.

Nevertheless, its global daily active users metric surprised to the upside, coming in at 363 million versus expectations of 358.2 million. This equated to a 19% year-over-year increase. Unfortunately, the average revenue per user fell 11% to $3.11.

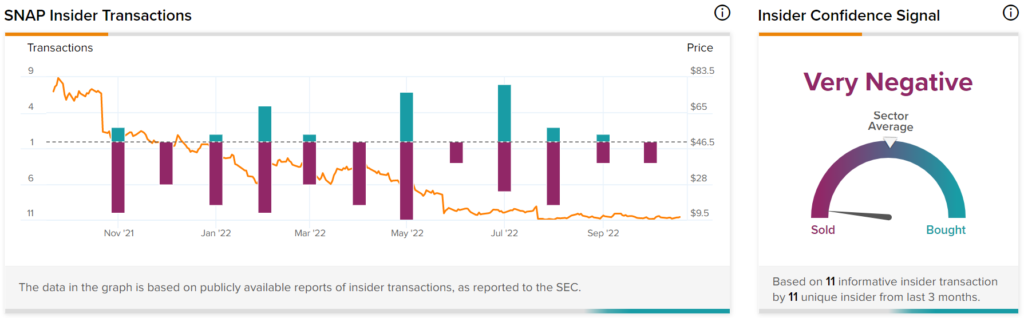

Insiders at SNAP Have Been Selling

When looking at insider activity at Snap, there seems to be a lot of selling. In fact, insiders have sold $3.3 million worth of shares in the past three months. As a result, confidence from within appears to be very low, as the Insider Confidence Signal for SNAP stock is very negative, and is below the sector average as shown in the picture below:

Is Snap Stock a Hold or Sell?

Snap has a Hold consensus rating based on nine Buys, 23 Holds, and two Sells assigned in the past three months. The average SNAP stock price target of $13.97 implies 29.2% upside potential.