The Kroger Co. (NYSE:KR) and Costco Wholesale Corporation (NASDAQ:COST) can help investors sail through the volatility in the U.S. food retail market, which has been ramped up by severe drought, high inflation levels, and the global food crisis. Despite the tough market conditions and changing shopping behavior, consumer spending on grocery items mostly remains resilient as these are basic necessities for survival.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Therefore, Kroger and Costco are good investment choices as they provide diversification benefits, steady growth, and stability to the investment portfolio amid rising food prices.

Drought & Inflation to Push Food Prices Higher

The worst drought conditions on record have resulted in a decrease in rice crop plantations in California. A U.S. Department of Agriculture (USDA) report highlighting June estimates states that the amount of rice sown in California this spring decreased by 30% year-over-year to 285,000 acres. Notably, the state is responsible for producing one-fifth of U.S. rice, per a WSJ report. The USDA reports also indicate that U.S. rice exports have declined 16% in the first half of 2022.

India’s ban on exporting broken grains raises more questions. It has also levied a 20% export duty on international shipments of white and brown varieties of rice. India’s move may aggravate food supply shortages and increase global inflationary pressure.

The produce industry, which includes leafy greens and fruits, is feeling the brunt of rising temperatures in the Western United States as crops are getting spoiled and shipments are falling.

The U.S. Consumer Price Index (CPI) is expected to indicate a decline in inflation levels. However, food prices are expected to have remained high in the past month. There was a 13.4% jump in grocery costs over the prior year in August, per a WSJ report.

Against this backdrop, let’s take a closer look at the two grocery store stocks that can provide some protection to your portfolio against rising food prices.

The Kroger Co. (NYSE:KR)

The supermarket chain recently reported encouraging second-quarter 2022 results as earnings and revenues beat expectations. The grocery retailer also pleased investors as it increased the full-year 2022 outlook. It also announced a $1 billion share buyback program.

Kroger is seeing support from its strategies to increase the freshness, and quality and enhance the affordability of the products, along with widening digital capabilities.

Is Kroger Stock a Buy, Sell or Hold?

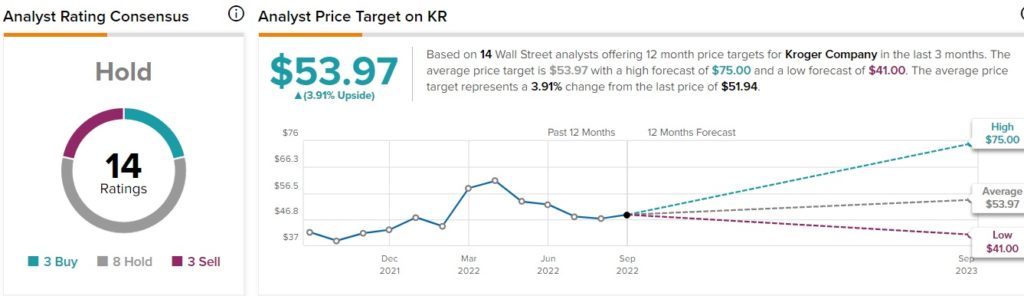

Analysts have mixed feelings about Kroger stock. According to TipRanks, Street is Neutral about KR stock, which carries a Hold consensus rating based on three Buys, eight Holds, and three Sells. Further, hedge funds look apprehensive about KR stock, as they have sold 4.1 million shares of KR stock in the last quarter.

Meanwhile, financial bloggers and retail investors seem bullish about KR stock. Financial bloggers’ opinions are 90% Bullish on KR stock, above the sector average of 64%. Also, retailer investors have increased their portfolio holdings in the KR stock by 1% in the past 30 days.

Finally, KR stock’s average price target of $53.97, signals a 3.9% upside potential from its current level.

Costco Wholesale Corporation (NASDAQ:COST)

The bulk-buy retailer, Costco, offers discounted prices through its membership warehouses. In fact, the company is among the largest warehouse club operators in the United States. Costco also sells food and sundries, fresh foods, and other items through its operations in the United States, Canada, and other regions. The company provides cost savings to its customers through its discount offerings. Costco’s top line also gets support from the fees that it charges for providing its membership.

Amid surging costs, high inflation levels, and the global food crisis, Costco has managed to maintain its footing. According to the recently released data, there was an 11.4% year-over-year jump to $17.55 billion in net sales for the retail month of August (the four weeks ended August 28, 2022).

Costco Stock Commands a Strong Buy Rating

Analysts are optimistic about the Costco stock as it has a Strong Buy rating, based on 12 Buys and three Holds. COST’s average stock price of $562.79, signals a 4.9% upside potential from current levels.

Moreover, financial bloggers and hedge funds look bullish about the COST stock. Financial bloggers’ opinions are 71% Bullish on COST stock, above the sector average of 64%. Hedge funds have also purchased 1.2 million shares of Costco stock in the last quarter.

Finally, according to a TipRanks tool, COST stock carries a Smart Score of 9 out of 10 which highlights its ability to outperform.

Final Thoughts

Grocery store stocks enable investors to capitalize on rising food prices as they are passed on to the end customers. With their strong underlying fundamentals and competitive advantages, Kroger and Costco look like good investment options. Adding to their appeal, KR and COST have returned 23.4% and 17.5%. respectively, in the past year.

Read full Disclosure