Earlier today, grocery retailer Kroger (NYSE: KR) released its Fiscal Q2-2022 earnings results, causing the stock to finish 7.4% higher. This is because both earnings per share (EPS) and revenue beat expectations. In addition, the company raised its guidance for the remainder of its fiscal year and approved a $1 billion share buyback program.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Kroger’s Q2 revenue of $34.6 billion grew 9% on a year-over-year basis (5.2% when excluding fuel), beating the consensus estimate of $34.4 billion. The company’s earnings per share came in at $0.90, beating the $0.82 estimate and improving from the $0.80 figure seen in Q2 2021. KR’s gross profit margin also beat analyst estimates by 40 basis points, reaching 20.9%. The strong results are due to robust demand for home-prepared food and private-label products.

Next, Kroger’s operating income increased to $954 million, 13.7% higher than last year, giving it an operating income margin of 2.8%.

The company ended the quarter with over $1 billion in cash & cash equivalents, with a net total debt figure of $12.4 billion.

Kroger Raises Its Fiscal 2022 Guidance

Investors were pleased to see that Kroger raised its full-year 2022 outlook. For the full year, KR is projecting adjusted EPS to be between $3.95 and $4.05; the previous outlook was $0.10 lower on both the high and low ranges. For reference, last year, its full-year adjusted EPS came in at $3.68.

Also, Kroger anticipates full-year operating income to come in between $4.6 billion to $4.7 billion, higher than the previous estimates of $4.3 billion to $4.4 billion.

Is KR Stock a Buy, Sell, or Hold?

Turning to Wall Street, Kroger stock earns a Hold consensus rating based on three Buys, eight Holds, and three Sells assigned in the past three months. The average KR stock price prediction of $53.97 implies 3.9% upside potential from the last closing price.

Top TipRanks Investors are Very Positive on KR Stock

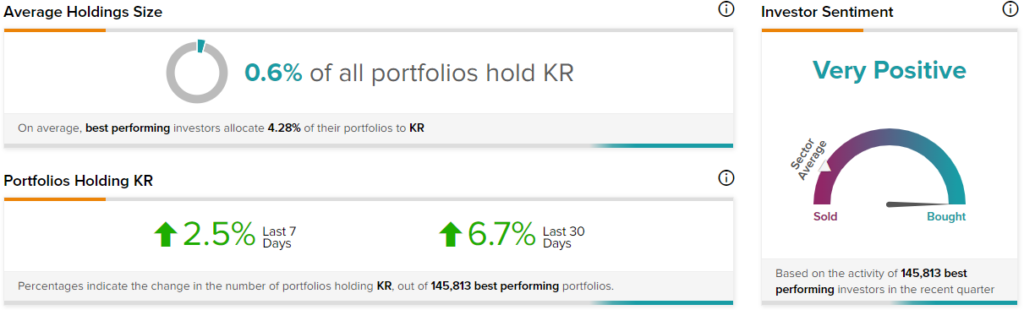

TipRanks currently tracks 729,069 investor portfolios that use the Smart Portfolio tool. The top investors, which amount to 145,813 portfolios, appear very positive on Kroger.

In the past 30 days, the number of top-performing TipRanks portfolios holding KR stock increased by 6.7%, leading to 0.6% of portfolios holding the stock. In the past seven days, this number increased by 2.5%. Kroger’s positive investor sentiment is above the sector average, as shown in the image below:

Conclusion: Kroger’s Solid Results Spark a Rally

Kroger’s results beat both revenue and earnings estimates, and the company’s guidance came in higher than the consensus as well. This caused the stock to rally significantly today. However, analysts have a Hold rating on the stock, and they don’t see much upside potential from here. It will be interesting to see if this earnings report will bring about any major analyst upgrades.