Investors interested in U.S. oil & gas companies could find Texas-based Occidental Petroleum Corporation (NYSE: OXY) appealing as its financials are very solid, industry fundamentals are great, shares are rising, and prospects look very bright. If analysts, hedge funds, and retail investors covered by TipRanks are to be believed, the stock is a Buy at current levels.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

However, before jumping to any conclusion, let us learn more about the performance and future prospects of this $58.7-billion energy company.

Occidental Petroleum engages in the exploration and production of oil and natural gas in the United States, Latin America, the Middle East, and Africa. Also, the company has expertise in making chemicals, and processing, transporting, and storing oil, natural gas, natural gas liquids (NGLs), and others products.

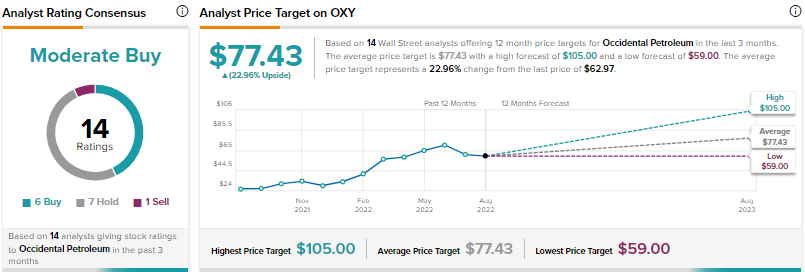

Interestingly, shares of Occidental Petroleum have surged 102.74% year-to-date. Also, the company has received six Buy recommendations from analysts covered by TipRanks. Its consensus rating is a Moderate Buy, which depicts analysts’ cautiously optimistic approach toward the stock. OXY’s average price target of $77.43 mirrors 22.96% upside potential from the current level.

Factors Influencing Occidental Petroleum’s Growth Prospects

A diversified business portfolio, with operations ranging from oil and natural production to transportation and storage, and chemical manufacturing (through OxyChem), is a boon for Occidental Petroleum. The prospects of these businesses look very bright, especially in the backdrop of rising oil and natural gas prices, healthy demand, and restricted supply in the industry.

It is worth noting that the company is the largest producer in the DJ and Permian basins. Along with its presence in these basins, its operations in the offshore Gulf of Mexico raise its appeal. At the end of 2021, the company had proven reserves of 3,512 million barrels of oil equivalent (MMboe), up 20.6% year-over-year.

Furthermore, Occidental Petroleum’s solid cash position equips the company to reward its shareholders with dividend hikes and share buybacks, lower its leverage, and invest in growth projects. Notably, the company is progressing well with its partnership with Colombia-based Ecopetrol S.A., Algeria contract, and expansion plans of the Oxychem Battleground plant.

Talking about financials, Occidental Petroleum has delivered better-than-expected results in the last four quarters. Its average earnings surprise is 19.82%. In the second quarter of 2022, the company’s adjusted earnings of $3.16 per share surpassed the consensus estimate of $3.03 per share by 4.3% and the year-ago tally of $0.32 per share.

The bottom line strength was driven by a 78.6% rise in revenues, partially offset by a rise in oil and gas operating expenses, chemical and midstream costs, costs of purchased commodities, and selling and administrative expenses. During the quarter, the company paid cash dividends of $323 million, repurchased shares worth $532 million, invested $972 million in capital expenditures, and used $3,849 million to repay debts.

The company’s CEO, Vicki Hollub, said, “Oxy completed another quarter with strong operational and financial performance across all of our businesses. We generated $4.2 billion of free cash flow before working capital in the second quarter, our highest quarterly free cash flow to date.”

The company anticipates oil and gas production to be within 1,140-1,170 thousand barrels of oil equivalent per day (Mboed) in 2022.

Hedge Funds and Retail Investors Are Optimistic about OXY’s Prospects

According to TipRanks, hedge funds have bought 18.8 million shares of OXY in the last quarter, while retail portfolios holding OXY stock have increased 6.4% in the last 30 days. Top portfolios with investments in OXY shares grew 16.1% in the last month.

What Is the Future of OXY Stock?

Investors will be thrilled to know that the U.S. stock-market icon Warren Buffett, through its company Berkshire Hathaway Inc. (NYSE: BRK.A) (NYSE: BRK.B), has purchased a large number of OXY shares since the beginning of 2022. Berkshire Hathaway is the largest shareholder in Occidental Petroleum, holding > 20% of OXY stocks.

Buffett’s interest in Occidental Petroleum and hedge funds and retail investors’ bullish stance underpin the company’s growth story. Also, a ‘Perfect 10’ Smart Score on TipRanks mirrors the company’s potential to outperform the broader market.

Read full Disclosure