The Goldman Sachs Group, Inc. (NYSE:GS), Morgan Stanley (NYSE:MS), and Bank of America Corporation (NYSE:BAC) are three U.S. capital market investment banks that have suffered from a fall in corporate activities, like mergers and initial public offerings (IPOs), since the beginning of 2022. Such complex transactions, which require investment banking services, decreased due to volatility in the stock market. On the other hand, bank stocks usually thrive when interest rates rise, as financial institutions benefit from lending at higher interest rates.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

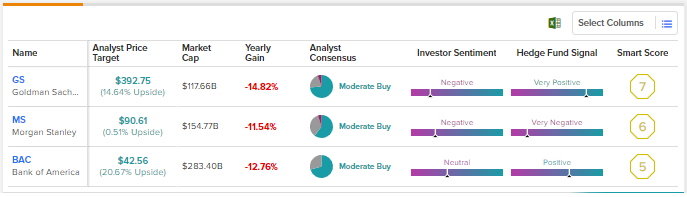

Let’s see how these banks have been faring. This chart, designed using TipRanks’ Stock Comparison tool, clearly shows how each bank has been performing.

The Goldman Sachs Group, Inc. (NYSE:GS)

The New York-based financial firm offers consumer banking, investment management, securities, and investment banking services. Its clientele includes governments, corporations, individuals, and financial institutions. The company’s market capitalization stands at $117.66 billion.

In the second quarter of 2022, revenues of Goldman Sachs’ Investment Banking segment declined 41% year-over-year due to a 5% fall in financial advisory, an 89% dip in equity underwriting, and a 52% decline in debt underwriting sales. Overall, Investment Banking revenues accounted for 18% of the company’s total revenues in the quarter, compared with 19% in the first quarter of 2022.

The company’s Chairman and CEO, David Solomon, said, “Despite increased volatility and uncertainty, I remain confident in our ability to navigate the environment, dynamically manage our resources and drive long-term, accretive returns for shareholders.”

Is GS Stock a Good Buy?

Despite facing hurdles, Goldman Sachs stands to benefit from rising interest rates, which increases its investment appeal. Also, the company’s commitment to rewarding its shareholders handsomely through dividend payments and share buybacks works in its favor. In July, Goldman Sachs increased its quarterly dividend rate by 25%.

On TipRanks, analysts are cautious but optimistic about the prospects of Goldman Sachs, which warrants a Moderate Buy consensus rating based on 14 Buys, four Holds, and one Sell. GS’ average price target is $392.75, which represents upside potential of 14.64% from the current level.

According to TipRanks, hedge funds are Very Positive on the stock, as they have purchased 513,400 GS shares in the last quarter. On the contrary, investor sentiment is Negative toward the stock. Notably, the number of portfolios with exposure to GS stock has declined 1.2% in the last 30 days.

Morgan Stanley (NYSE:MS)

The $154.77-billion financial services company has expertise in providing investment banking, securities, investment management, and wealth management services. Individuals, corporate institutions, and governments are the company’s customers.

Morgan Stanley’s investment banking revenues declined 55% year-over-year in the second quarter of 2022. While advisory revenues were down 54.9%, equity underwriting and fixed income underwriting revenues declined 9.9% and 86.2%, respectively.

The company’s Chairman and CEO, James P. Gorman, said that growth in underwriting revenues (fixed income and equity) partially offset weakness in investment banking revenues.

“We continue to attract positive flows across our Wealth Management business, and Investment Management continues to benefit from its diversification,” Gorman added.

Is Morgan Stanley a Good Long-Term Investment Option?

With continued strength across its wealth management and investment management businesses, as well as strengthening interest rates in the country, the company could be a solid investment option for long-term investors. Also, Morgan Stanley’s dividend yield stands at 3.21%.

Morgan Stanley has a Moderate Buy consensus rating, which is based on 12 Buys, seven Holds, and one Sell. MS’ average price forecast of $90.61 suggests 0.51% upside potential from the current level.

As of now, hedge funds and retail investors are shying away from the stock. While hedge funds sold 1.3 million MS stocks in the last quarter, retail investors decreased their exposure by 0.6% in the last 30 days.

Bank of America Corporation (NYSE:BAC)

The financial company provides banking, wealth management, risk management, investment banking, and other services. With a market capitalization of $283.4 billion, Bank of America’s clients include corporations, individuals, institutions, and governments.

In the second quarter of 2022, Morgan Stanley’s investment banking revenues declined 47% year-over-year. Notably, investment banking revenues fell 41% for the Global Banking segment and declined 52% for the Global Markets segment.

The company’s CFO, Alastair Borthwick, said, “We believe our earnings generation over the next 18 months will provide ample capital to support growth, pay dividends, buy back shares and continue to invest in our people, platforms and communities as we grow into new regulatory capital level requirements.”

Is BAC Stock a Buy or Sell?

Considering the take of analysts and hedge funds tracked by TipRanks, and rising interest rates, BAC stock could be an attractive investment option for prospective investors.

Analysts have a Moderate Buy consensus rating on BAC, which is based on 12 Buys and five Holds. BAC’s average price target of $42.56 mirrors upside potential of 20.67% from the current level. Hedge funds are Bullish on the stock and have bought 1.7 million shares in the last three months.

However, retail investors are Neutral on the stock, as the number of portfolios with investments in BAC stock has slipped 0.4% in the last seven days.

Concluding Remarks

Goldman Sachs, Morgan Stanley, and Bank of America are exposed to near-term hurdles, triggered by a decline in investment banking revenues. Despite this, these companies appear well-positioned to benefit from increasing interest rates and have solid long-term prospects. A price performance chart of these companies is provided below.

Read full Disclosure