This year’s bear market has caused many high beta stocks to sell off excessively, with semiconductor stocks being in the thick of it all.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Nevertheless, with chaos comes opportunity; I’d like to quote Barron Nathan Rothschild: “Buy when there’s blood in the streets.”

Many of the ‘semis’ have drawn down significantly, and I’m bullish on the following three stocks as I believe they’re tremendously undervalued.

Nvidia

Nvidia (NVDA) is an outlier in the semiconductor market, focusing on the fast-growing GPU (graphics processing unit). The company holds 78% of the GPU market, which is growing at a compound annual growth rate of 32.7%.

Many investors are concerned about Nvidia’s exposure to the crypto mining space, which has seemingly “crashed” and drawn down hardware prices. However, Nvidia’s CMPs (cryptocurrency mining processors) have mainly been utilized for crypto mining, and its standard GPUs don’t have much viability for crypto mining. Thus, the notion that a potential crypto crash could derail Nvidia’s prospects remains a myth.

Furthermore, Nvidia exhibits extraordinary profitability metrics. For example, the company has a gross profit margin of 65.26%, implying that it has achieved economies of scale, which provides it with pricing power. Moreover, Nvidia’s return on common equity of 41.95% suggests that the company’s investors are getting full value for their money.

After losing more than half of its market value since the start of the year, Nvidia’s undervalued on a normalized basis. The stock’s price-to-earnings and price-to-cash flow ratios are at discounts of 33.74% and 15%, respectively, implying that investors are underscoring the stock’s intrinsic value.

Turning to Wall Street, Nvidia earns a Strong Buy consensus rating, based on 26 Buys and six Hold ratings assigned in the past three months. The average NVDA stock price target of $262.41 implies 80.69% upside potential.

Advanced Micro Devices

AMD (AMD) is raking in profits from both the CPU (central processing unit) and GPU markets. Although the CPU market is growing slower than the GPU market, its addressable consumer base is 10x larger, and AMD holds 36.4% of the market share.

Even though it’s not its primary line of business, AMD owns approximately 13.9% of the GPU market, with its AMD Rhodeon a key player in the personal computing landscape.

Furthermore, AMD recently beat its first-quarter earnings target when it posted earnings of $1.13 per share. The firm expects a solid second quarter, with its guidance set at $6.5 billion in revenue, topping the consensus by $140 million.

Quantitative metrics suggest that AMD stock is undervalued. The stock’s price-to-earnings ratio is at a 66.38% discount to its 5-year average, implying value in abundance. Additionally, AMD’s RSI (relative strength index) is at 31.37, conveying that the stock is borderline oversold, providing investors with a lucrative entry point.

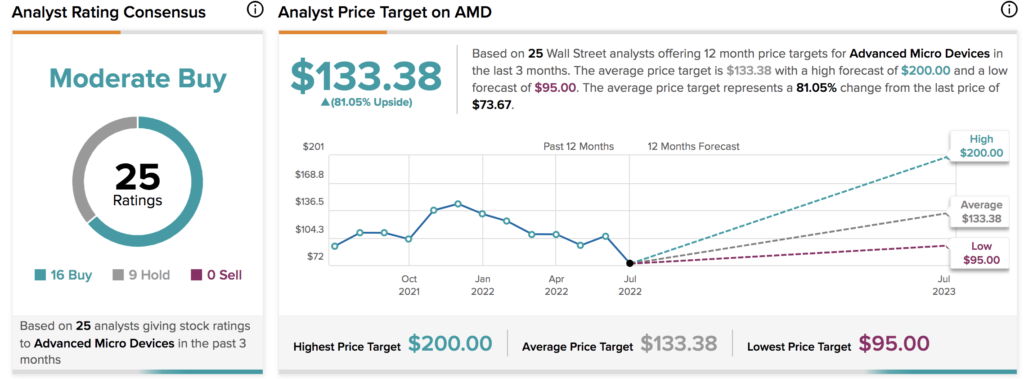

Turning to Wall Street, Advanced Micro Devices earns a Moderate Buy consensus rating based on 16 Buys and nine Hold ratings assigned in the past three months. The average AMD stock price target of $133.38 implies 81.05% upside potential.

Intel

Intel (INTC) is a mature semiconductor stock, meaning it’s less volatile but provides a solid risk-return profile with generous dividends.

The company’s 63.55% market share in the CPU space is predominantly driven by personal computing. The company’s personal computing revenue has declined 13% year-over-year, which has caused the stock to draw down by more than 50% in 2022. However, as soon as inflation tops out, we’ll likely see a recovery in the consumer goods space, causing Intel’s PC and broad-based revenue to proliferate in the long-run.

Intel is a long-term investment and by no means a short-term recovery play. The stock’s trading at 1.9x its sales, which is 39.12% lower than its 5-year average. In addition, Intel sports a dividend yield of 3.92%, which is in the upper quantile of U.S. listed stocks.

Turning to Wall Street, Intel earns a Hold consensus rating based on five Buys, nine Holds, and five Sell ratings assigned in the past three months. The average INTC stock price target of $50.94 implies 40.18% upside potential.

Concluding Thoughts

There’s no guarantee that the stocks mentioned in this article will revert to their previous heights. Nonetheless, they provide some of the best relative valuation metrics on the market and exhibit secular growth attributes that could see them gain traction soon.

Read full Disclosure