The debate surrounding buy-and-hold investments has been around as long as I’ve been on this earth. Do-it-yourself investors have always sought out no-brainer forever stocks that can be put on autopilot and left to grow unattended. There is no question certain stocks have experienced extended runs over the years, even decades.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

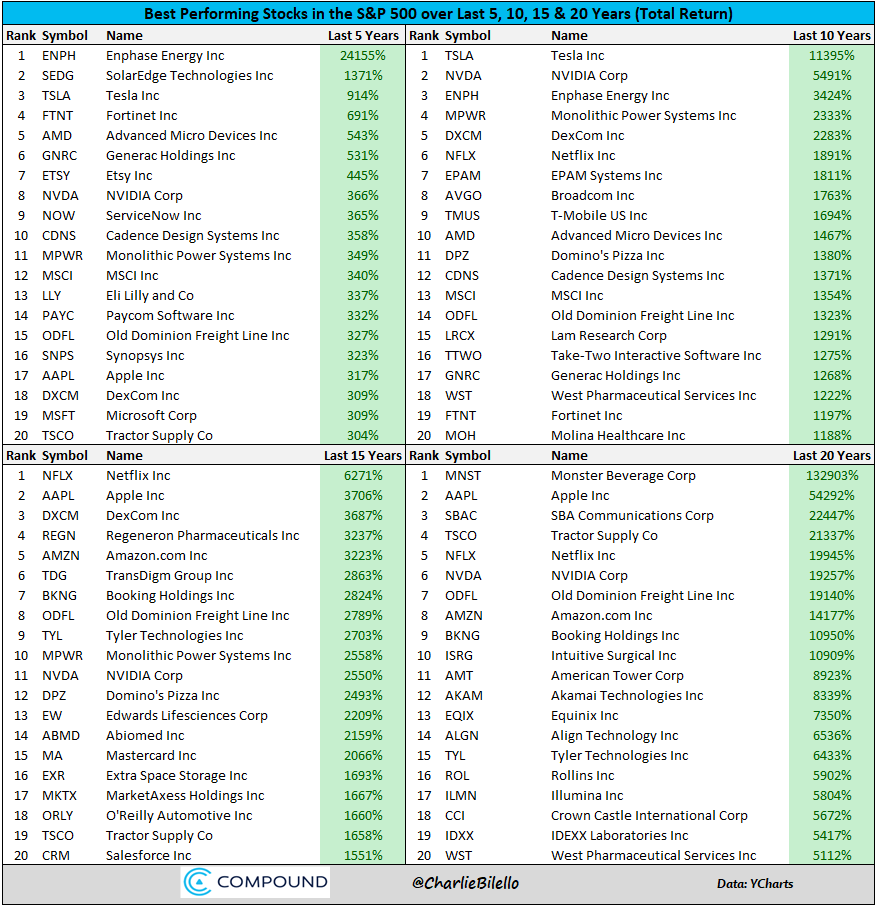

Portfolio manager Charlie Bilello published a tweet in late June that highlighted the 10 top-performing S&P 500 (SPX) stocks over five, 10, 15, and 20-year periods. The top-performing stock over 20 years was Monster Beverage (NASDAQ:MNST), up 132,903% over this period.

Is Monster Beverage a forever stock? If it’s not, it’s pretty darn close.

The second top-performing stock over 20 years was Apple (NASDAQ:AAPL), which gained 54,292% over the same period. It’s fair to say that the iPhone maker would be on most people’s short list of no-brainer forever stocks.

Who are some of the other candidates? That’s what I’m here to uncover.

Interestingly, if you look at all four of Billelo’s charts, you’ll notice that no company — not even Apple — made all four charts, suggesting that even forever stocks have periods of underperformance.

Forever stocks are companies whose business models stand the test of time. They might not always be top performers, but they’ll almost certainly outdo the indexes over the long haul.

Here are my three no-brainer stocks for 2023 and beyond.

Tractor Supply Company (NASDAQ:TSCO)

Tractor Supply was one of Bilello’s top-performing stocks over the 5, 10, and 20-year periods. It missed out over 15 years. You can’t win them all.

One of the best career decisions Hal Lawton, CEO of TSCO, ever made was in December 2019. At the time, he was president of Macy’s (NYSE:M), the New York City-based department store chain. His company was in the middle of the holiday shopping season, the retail industry’s Super Bowl.

Tractor Supply announced on December 5, 2019, that Lawton would join the lifestyle retailer as CEO, replacing Greg Sandfort, who retired after more than seven years in the top job.

“After conducting a robust search process, the Board is convinced Hal Lawton is the right CEO to build on Tractor Supply’s success and lead the next stage of the Company’s growth,” said Cynthia Jamison, Tractor Supply’s Chairman of the Board. “Hal is a proven leader with a unique omnichannel experience to deliver on our customer’s evolving expectations as we look to the future of retail.”

Prior to joining Macy’s in 2017, Lawton served as the president of eBay (NASDAQ: EBAY) North America. Since Lawton’s first day at Tractor Supply on January 13, 2020, TSCO stock has gained 122%.

Is TSCO Stock a Buy, According to Analysts?

The 16 analysts covering TSCO have a “Moderate Buy” rating on the stock based on 11 Buys and five Holds assigned in the past three months. The average TSCO stock target price of $229.06 implies 12.6% upside potential.

Tractor Supply currently trades at 1.7x sales, approximately the same as its five-year average of 1.6x.

Visa (NYSE:V)

Visa isn’t a Dividend Aristocrat yet, but there’s a reasonably good chance it will be if it continues to generate fortress-like financial results. On October 25, the company reported its Q4-2022 results. Included in its report was a 20% increase in its quarterly dividend to 45 cents per share. That’s its 14th consecutive annual increase. It needs just 11 more to join the exclusive club.

Highlights of its Q4 report include a 10% increase in payments volume in the quarter while processed transactions jumped 12%. As a result, its revenues grew 18.8% year-over-year to $7.79 billion. That was $240 million higher than the consensus estimate.

The company’s total cross-border volume over last year was up 36% in the quarter. If you exclude transactions within Europe, cross-border volume jumps 49%.

As for its profitability, its non-GAAP net income in the quarter was $4.09 billion, 16.2% higher than $3.52 billion a year earlier.

“If you just looked at our numbers and didn’t look at what people are writing or saying in the media, you wouldn’t think there’s all this anxiety or uncertainty out there or that people aren’t feeling good about things,” Visa’s Chief Financial Officer Vasant Prabhu told MarketWatch. “The numbers have been steady for nine months, and spending is stable almost everywhere in the world and quite strong.”

There’s a possibility that Visa’s current experience will change in the months to come. However, anyone buying Visa as a forever stock ought to be thinking about the company’s long-term potential, which is excellent.

Is Visa Stock a Buy, According to Analysts?

According to Tipranks data, 19 analysts cover V stock, giving it a “Strong Buy” rating and an average target price of $245.00. That’s 26.3% higher than its current share price. Visa trades at 12.7x sales, considerably less than its five-year average of 18.1x.

Berkshire Hathaway (BRK.A) (BRK.B)

This last forever stock is a controversial one. After all, Warren Buffett is 92 years old. He won’t be with us forever, so how can Berkshire Hathaway be a forever stock?

Two words: Greg Abel, Buffett’s successor as the CEO of the massive holding company.

For years, the media and investors have speculated what would happen to Berkshire stock upon the Oracle of Omaha’s death. The guesses are all over the map — both up and down. Buffett weighed in on the subject at the company’s 2017 annual shareholder meeting.

“If I die tonight, I think the stock would go up tomorrow,” Buffett, 86, said at the time. “And there’d be speculation about breakups and all that sort of thing, so it would be a good Wall Street story.”

While it’s possible Abel and the board would decide to dismantle the entire Berkshire empire, it’s more likely to continue operating just as it always has, allocating capital and manpower when needed to help its various businesses be successful. Abel has worked at Berkshire long enough to understand the company’s overarching vision. He likely won’t change that.

In the meantime, Berkshire has been a solid stock to hold during the market’s correction in 2022. Berkshire stock is down 3.5% year-to-date, about 18 percentage points better than the S&P 500. Over the past year, it has been flat, about 18.5 percentage points better than the index.

Why would anyone want to sell this stock when it gives you a combination of offense and defense without the management fees of a mutual fund or exchange-traded fund (ETF)? In my opinion, it’s the ultimate forever stock.

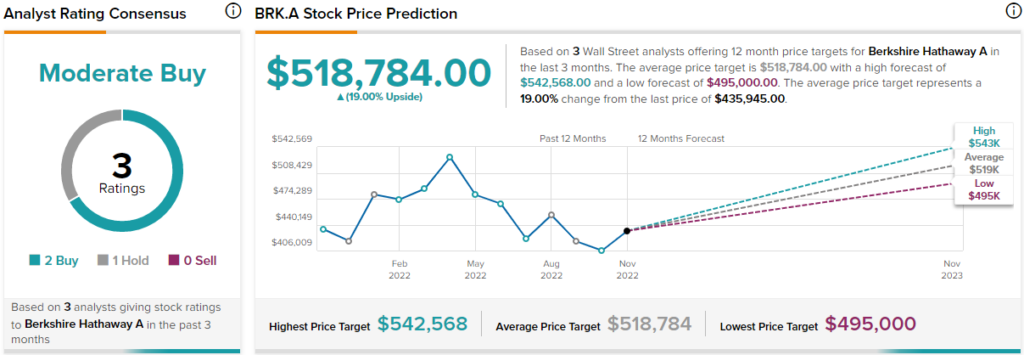

Is Berkshire Hathaway Stock a Buy, According to Analysts?

According to Tipranks data, three analysts cover Berkshire stock, giving it a “Strong Buy” rating and an average target price of $518,784.00, implying 19% upside potential. Meanwhile, Berkshire’s Class B shares have a $362 price target based on just two Buy ratings, implying 25.4% upside potential.