Education

About Us

Working with TipRanks

Follow Us

GB:0LMW ETF Price & Analysis

0LMW ETF Chart & Stats

$289.60

--

Market closed

$289.60

--

Day’s Range― - ―

52-Week Range$234.86 - $297.90

Previous Close$289.6

VolumeN/A

Average Volume (3M)225.00

AUM17.36B

NAV289.89

Expense Ratio0.09%

Holdings Count411

Beta0.68

Inception DateJan 26, 2004

Next Dividend Ex-DateN/A

Dividend Yield

(1.6%)Shares OutstandingN/A

Standard DeviationN/A

10 Day Avg. Volume106

30 Day Avg. Volume225

AlphaN/A

ETF Overview

Vanguard Health Care ETF

The Vanguard Health Care ETF (Ticker: VHT) is a compelling investment vehicle that provides exposure to the dynamic and ever-evolving health care sector. As a sector-focused, broad-based exchange-traded fund, VHT offers investors a diversified portfolio encompassing a wide array of health care industries, including pharmaceuticals, biotechnology, medical devices, and health care providers and services. This ETF is designed for investors seeking to capitalize on the growth potential within the health care sector, which is driven by factors such as aging populations, technological advancements, and increased global health care spending.

With VHT, investors gain access to a comprehensive range of health care companies, from established giants to innovative newcomers, allowing for a balanced approach to sector investing. The fund's strategic focus on health care ensures that it is well-positioned to capture the benefits of long-term trends such as the development of new treatments and the expansion of health care services worldwide.

Managed by Vanguard, a leader in low-cost investment solutions, the Health Care ETF offers a cost-effective opportunity to invest in the health care sector, with the added benefit of Vanguard's expertise in fund management. VHT is an ideal choice for investors looking to enhance their portfolio with the resilience and growth potential of the health care industry, making it a smart option for those seeking to invest in a sector that is integral to global well-being and economic progress.

Vanguard Health Care ETF (0LMW) Fund Flow Chart

Vanguard Health Care ETF (0LMW) 1 year Net Flows: -$765M

0LMW ETF News

0LMW ETF FAQ

What was GB:0LMW’s price range in the past 12 months?

GB:0LMW lowest ETF price was $234.86 and its highest was $297.90 in the past 12 months.

What is the AUM of GB:0LMW?

As of Feb 20, 2026 The AUM of GB:0LMW is 17.36B.

Is GB:0LMW overvalued?

According to Wall Street analysts GB:0LMW’s price is currently Undervalued.

Does GB:0LMW pay dividends?

GB:0LMW does not currently pay dividends.

How many shares outstanding does GB:0LMW have?

Currently, no data Available

Which hedge fund is a major shareholder of GB:0LMW?

Currently, no hedge funds are holding shares in GB:0LMW

0LMW ETF Smart Score

Neutral

1

2

3

4

5

6

7

8

9

10

Learn more about TipRanks Smart Score

For ETFs, the calculations for the Smart Score, Analyst Consensus, Price Target, Blogger Sentiment, News Sentiment and Insider Transactions are based on the weighted average of the ETF's holdings and some additional factors. Hedge Fund Trend, Crowd Wisdom and Technicals are based on the actual ETF ticker.

Top 10 Holdings

Eli Lilly And Company

12.70%

Johnson & Johnson

8.22%

Abbvie

6.00%

Merck & Company

4.19%

Unitedhealth Group Inc.

3.96%

Thermo Fisher Scientific

3.33%

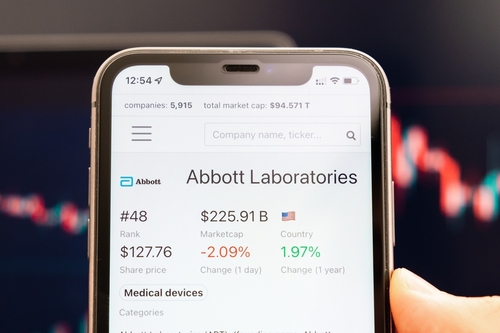

Abbott Laboratories

2.90%

Amgen Inc

2.80%

Intuitive Surgical

2.75%

Gilead Sciences

2.68%

Total49.53%

See All Holdings