DTE Energy (DTE) has joined hands with a ride-sharing platform provider, Lyft (LYFT), to reward drivers on Lyft’s platform, who bought or leased an EV and are within its electric serviceable range. Following the news, shares of Lyft gained 6.8% on Tuesday.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

DTE Energy is a diversified energy company that provides electricity and natural gas sales, distribution and storage services.

The incentive comes under DTE Energy’s Charging Forward program, whereby, it will provide a rebate of about $2,000 in case an EV is purchased or leased. Further, on completion of 200 rides every quarter, the drivers will be eligible to receive $750 per quarter in a year.

The deal has been designed to motivate more and more people to switch to EVs by making it reasonably accessible to all, especially in low-income areas.

Executive Comments

The Senior Manager of Sustainability at Lyft, Paul Augustine, said, “Lyft is excited to partner with DTE to help drivers make the transition to electric vehicles. For many, the price of switching to an EV remains too high, but with this program, more people will be able to access the benefits of electrification… Smart investments like these are an important step in ensuring Lyft reaches its goal of 100% EVs on our network by 2030.”

“We are eager to provide equitable access to new, cleaner technologies like EVs in southeast Michigan as we push forward in our journey toward a cleaner energy future,” said Tony Tomczak, the Vice-President of Electric Sales and Marketing at DTE Energy.

Stock Rating

Recently, Morgan Stanley analyst Stephen Byrd maintained a Buy rating on DTE Energy with a price target of $133 (1.9% upside potential from current levels).

The rest of the Street is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on nine Buys and seven Holds. Lyft’s average price target of $131.29 implies 0.5% upside potential to current levels.

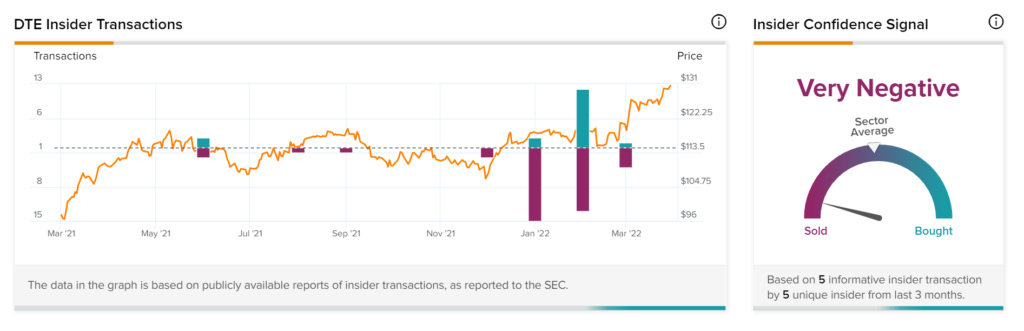

Insider Trading Activity

Based on the recent corporate insider activity, corporate insider sentiment is very negative. This means that over the past quarter there has been an increase in insiders selling their shares of DTE Energy.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Uber and bp Team Up, Will They Deliver?

XPeng’s Q4 Numbers Impress Analysts

Transocean Expands Exploration Portfolio with Ocean Minerals