As part of its restructuring plan, ConocoPhillips (NYSE: COP), the American multinational corporation engaged in hydrocarbon exploration and production, might sell its assets worth over $1 billion in the Permian Basin, as per a Bloomberg report. The move is expected to reduce the company’s market share in the Delaware region within the basin.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Though nothing has been revealed by the company, the source states that ConocoPhillips is in talks with an adviser for the auction of assets.

Oil companies, including ConocoPhillips, are exploring opportunities to offload non-core assets and focus on high-quality assets, following the surge in oil prices. Remarkably, the company became one of the basin’s biggest producers, post-completion of the acquisition of Royal Dutch Shell Enterprises LLC’s Delaware basin position in a cash deal worth $9.5 billion in December.

Furthermore, as part of its strategy to return cash to shareholders, along with upgrading its asset base, ConocoPhillips’s asset sale target was lifted 80% to between $4 billion and $5 billion by 2023, according to the source.

Wall Street’s Take

Speaking positively on the exploration and production, as well as the overall industry, Mizuho Securities analyst Vincent Lovaglio maintained a Buy rating on the stock and lifted the price target to $115 (22.97% upside potential) from $98.

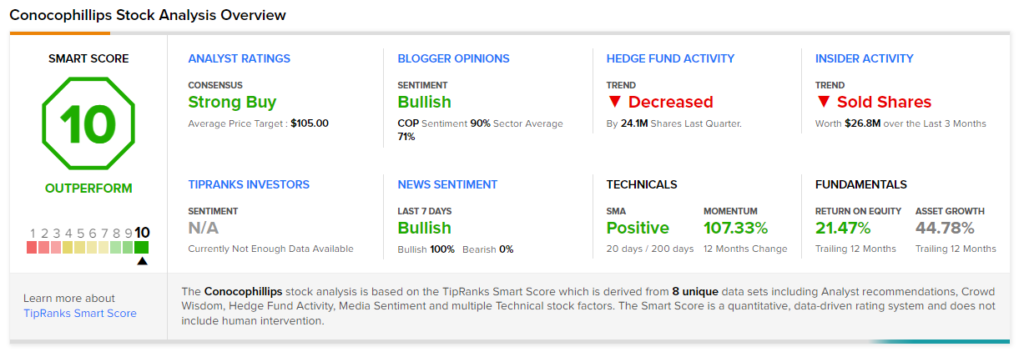

ConocoPhillips shares have skyrocketed 115.4% over the past year. The stock scores a Strong Buy consensus rating based on 14 Buys versus 2 Holds. The average ConocoPhillips price target of $105 implies 12.28% upside potential to current levels.

Smart Score

What’s more, ConocoPhillips scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

AstraZeneca’s Q4 Results Outperform; Shares Rise Pre-Market

Coca-Cola Posts Better-than-Expected Results as Sales Outperform

Novavax Reveals Positive Results for NVX-CoV2373 in Pediatrics