Alibaba (NYSE: BABA) has disclosed plans to raise its share buyback capacity to $25 billion from $15 billion. The Chinese multinational technology company specializes in e-commerce, retail, Internet and technology.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The repurchase authorization is effective for a two-year period through March 2024. Under the previous program, Alibaba bought about 56.2 million American depositary shares for $9.2 billion.

The company has increased its share buyback program twice in the past year. Also, it sees the recent increase as a “sign of confidence about the company’s continued growth in the future.”

Meanwhile, Alibaba has appointed Weijian Shan, the Executive Chairman of investment group PAG, as an independent director to its board, effective March 31.

Takeaway

Alibaba’s shares over the past three years have declined 42.1%. Key reasons for the stock’s disappointing performance include several investigations on the company, slowing growth of the Chinese economy and China’s regulatory concerns on the technology sector, leading to the imposition of several anti-monopoly and data security laws.

The move can be seen as an effort to control the falling share price, which has been wiping off billions of shareholders’ wealth. This record-high share repurchase program is expected to infuse confidence in investors and provide a boost to the stock.

Stock Rating

On March 21, Morgan Stanley analyst Gary Yu maintained a Buy rating on Alibaba and lowered the price target to $140 from $145. The new price target implies 35.2% upside potential from current levels.

Consensus among analysts is a Strong Buy based on 17 Buys and one Sell. The average Alibaba price target stands at $170.42 and implies upside potential of 64.5%.

Website Traffic

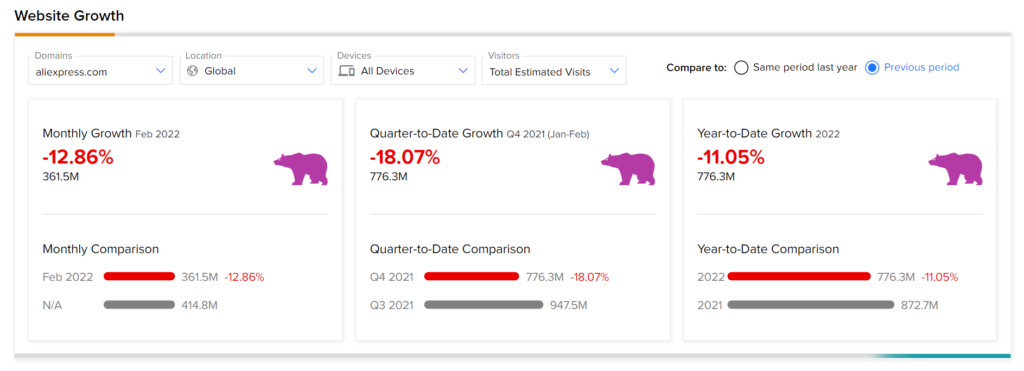

TipRanks’ Website Traffic tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into Alibaba’s performance.

According to the tool, the Alibaba website recorded a 12.9% monthly decline in global visits in February, compared to the previous year. Likewise, the website traffic has declined 11.1% year-to-date against the same period last year.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

NIKE Rises Over 5% on Upbeat Q3 Results; Street Says Buy

Halliburton Suspends Russian Operations; Shares Up 4%

Pinduoduo Smashes EPS Estimates; Shares Gain 6% Pre-Market