After market close today, Zoom Video Communications (ZM) reported its Fiscal Q2-2023 earnings results. While revenue missed expectations, non-GAAP earnings per share (EPS) beat estimates. Zoom has beaten earnings expectations in nine of the past nine quarters. However, the company’s guidance fell short of expectations. As a result, the stock is down after reporting the results.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Zoom’s revenue grew 8% year-over-year, reaching $1.1 billion, while estimates called for $1.2 billion in revenue. Non-GAAP EPS came in at $1.05, handily beating the $0.94 consensus. The company’s non-GAAP operating margin was 35.8%, down 580 basis points from the 41.6% margin recorded in the same period last year. As a result, its non-GAAP operating income was $393.7 million, falling 7% year-over-year.

Also, its GAAP operating margin fell from 28.8% to 11.1%. Similarly, Zoom’s cash flow saw a big drop, as the company recorded adjusted free cash flow of $221.1 million against last year’s figure of $455 million.

Zoom’s Guidance Comes in Worse Than Expected

Moving on to Zoom’s outlook, it expects next quarter’s revenue to come in at $1.095 billion to $1.1 billion; analysts were expecting guidance of $1.15 billion. Likewise, ZM sees Fiscal 2023 revenue of $4.385 billion to $4.395 billion, missing the consensus estimate of $4.54 billion.

In terms of earnings per share, ZM expects $0.82 to $0.83 for the next quarter and $3.66 to $3.69 for the full fiscal year. Analysts were expecting EPS of $0.91 and $3.76, respectively.

Is ZM Stock a Buy or Sell?

Turning to Wall Street, ZM stock earns a Moderate Buy consensus rating based on nine Buys, nine Holds, and one Sell rating assigned in the past three months. The average Zoom price prediction of $132.13 implies 35.6% upside potential. Analyst price targets range from a high of $190 to a low of $91.

Top TipRanks Investors are Slightly Bullish on ZM Stock

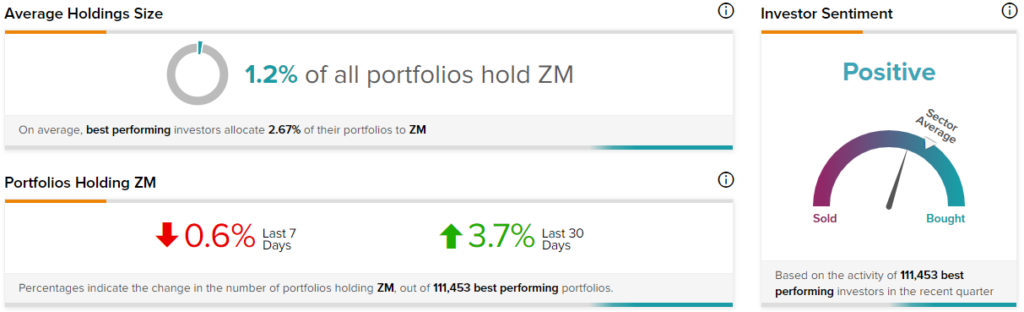

TipRanks currently tracks 557,268 investor portfolios that use the Smart Portfolio tool. The top investors, which amount to 111,453 portfolios, appear slightly bullish on ZM stock.

In the past 30 days, the number of top-performing TipRanks portfolios holding ZM stock increased by 3.7%, leading to 1.2% of portfolios holding the stock. However, in the past seven days, this number decreased by 0.6%. Zoom has positive investor sentiment, but it is close to neutral and is below the sector average, as shown in the image below:

Conclusion: Zoom Stock is Still Worth Considering

While Zoom’s revenue grew year-over-year, tough economic conditions caused the company’s profits to fall significantly. Also, besides beating on EPS, Zoom missed analysts’ estimates regarding Fiscal Q2 revenue and its future outlook, which is likely why the stock is down. Nonetheless, it’s still a growing company that is well off its highs, and analysts and top TipRanks investors are currently cautiously optimistic about the stock, making it worth considering.