Viva Energy (ASX:VEA) shares soared almost 7% today, hitting an intraday high of AU$2.80 and coming within striking distance of their 52-week high of $3.11. The stock surged after Viva Energy announced a deal to expand its business through the purchase of Coles Group’s (ASX:COL) Coles Express fuel and convenience retailing network.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

Viva Energy supplies Shell-branded transport fuels. It supplies fuel to more than 1,330 service stations across Australia. Viva also operates the Geelong Refinery in Victoria.

Viva to acquire Coles’ fuel and convenience business

Viva has agreed to acquire Coles’ fuel stations and convenience stores across Australia in a deal valued at AU$300 million. The deal involves the transfer of 710 Coles Express sites to Viva. The transaction is expected to close in the first half of 2023.

Viva is betting on the deal to accelerate its plans to develop a leading integrated fuel and convenience business. The deal means Viva is set to own the Coles Express service stations it has previously been supplying to.

In the past seven years, Coles Express sales recorded an annual growth rate of 3.7%, exceeding the average market growth rate of 3.1%. Viva expects the convenience segment to continue to grow over the long-term. It sees the shift to electric vehicles opening up expanding growth opportunities in the segment.

Viva Energy share price forecast

ASX shares have already gained more than 17% since the beginning of 2022. Analysts remain bullish on the stock’s outlook. According to TipRanks’ analyst rating consensus, Viva Energy stock is a Strong Buy based on seven Buys versus one Hold. The average Viva Energy share price prediction of AU$3.22 implies over 17% upside potential.

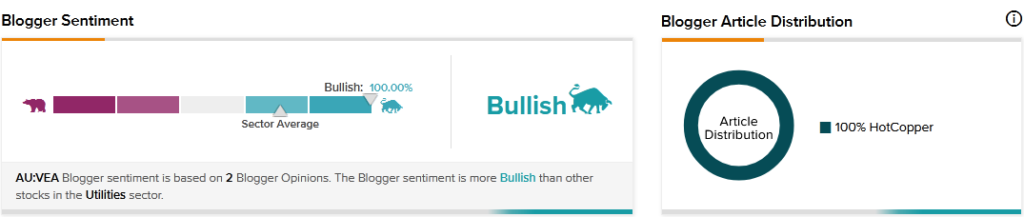

Viva Energy scores a nine out of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations. Moreover, the stock is receiving favourable mentions on financial blogs. TipRanks data shows that financial blogger opinions are 100% Bullish on VEA, compared to a sector average of 71%.

Final thoughts

Although Viva Energy currently relies on the fossil fuel business, it is taking steps to position itself for the renewable energy shift. For example, the Coles Express deal would give Viva an outlet network well positioned to cater for the rechargeable electric car market.