Nu Holdings Ltd. (NYSE: NU) has delivered better-than-expected results for the first quarter of 2022. Its quarterly loss was 50% lower than the consensus estimate while revenues surpassed the same by 23.4%.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Shares of this $20.1-billion digital banking service provider rose 12.2% in the pre-market trading session on Tuesday. Its shares lost 9.8% in the normal trading session on Monday.

Financial Highlights

In the quarter, Nu Holdings reported a loss of $0.01 per share, below the consensus loss estimate of $0.02 per share. Also, the bottom line was better than the year-ago tally of a loss of $0.04 per share.

Revenues stood at $877.3 million, above the consensus estimate of $710.7 million. On a year-over-year basis, the top line surged 258% on the back of 386.6% growth in interest income and gains on financial instruments and 119% expansion in fee and commission income.

Exiting the first quarter, the company’s total customers were 59.6 million, with roughly 5.7 million added during the quarter.

The total cost of financial and transactional services provided in the quarter increased 350.7% year-over-year. The rise in revenues was offset by a 350.7% rise in the total cost of financial and transactional services. Gross profits in the quarter came in at $294.1 million, up 154.2% year-over-year. Total operating expenses grew 114% in the quarter.

Balance Sheet and Cash Flow

Exiting the first quarter, Nu Holdings’ cash and cash equivalents were $2,968.6 million, up 9.7% year-over-year. Total liabilities in the quarter were $19,467.4 million, up 26.3% from the year-ago quarter.

Deposits expanded 94% year-over-year to $12.6 billion, and interest-earnings portfolios were up 343% to $3.1 billion.

The company generated net cash of $78.3 million in the quarter, compared with ($222.7) million in the year-ago quarter. Funds spent on acquisitions of property, plant and equipment totaled $4.7 million.

Management Comments

Nu Holdings’ Founder and CEO, David Velez, said, “Despite recent short-term market volatility and our upcoming lock-up release, we remain fully confident and committed to our long-term value creation, as reiterated by our main shareholders.”

Stock Rating

Overall, the Street is cautiously optimistic about the growth prospects of Nu Holdings and has a Moderate Buy consensus rating based on two Buys and one Hold. NU’s average price target of $9.67 suggests 122.3% upside potential from current levels.

Over the past year, shares of Nu Holdings have declined 57.9%.

Bloggers’ Stance

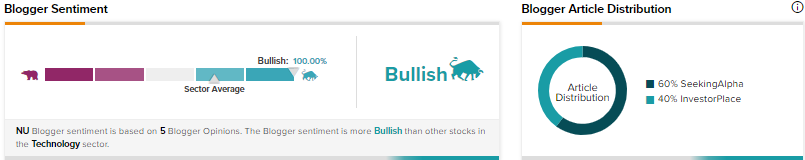

According to the TipRanks data, the financial bloggers are 100% Bullish on NU versus the sector average of 68%.

Conclusion

A growing addressable market for digital banking services as well as Nu Holdings’ capabilities to leverage prevalent growth opportunities is expected to be beneficial for the company. However, a check on costs and expenses by Nu Holdings is desirable.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Armed with Strategic Moves, Luna Innovations Beats Q1 Expectations

United Airlines Flies Higher on Strong Q2 Outlook

DADA Stock Jumps on Solid Q1 Performance