Lowe’s Companies, Inc. (NYSE: LOW) has posted mixed results for the first quarter of Fiscal 2022 (ended April 29, 2022). Its earnings surpassed the consensus estimate by 9%, while revenues missed the same by 0.5%.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Despite upbeat earnings, the revenue miss seems to have impacted investors’ confidence. At the time of writing, shares of this $128.3-billion home improvement company declined 2.9% in the pre-market trading session on Wednesday.

Financial Highlights

In the quarter, Lowe’s earnings were $3.51 per share, above the consensus estimate of $3.22 per share. On a year-over-year basis, the bottom line has grown 9.3%.

Revenues came in at $23.66 billion, below the consensus estimate of $23.78 billion. However, the top line slipped 3.1% from the year-ago tally of $24.42 billion. The top line was adversely impacted by weakness in its outdoor seasonal business, due to cold temperatures in spring.

Meanwhile, the company has recorded a 4% decline in comparable sales and a 3.8% fall in its U.S. businesses.

The impact of a decline in revenues was offset by a 4.2% year-over-year fall in the cost of sales and a 4.3% cut in selling, general and administrative expenses. The gross margin in the quarter expanded 74 basis points (bps) to 34.03%, and the operating margin grew 67 bps to 13.96%.

Balance Sheet and Cash Flow

Exiting the first quarter, Lowe’s had cash and cash equivalents of $3,414 million, up 201.3% from the previous quarter. Its long-term debts stood at $28,776 million, up 20.6% sequentially. At this juncture, it is worth mentioning that the company, in the first quarter, raised $4,964 million from debt instruments.

In the quarter, Lowe’s generated net cash of $2,977 million from its operating activities, down 33.7% from the year-ago quarter. Capital expenditure declined 25.6% to $343 million.

Projections

For the Fiscal Year 2022 (ending January 2023), Lowe’s projects revenues within the $97-$99 billion range, including $1-$1.5 billion realized from the year’s 53rd week. The change in comparable sales is expected to vary from (1%) to 1%.

The company expects slight growth in gross margin while predicting operating margin within the 12.8%-13% range.

Earnings per share are expected to be $13.10-$13.60 per share. Share buybacks are expected at $12 billion.

Official Comment

Lowe’s Chairman, President, and CEO, Marvin R. Ellison, said, “Despite some increased uncertainty in the macro environment, we remain confident in the outlook for the home improvement market and our ability to deliver operating margin expansion in 2022.”

Capital Deployment

In the first quarter, Lowe’s used $773 million to repay debts (up 42.4% year-over-year), $537 million for the disbursement of dividends (up 22%), and $4,037 million for repurchasing shares (up 32.9%).

Wall Street’s Take

Five days ago, Joseph Feldman of Telsey Advisory reiterated a Buy rating on LOW while decreasing the price target to $250 (28.85% upside potential) from $285.

Overall, the Street is optimistic about LOW and has a Strong Buy consensus rating based on 10 Buys and three Holds. LOW’s average price target of $247.50 suggests 27.56% upside potential from current levels.

Over the past year, shares of Lowe’s have inched up 0.7%.

Crowd Wisdom

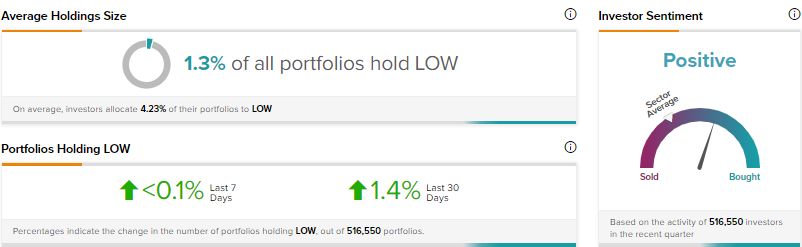

Per the TipRanks tool, the investor sentiment is Positive on LOW. In the past 30 days, 1.4% of portfolios tracked by TipRanks increased their exposure to the stock.

Conclusion

Lowe’s exposure to seasonal headwinds and a highly leveraged balance sheet are concerning for the company. However, a large addressable market, solid product offerings, and efforts to reward shareholders handsomely seem to be working in its favor.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Palatin’s Quarterly Update Leaves Investors Hopeful

Funko: Bullish on Q1-2022 Results and eBay Investment

Target Reports Q1 Earnings Tomorrow: What to Expect