WELL Health Technologies (TSE: WELL), a healthcare services provider, recently reported record Q3-2022 results that beat both revenue and earnings-per-share (EPS) estimates. The company also raised its 2022 guidance for the fourth time in a row, and the earnings report was good enough to send the stock surging.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

WELL Health’s revenue rose to a record C$145.8 million (a 47% year-over-year increase), which beat expectations of C$141.85 million. Notably, its Virtual Services division saw organic growth of 75%, representing 36% of the company’s revenue.

Also, its adjusted earnings per share were C$0.07, greater than the C$0.06 consensus estimate and last year’s adjusted EPS of -C$0.06.

Additionally, WELL Health’s adjusted EBITDA rose 23% year-over-year to a record C$27.5 million, and its adjusted gross profit margin increased by 330 basis points to 53.6%.

Cash flow from operations for the nine months ended September 30 was C$47.54 million compared to C$13.86 million in the same period last year, showing that the company is becoming a cash-flow machine.

Lastly, the company provided full-year 2022 guidance. Revenue is expected to be higher than C$565 million compared to its previous guidance of over C$550 million (revenue was C$302.3 million in 2021). It also expects an “exit run-rate revenue” of about C$700 million by the end of next year. Meanwhile, adjusted EBITDA is forecast to be over C$100 million for 2022 compared to C$60.4 million last year.

Is WELL Health Technologies a Buy, According to Analysts?

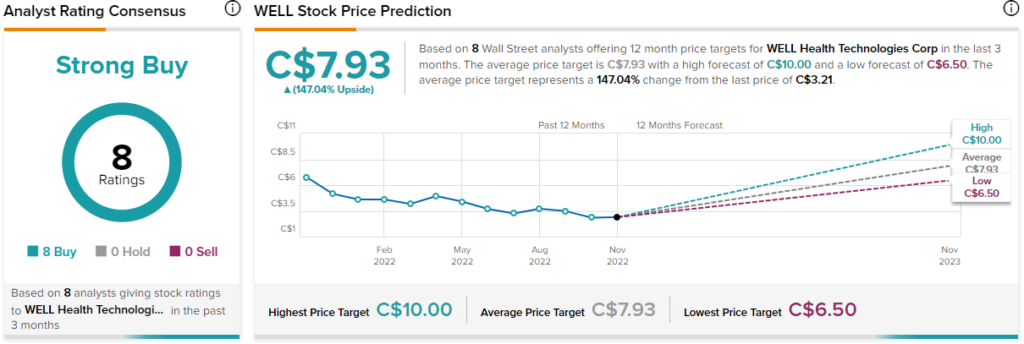

Analysts are all bullish on WELL stock, as it has eight unanimous Buy ratings, making it a “Strong Buy.” The average WELL Health stock price target of C$7.93 implies about 147% upside potential.

Conclusion: WELL Health Impresses Investors with Solid Earnings

WELL Health’s solid earnings results, combined with the broader market’s rally after a lower-than-expected inflation report this morning, sent shares on a major rally today. WELL Health continues to grow rapidly while beating expectations.