Shares of beauty retailer Ulta Beauty (NASDAQ:ULTA) fell in after-hours trading despite posting Q4 earnings that surpassed expectations. This can be attributed to the company’s cautious outlook for 2024, as earnings guidance dampened investor enthusiasm.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Earnings per share came in at $8.08, which beat analysts’ consensus estimate of $7.53 per share. Sales increased by 9.9% year-over-year, with revenue hitting $3.55 billion. This beat analysts’ expectations by $20 million.

Looking ahead, Ulta expects FY 2024 earnings and revenues to be in the ranges of $26.20 to $27 per share and $11.7 billion to $11.8 billion, respectively. For reference, analysts were expecting $27.03 per in earnings and revenue of $11.7 billion.

Is ULTA a Good Stock?

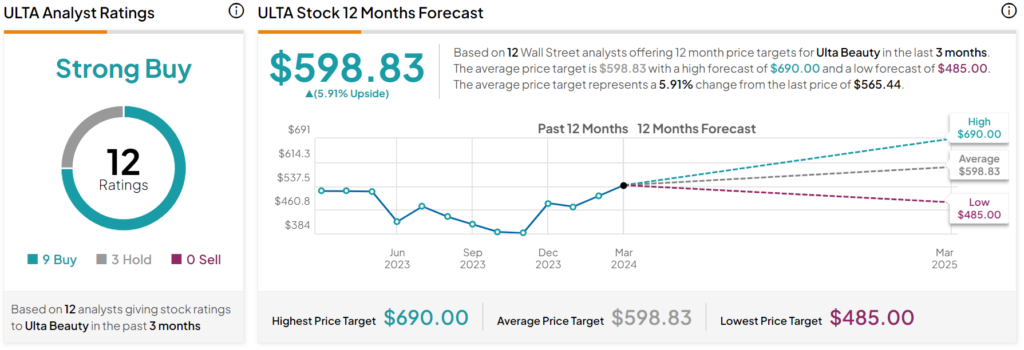

Turning to Wall Street, analysts have a Strong Buy consensus rating on ULTA stock based on nine Buys, three Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 7.8% rally in its share price over the past year, the average ULTA price target of $598.83 per share implies 5.9% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.