Warren Buffett and Ken Griffin are two of the most respected investors in the world, but their paths to financial success are very different.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Buffett is a long-term value investor who focuses on buying fundamentally strong, undervalued companies and holding them for long periods to benefit from compounding growth. In contrast, Citadel founder Ken Griffin employs a more active, quantitative, and data-driven approach, exploiting market inefficiencies to generate big returns.

But sometimes their different strategies lead them to the same conclusions. And when two such storied investors are seen getting behind the same companies, it merits some investigation into the reasons why.

Recently, both have been loading up on shares of Sirius XM (NASDAQ:SIRI) and Ulta Beauty (NASDAQ:ULTA), so naturally we’ve decided to give these names a closer look.

With some assistance from the TipRanks database, we can get an idea of whether the Street’s analyst community thinks these stocks make for good picks in the current environment. Let’s dive in.

Sirius XM Holdings

First up on our Buffett/Griffin endorsed list is Sirius XM, a leading provider of satellite radio and online streaming services. The company offers a broad spectrum of programming, including music, sports, news, and entertainment, serving millions of subscribers across North America via more than 150 channels, with exclusive content such as live sports, talk shows, and curated music stations. Over the years, it has also expanded its reach through digital platforms, enabling users to stream content online and via its mobile app.

Formed via the merger of Sirius Satellite Radio and XM Satellite Radio in 2008, the company has become the dominant player in the satellite radio industry. The most recent SIRI news also revolves around a merger. Earlier this week, the company announced that it had finalized its merger with Liberty Media’s Sirius XM tracking stock, resulting in what the company has called a “simplified capital structure and strategy.” The newly combined entity will maintain the Sirius XM brand, and trading commenced after a much-anticipated reverse stock split.

Along with the announcement, the company also reiterated its revenue and adjusted EBITDA outlook for the year, still anticipating $8.75 billion and around $2.7 billion, respectively, while free cash flow is expected to reach $1.0 billion.

Meanwhile, both Buffett and Griffin appear to be fans. In Q2, Buffett’s Berkshire Hathaway improved its SIRI position by 18% with the addition of ~15.43 million shares. The company now holds more than 101.38 million shares, worth $2.87 billion. Griffin’s stake is more modest; he holds ~5.1 million shares, which command a market value of ~$144 million.

Also laying out the bull case for the new look Sirius, Seaport Global David Joyce highlights how the big merger can be beneficial for the company and the stock.

“The long road to collapsing the Liberty Media control ownership into SIRI has reached its end. After what appears to be idiosyncratic deal-related trading pressures on SIRI shares, we think the single-class, single-corporate structure of New Sirius should significantly enhance trading liquidity from here and simplify the story, which could broaden the shareholder base and possibly improve sentiment and valuation,” Joyce opined.

“We like the stable business model with sticky satellite radio subscribers, a growing podcasting services and advertising business, and a manageable/modest decline in the Pandora business. The company is in the early innings of pushing its streaming service, as a strategy to attract and retain a younger user base,” Joyce went on to add.

Quantifying his stance, Joyce rates SIRI shares as a Buy while his $37 price target leaves room for 12-month returns of ~31%. (To watch Joyce’s track record, click here)

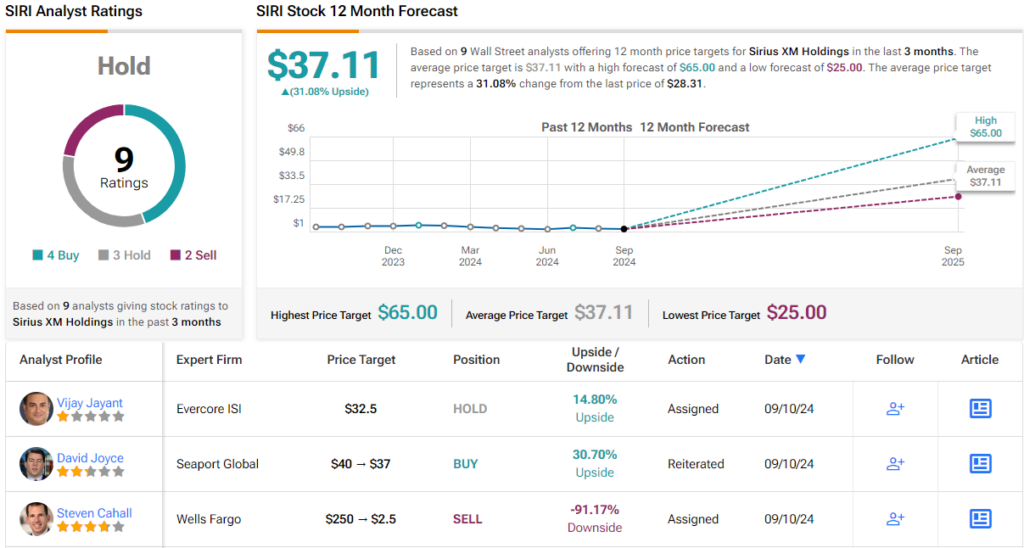

Joyce’s objective is roughly the same as the Street’s average target, although the ratings tell a bit of a different story. The stock only claims a Hold consensus rating, based on a mix of 4 Buys, 3 Holds and 2 Sells. (See SIRI stock forecast)

Ulta Beauty

Next up, is Ulta Beauty, a U.S. retailer offering a wide range of beauty products, including cosmetics, skincare, haircare, and fragrances, alongside salon services. Since being established in 1990, the company has grown to operate over 1,300 stores across the U.S., providing a combination of prestige, mass, and salon-quality brands under one roof. Its product lineup features both well-known luxury names and affordable drugstore options, thereby catering to a wide demographic of consumers.

On top of its retail presence, Ulta Beauty has a strong online platform and loyalty program, which helps boost customer engagement and sales growth. The company also emphasizes inclusivity and sustainability and promotes eco-conscious beauty initiatives.

All that generated revenue of $2.6 billion in the company’s fiscal second quarter, which represented a 4% year-over-year increase although the figure missed the forecast by $10 million. Likewise at the other end of the spectrum, EPS of $5.30 fell $0.15 short of the analysts’ target.

Those results didn’t help the stock, which in total has lost 24% so far this year.

Buffett and Griffin, however, must feel the company is poised for further success. In fact, during Q2, Buffett opened a new position with the purchase of 690,106 ULTA shares. These are currently worth almost $257 million. Meanwhile, Griffin increased his holdings by 267% with the acquisition of almost 96,000 shares. His total holdings now stand at 131,713 shares, which at the current price are worth ~$49.2 million.

While Loop Capital’s Anthony Chukumba acknowledges the difficult environment Ulta operates in, he believes the company is strong enough to withstand the headwinds.

“While we think it will take Ulta Beauty time to adjust to the ‘new normal’ competitive landscape, we believe the company’s formidable business model (e.g., prestige and mass products, strong customer loyalty program, robust omni channel offering, in-store salons) will eventually shine through,” the 5-star analyst explained.

“Management reiterated the following initiatives intended to regain market share: (1) strengthening the merchandise assortment; (2) enhancing the company’s social media relevance (including doubling the size of the company’s influencer network); (3) improving the digital experience, including enhancing search and product filtering; (4) further leveraging the Ulta Beauty Rewards loyalty program, including adding member-only events; and (5) evolving promotional levers,” Chukumba noted.

These comments underpin Chukumba’s Buy rating, which is backed by a $450 price target. This figure offers a 12-month upside of ~21%. (To watch Chukumba’s track record, click here)

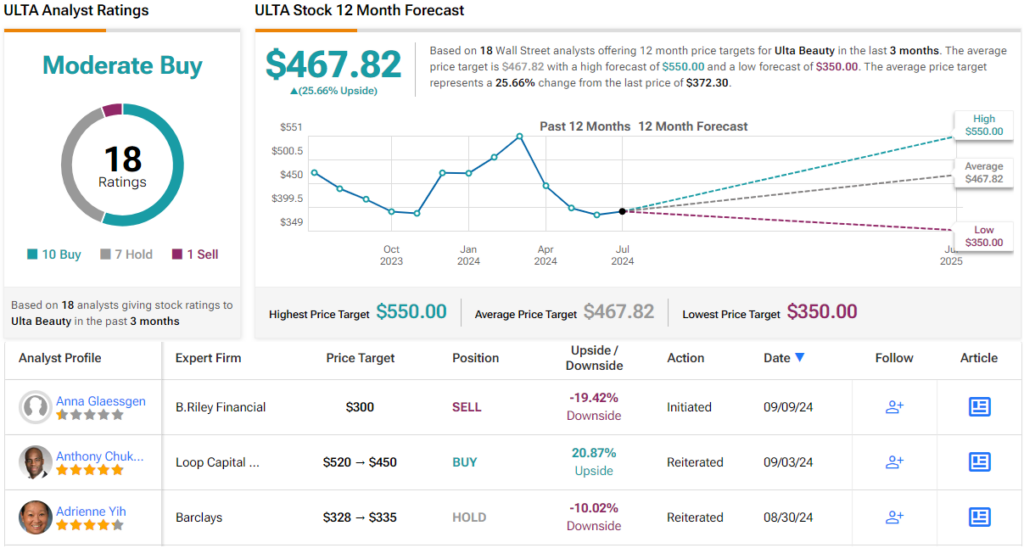

Turning now to the rest of the Street, where based on an additional 9 Buys, 7 Holds and 1 Sell, the stock receives a Moderate Buy consensus rating. Going by the $467.82 average target, a year from now, the shares will be changing hands for a ~26% premium. (See ULTA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.