Tripadvisor (NASDAQ:TRIP) stock plunged after the online travel company’s third-quarter earnings lagged the Street’s expectations. Adjusted earnings climbed 75% year-over-year to $0.28 per share but missed the analysts’ estimate of $0.39.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Tripadvisor stock nosedived 18.7% in Monday’s after-hours trading. The stock is down 16.3% year-to-date.

The company reported revenue of $459 million, which climbed over 51% from the prior-year quarter. The figure also surpassed the consensus estimate of $444.3 million. The top line benefited from strong demand for travel-related services in the reported quarter.

TRIP witnessed 8% growth in its average monthly unique users on Tripadvisor-branded websites.

Regarding the Q4 outlook, Tripadvisor expects revenue to rise in the low-single-digit range from 2019 levels. The company’s guidance is based on assumptions that travel demand remains strong despite macro woes, along with upbeat bookings and revenue growth witnessed by Viator.

Is Tripadvisor a Buy, Hold, or Sell Stock?

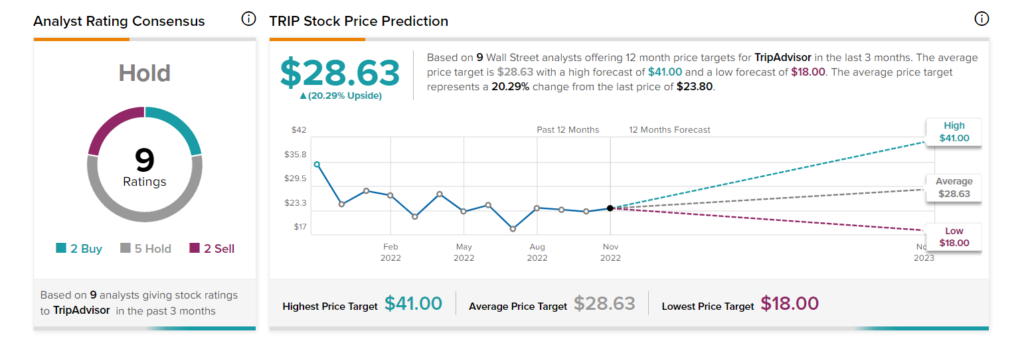

TRIP has a Hold consensus rating based on two Buys, five Holds, and two Sells. The average Tripadvisor stock price target of $28.63 implies 20.29% upside potential.