Trade Desk (TTD) has unveiled OpenPath, a new tool through which online advertisers can access premium digital advertising inventory. According to Reuters, the new tool will help publishers solicit bids directly from their clients. In addition, it should help reduce the reliance on global market leader Alphabet’s Google (GOOGL). Trade Desk’s stock price jumped 5.24% to close at $80.52 on Tuesday.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Trade Desk is a technology company that offers a platform for advertising. Ad buyers can create, manage, and optimize digital advertising campaigns on its cloud-based platform.

OpenPath’s Edge

With OpenPath, publishers will integrate directly with Trade Desk. In return, advertisers should gain direct access to advertising impressions, maximizing revenue from such impressions for the publishers. The new tool also addresses inefficiencies in the programmatic supply chain for digital advertising. Some of the partners to join OpenPath include Reuters, The Washington Post, and the USA Today Network.

The new advertising tool is expected to level the playing field for advertisers by ensuring transparency and objective access to the best digital advertising inventory. In addition, it should help address Google’s monopoly in managing ad auctions as publishers will now be able to solicit bids directly.

Trade Desk has already confirmed it will stop buying ads for clients from Google’s Open Bidding. Over the years, Google has been accused of taking monopoly profits from the advertising industry, claims it has vehemently opposed.

Analysts’ Take

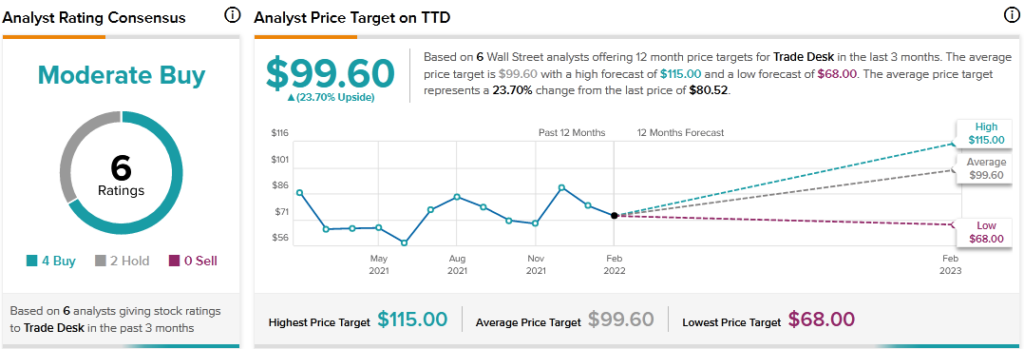

Stifel Nicolaus analyst Mark Kelley recently reiterated a Hold rating on Trade Desk stock with a price target of $68. Kelley’s price target suggests 15.55% downside potential. Trade Desk shares are overly stretched at current levels according to the analyst. He believes most of investor optimism in the stock is focused around Connected TV advertising, which has some room for improvement.

Consensus among analysts is a Moderate Buy based on 4 Buys and 2 Holds. The average Trade Desk price target of $99.60 implies 23.70% upside potential to current levels.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Resonant Shares Jump 260% on Acquisition by Murata

Glencore 2021 Profit Nearly Doubles

FirstService Posts Higher Revenues, Profits in Q4