The hybrid world of fintech can be a tough nut for investors to crack, as evidenced by SoFi Technologies (NASDAQ:SOFI). Despite a strong showing in the first half of 2024 and more than doubling its customer base over the past two years, SoFi’s stock has still dropped over 25% this year.

Indeed, SoFi’s Q2 earnings report brought good news for investors, with a record revenue of $599 million, up 22% year-over-year. Net income also saw significant improvement, reaching $17 million, a turnaround from the $48 million loss in Q2 2023. At the same time, SoFi raised both its Q3 2024 and full-year guidance, surpassing expectations.

So, why the disconnect between SoFi’s impressive growth and its struggling stock performance? One investor, known as On the Pulse, chalks it up to the market not fully understanding how to evaluate the fintech company.

“Investors lump SoFi Technologies in with other banks rather than technology companies that have considerable potential for scale,” writes On the Pulse. “This is a mistake.”

Traditional banks primarily profit from lending practices, but SoFi’s growth strategy focuses on expanding its range of financial services. According to the investor, this emphasis on financial services is what’s driving SoFi toward profitability.

“SoFi Technologies’ secret sauce is that the fintech has gotten extremely good at bringing new financial services products to its customers,” writes On the Pulse. “It is a nugget that investors may not fully appreciate.”

This underappreciation of SoFi’s unique business model, argues the investor, presents a compelling buying opportunity. “Paying just 2.6x forward sales for a fintech with substantial sales and EBITDA momentum is an excellent deal for investors looking for long-term gains in the fintech sector,” he concludes.

To this end, On the Pulse rates SoFi shares a Buy, while estimating an implied intrinsic value of $11-$13, which suggests potential gains of 46%-73%. (To watch On the Pulse’s track record, click here)

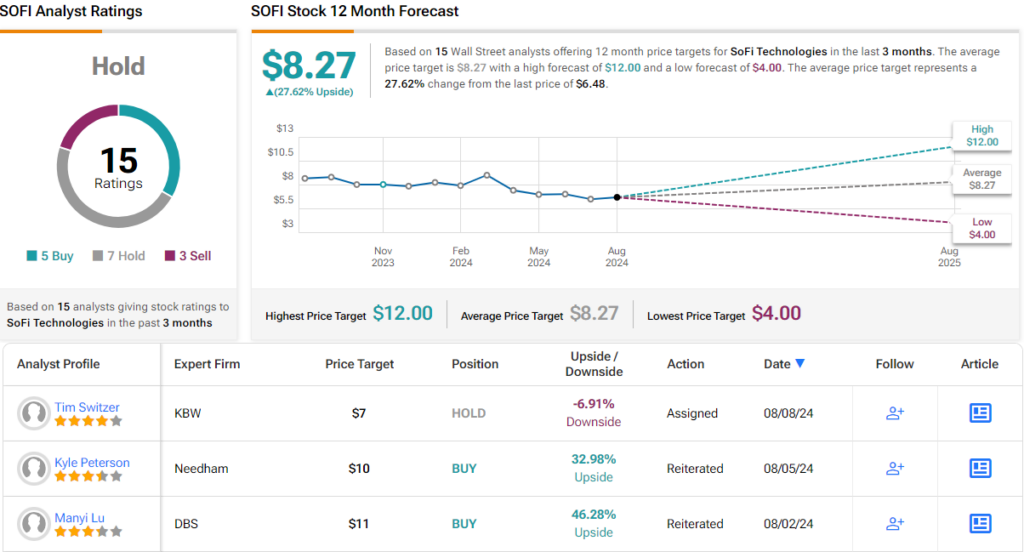

However, not everyone on Wall Street shares this optimism. The stock currently carries a Hold (i.e. Neutral) consensus rating based on 7 Hold recommendations, 5 Buys, and 3 Sells. Supporting the bullish view, though, is a solid upside of ~28%, with the average price target sitting at $8.27. (See SOFI stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.