Financial technology concern SoFi Technologies (SOFI) continues to post impressive financial results and show improvement in its profitability. The company’s business model, which combines lending, financial services, and a technology platform, has proven popular with customers and resilient in the face of macroeconomic headwinds. For these reasons, I’m bullish on SOFI stock.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Accelerating Revenue Growth

A big reason I’m bullish on SOFI is the company’s momentum, which is accelerating thanks to sales of its financial services and technology platform. Together, these business segments grew Q2 net revenues by 46% year over year and now contribute 45% of the company’s total sales, up from 38% a year ago. The company’s lending segment, which represents a large chunk of the total business, grew 5% in the same period.

SoFi’s financial services unit saw revenue increase a blistering 80% year over year to $176 million. This was driven by a 91% increase in new product additions, with services such as SoFi Money and SoFi Invest seeing impressive adoption rates. SoFi’s banking services were also a highlight, with deposits increasing $2.2 billion quarter over quarter, with 90% of these deposits tied to sticky direct deposit relationships. SoFi’s technology platform grew sales by 9% to $95 million.

Lastly, the company’s investment in alternative assets and mutual funds propelled its SoFi Invest business, resulting in a 58% year over year increase in assets under management. This portfolio of products continues to attract new customers, with SoFi adding 643,000 members in Q2, bringing its total to 8.8 million, a 41% increase from a year ago.

SoFi’s Profitability on the Rise

Another reason to be bullish on SOFI stock is the company’s improving profitability. SoFi Technologies recently celebrated its third consecutive quarter of profitability, posting net income of $17 million compared to a loss of $47.5 million a year earlier. Earnings increased 80% year over year to $138 million, with the margin reaching 23%, up from 16% last year.

A major driver of these profits has been SoFi’s net interest income growth. It grew 42% year over year in the most recent quarter, fueled by higher loan balances. The company’s net interest margin for the quarter was 5.83%, up from 5.74% a year ago. This was due to the rapid growth of SoFi’s personal loan originations, which hit a record $4.2 billion in this year’s second quarter, a 12% increase from the same period of 2023.

Despite conservative lending due to a soft macroeconomic environment, SoFi maintained high margins in its lending segment, achieving a 58% contribution margin for the quarter. Management’s focus on stringent underwriting has resulted in strong credit performance, keeping cumulative losses within their 7% to 8% assumption.

SOFI Stock’s Conservative Valuation

The strong financials and future growth prospects make me bullish about SoFi. Management raised guidance for the company’s Fiscal 2024 year, saying they now expect revenue of $2.425 billion to $2.465 billion, up from previous guidance of $2.39 billion to $2.43 billion. This represents projected annual growth of 17% to 19%, with earnings expected to reach $605 million to $615 million, a notable increase from prior expectations of $590 million to $600 million.

SoFi is also well-positioned to capitalize when macroeconomic conditions improve as interest rates decline. CEO Anthony Noto highlighted SoFi’s strategic positioning, forecasting that the company’s lending and deposit growth will rise as interest rates move lower. The U.S. Federal Reserve just reduced interest rates 50-basis points and signaled more rate reductions are coming.

SoFi’s valuation is also attractive. Trading at only 16.4 times forward earnings estimates, SOFI stock is reasonably priced compared to its peers. As profitability continues to improve, the market should be forced to recognize the stock’s underlying value.

Is SoFi Stock a Buy or Sell?

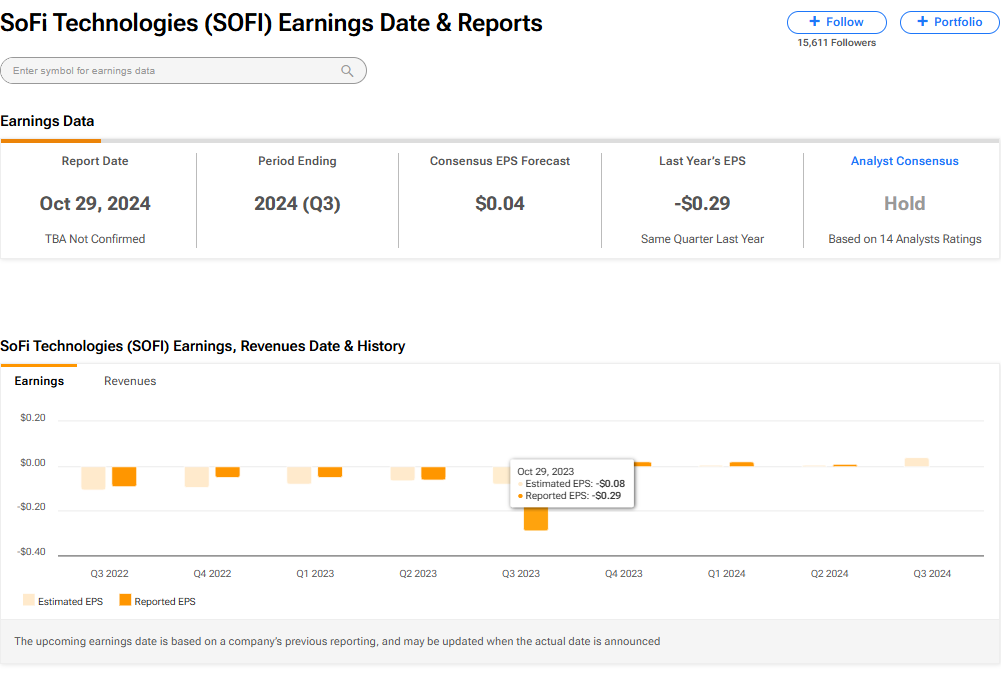

SoFi stock currently has a Hold rating among 14 Wall Street analysts who cover the company. This rating is based on five Buy, six Hold, and three Sell recommendations assigned in the past three months. The average price target on SOFI stock of $8.27 suggests upside potential of 2.73%.

If you’re wondering which analyst to follow concerning SOFI stock, the most profitable analyst (on a one-year timeframe) is Dan Dolev from Mizuho Financial Group (MFG), with an average return of 4.66% per rating and a 68% success rate.

Read more analyst ratings on SOFI stock

Takeaway

SoFi Technologies is a leader in the financial technology space and is positioned for sustained growth. Diversification and profitability improvements set the company up for future success. With the stock trading at a conservative valuation, SoFi seems compelling right now.