Shares of SoFi Technologies (SOFI) are up 3% after an analyst at Mizuho Financial Group raised his price target on the financial technology company’s stock.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Dan Dolev, a four-star rated analyst for Mizuho, lifted his price target on SOFI stock to $16 a share from $14 previously. The analysts also reiterated their Buy-equivalent Outperform rating on the stock. The upgrade comes after Mizuho Financial Group hosted SoFi chief financial officer (CFO) Chris Lapointe for an investor meeting.

After meeting with Lapointe, Dolev said that higher market multiples in the financial technology sector led it to raise its price target on the stock. SoFi has done an “impressive job” reducing net charge-off rates, even excluding the impact of delinquent loan sales, the analyst said in a research note.

SOFI Stock Marches Higher

The bullish note from Mizuho comes as SOFI stock continues marching higher. The 3% increase on November 19 puts the share price within a whisker of its 52-week high of $14.44 a share. So far in 2024, SoFi Technologies’ share price has gained 44%.

At Mizuho, the analyst team complimented the fintech firm on its efforts to reduce risk and improve its loans. SOFI stock has been rising since the company reported better-than-expected financial results for this year’s third quarter.

Is SOFI Stock a Buy?

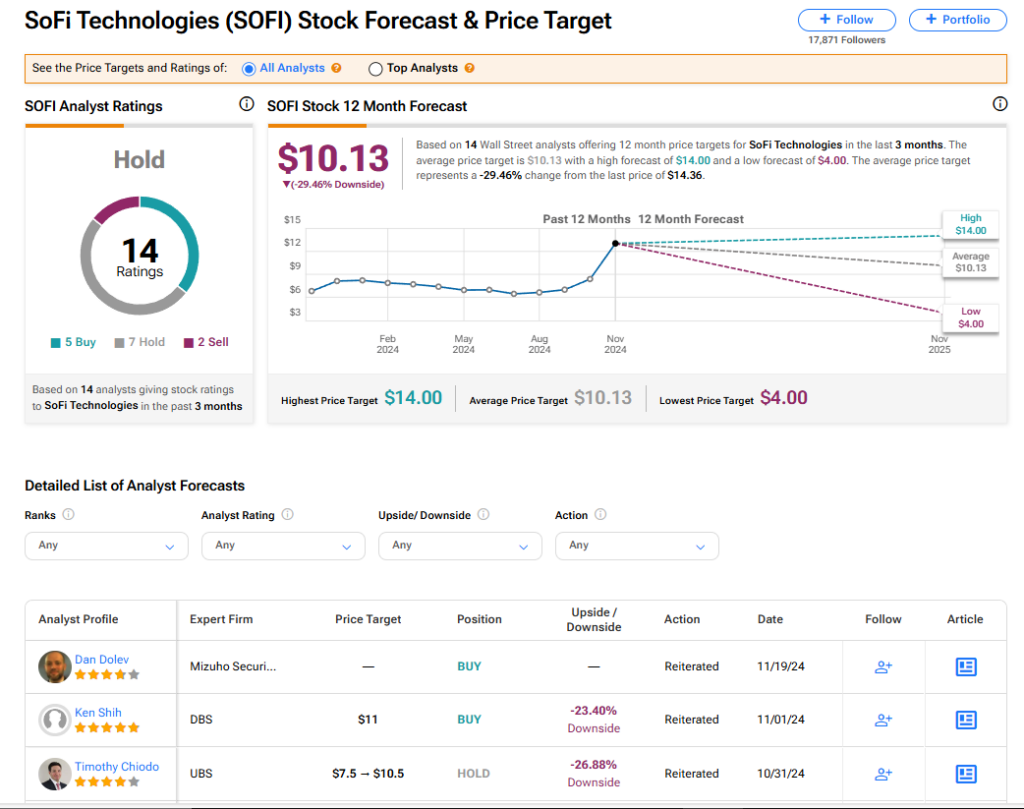

The stock of SoFi Technologies has a consensus Hold rating among 14 Wall Street analysts. That rating is based on five Buy, seven Hold, and two Sell recommendations issued in the last three months. The average SOFI price target of $10.13 implies 29.46% downside risk from current levels.

Read more analyst ratings on SOFI stock

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue