Registering its worst fall in the past 35 years, Target Corporation (NYSE: TGT) declined almost 25% to close at $161.61 on Wednesday. The dip in Target’s stock price also had adverse impacts on the broader market sentiment. The stock is currently down another 3.6% today.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The reaction arose over Target’s earnings disaster in the first quarter of Fiscal 2022 (ended April 30, 2022) and concerns over the health of retailers in the country. A couple of days back, another retail behemoth, Walmart Inc. (NYSE: WMT), delivered disappointing results, with an earnings miss of 12.2% in the first quarter of Fiscal 2023 (ended April 30, 2022).

Financial and Operational Highlights

Target reported adjusted earnings of $2.19 per share in the first quarter, lagging the consensus estimate of $3.07 per share by 28.7%. On a year-over-year basis, the bottom line decreased 40.7% from the year-ago tally of $3.69 per share.

Revenues came in at $25.17 billion, surpassing the consensus estimate of $24.48 billion by 2.9%. Also, the top line increased 4% year-over-year on the back of 4% growth in total sales and a 6.7% hike in other revenues. Demand was favorable for household, food and beverage, and beauty products.

Comparable sales in the quarter grew 3.3% year-over-year, with stores-originated sales increasing 3.4% and digitally originated growing 3.2%. It is worth mentioning that comparable sales growth was 22.9% in the year-ago quarter.

At the end of the first quarter, Target had 1,933 stores, an increase from 1,926 at the end of the previous quarter. Guest traffic growth was recorded at 4% in the quarter.

The company recorded a 10.4% increase in the quarter’s cost of sales and a 5.6% hike in selling, general and administrative expenses. High transportation, supply-chain issues, freight charges, and actions to lower huge inventory dragged down quarterly results.

Gross margin was down 430 basis points (bps) to 25.7%, while operating margin shed 450 bps to 5.3%. Earnings before interest, tax, depreciation, and amortization fell 39.7% year-over-year to $2.04 billion.

Balance Sheet and Cash Flow

Exiting the first quarter, Target’s cash and cash equivalents stood at $1.11 billion, down 81.2% sequentially. Also, its long-term debts decreased 1.3% quarter-over-quarter to $13.4 billion.

The company used $1.39 billion for its operating activities in the first quarter versus cash generation of $1.14 billion in the year-ago quarter. Capital expenditure at $952 million reflected year-over-year growth of 76.3%.

Projections

For the second quarter of Fiscal 2022 (ending July 2022), Target anticipates its operating margin to be “in a wide range centered around [the] first quarter’s operating margin rate of 5.3%.”

For the Fiscal Year 2022, ending January 2023, the company predicts revenue growth to vary within the low- to mid-single-digit range (the same as the prior guidance). The operating margin will be around 6% as compared with the 8% expected earlier.

Management Commentary

Target’s Chairman and CEO, Brian Cornell, opined that despite near-term headwinds, “our team remains passionately dedicated to our guests and serving their needs, giving us continued confidence in our long-term financial algorithm, which anticipates mid-single-digit revenue growth, and an operating margin rate of 8% or higher over time.”

Capital Deployment

Target used $48 million to repay long-term debts in the first quarter while distributing dividends of $424 million to its shareholders. It also made stock buybacks of $181 million, and its accelerated share repurchases (pending final settlement) amounted to $2.75 billion.

Wall Street’s Take

On May 18, 2022, Mark Astrachan of Stifel Nicolaus downgraded TGT’s rating to Hold from Buy while lowering the price target to $185 (14.47% upside potential) from $270. The changes were induced by the company’s first-quarter earnings miss and risks from high costs.

The analyst commented that the company’s cost headwinds are “likely to continue through at least year-end 2022, resulting in considerable earnings pressure.”

Meanwhile, Oliver Chen of Cowen & Co. maintained a Buy rating on TGT while lowering the price target to $190 (17.57% upside potential) from $265. The analyst opined that “TGT’s weaker print & guide sent shares sharply lower” and expects that “the stock will be range-bound in the near-term.”

Overall, the Street has a Moderate Buy consensus rating on TGT based on 12 Buys and seven Holds assigned in the past three months. Target’s price forecast of $220.43 implies 41.7% upside potential from current levels. Over the past year, shares of Target decreased 24.6%.

Website Traffic

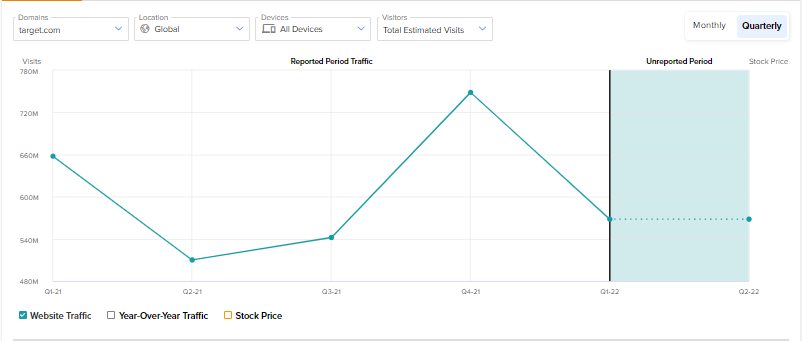

TipRanks’ Website Traffic Tool, powered by data from SEMrush Holdings, Inc. (NYSE: SEMR), offers an insight into Target’s performance.

According to the TipRanks Website Traffic tool, the total number of global visits to the company’s website (target.com) in Q1 showed a downtrend, mirroring a 24.1% fall from the previous quarter. Also, the first quarter number was 13.6% below the year-ago quarter.

It is evident that the predictions, which were based on TipRanks’ website visits data, are in sync with Target’s dismal results for the first quarter of Fiscal 2022.

Conclusion

Big retailers like Target and Walmart struggling with their numbers is worrying for the retail industry in the country. A shift in consumer preferences and profits at the mercy of high costs and expenses needs to be effectively dealt with. Until the cloud clears for Target, a wait-and-watch approach will be prudent.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Argo Blockchain’s Q1 Revenues Improve on Higher Hash Rate

Why Did Lowe’s Stock Lose its Sheen Despite Q1 Earnings Beat?

Home Depot Hits Home Run with Solid Q1 Results