The stock of financial technology company SoFi Technologies (SOFI) is on track to close out November 40% higher.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Heading into the last few trading days of the month, SOFI stock has risen 38%. The company’s share price has nearly doubled (up 99%) in the past three months amid a rally that has accelerated since SoFi reported strong financial results at the end of October.

At $15.49 a share, SOFI stock is trading close to its 52-week high. The ongoing rally is also being driven by expectations for less regulation of the financial services industry under a second Donald Trump presidency, and as the U.S. Federal Reserve lowers interest rates.

SoFi is essentially an online bank. Founded in 2011 at Stanford University, the company today offers its clients mortgages, personal loans, credit cards, insurance products, and bank accounts.

Bullish Outlook

The rally in SOFI stock has also been propelled forward by several recent analyst upgrades since the company’s last financial results were made public. Stephen Guilfoyle, a veteran Wall Street trader and four-star rated blogger on TipRanks, recently raised his price target on SOFI stock to $19 from $13.50.

Guilfoyle and other analysts note that SoFi recently launched a new robo-adviser platform that provides its clients with automated investment offerings. The robo-investing product could provide SoFi with a new catalyst that could further drive the share price upwards.

Is SOFI Stock a Buy?

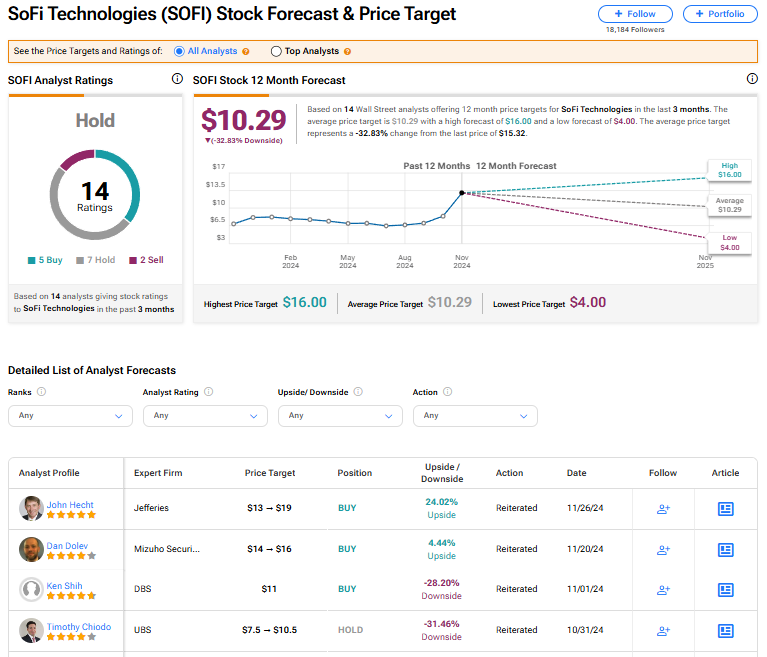

The stock of SoFi Technologies has a consensus Hold rating among 14 Wall Street analysts. That rating is based on five Buy, seven Hold, and two Sell recommendations issued in the last three months. The average SOFI price target of $10.29 implies 32.83% downside risk from current levels.