Shares of financial technology company SoFi Technologies (SOFI) dipped 2% on November 12 as the broader post-election rally in the stock market took a breather.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The pullback in SOFI stock comes after a huge rally that sent the share price up 15% in the last five trading sessions. Having risen above $14 a share, SoFi’s stock logged its best five-day performance in over a year.

The rally has been sparked by a combination of strong third-quarter financial results and optimism surrounding Donald Trump’s electoral win on November 5. Investors are betting on deregulation in the banking sector and among the student and home loans offered by SoFi under a Trump administration.

Rally Pauses

SOFI stock ended trading down 2% at $13.81 a share on November 12. The dip coincides with a broader pullback in the U.S. market after a big post-election rally. All three major U.S. indices ended the day in the red, with the blue-chip Dow Jones Industrial Average falling nearly 400 points and the benchmark S&P 500 index dropping 0.29% on the day.

Analysts and market commentators were quick to attribute the market’s pullback to a breather after a big run in a short period of time. However, markets may also be adjusting to a shift in expectations on interest rates. Some see fewer interest rate cuts from the U.S. Federal Reserve in 2025 as they expect inflation to rise as the Trump administration ramps up spending and cuts taxes.

Is SOFI Stock a Buy?

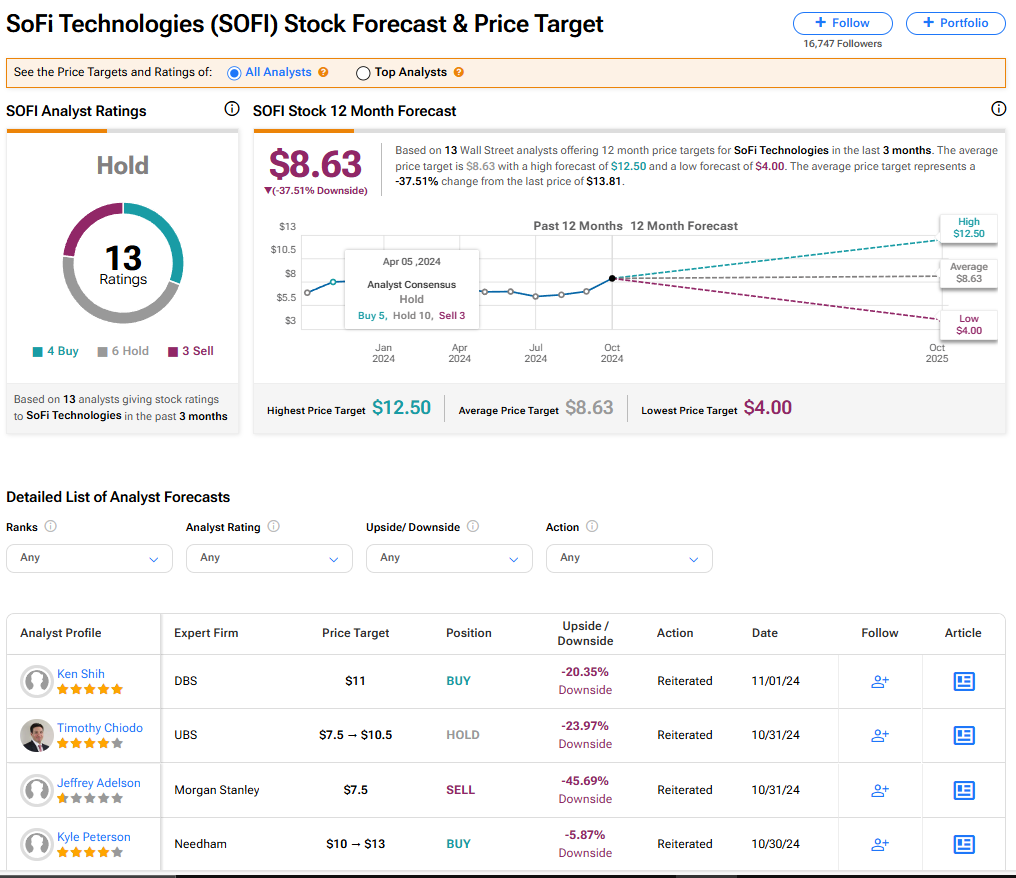

The stock of SoFi Technologies has a consensus Hold rating among 13 Wall Street analysts. That rating is based on four Buy, six Hold, and three Sell recommendations issued in the last three months. The average SOFI price target of $8.63 implies 38.84% downside risk from current levels.