The market capitalization of financial technology company SoFi Technologies (SOFI) is nearing $15 billion amid a sustained rally in the stock.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

SOFI stock is up less than 1% on November 13. However, the slight rise in the share price to $13.88 is enough to push the company’s market capitalization to $14.99 billion. The market cap growth comes as SoFi’s stock has gained 15% in the last five trading sessions.

The share price of SoFi Technologies has more than doubled in the past three months (up 109%). For the year, the stock is now up 39%. The stock has gained ground since late summer after the company issued strong quarterly financial results.

Catalysts for SOFI Stock

SoFi, which is an online company that offers its nearly 10 million customers mortgages, student loans and credit cards, is seen as a likely beneficiary of Donald Trump’s return to the White House. Regulations in the banking and finance space are expected to be lighter under a Trump administration.

Also, SoFi had been impacted by the cancelation of student loans under the current administration of President Joe Biden. The end of that student loan forgiveness program is expected to provide a catalyst to SoFi. Lastly, demand for the company’s loans is expected to rise as interest rates move lower.

Is SOFI Stock a Buy?

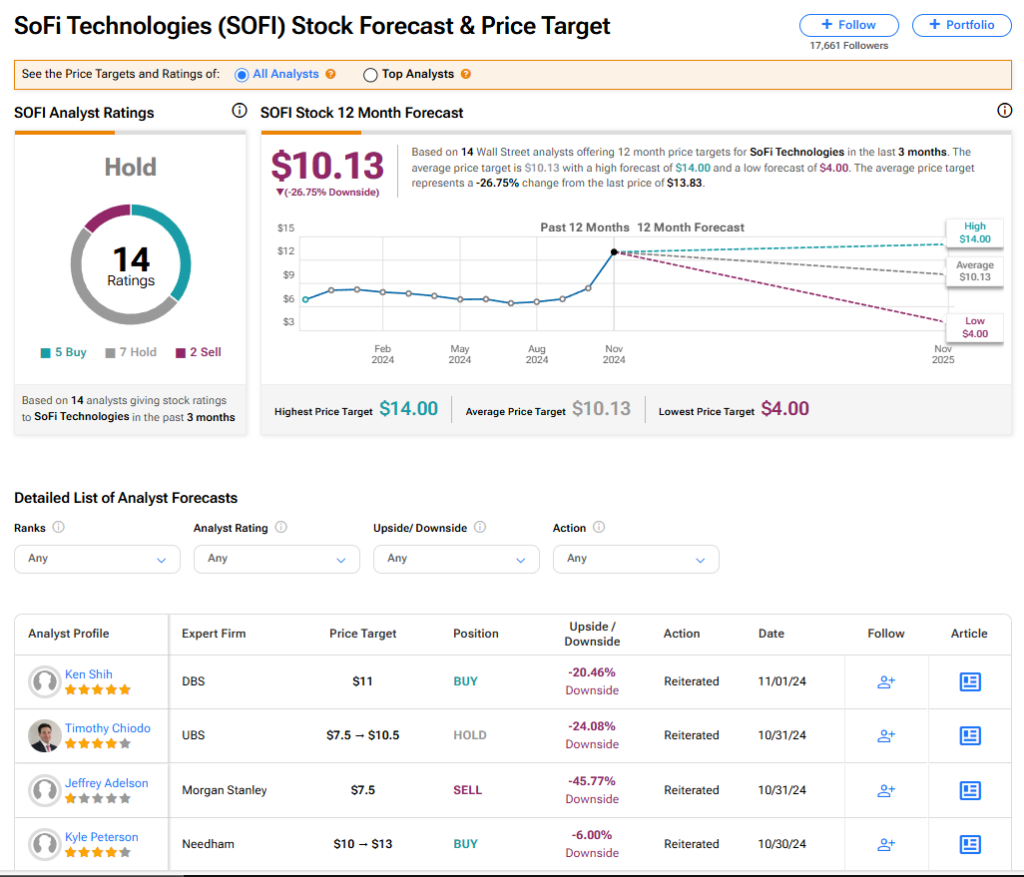

The stock of SoFi Technologies has a consensus Hold rating among 14 Wall Street analysts. That rating is based on five Buy, seven Hold, and two Sell recommendations issued in the last three months. The average SOFI price target of $10.13 implies 26.75% downside risk from current levels.