Financial technology company SoFi ($SOFI) is scheduled to release its second-quarter results on July 30, before the market opens. Analysts are expecting earnings per share to come in at $0.01 against a loss of $0.06 in the year-ago quarter. Meanwhile, analysts expect revenues of $564.39 million, reflecting a year-over-year decline of 16.6%.

Interestingly, SOFI has an encouraging earnings surprise history. The company exceeded earnings estimates in 10 out of the previous 12 quarters.

Impressive Website Traffic Trend

According to TipRanks’ Website Traffic tool, visits to sofi.com grew by 131.1% year-over-year in Q2. The company’s website traffic jumped to 45 million visits from 19.49 million in the year-ago quarter.

The increase in visits suggests that demand for the company’s offerings remained strong during the quarter.

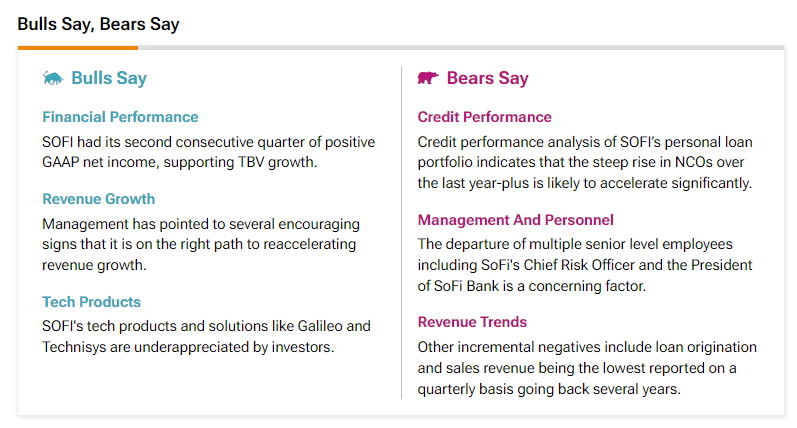

Insights from TipRanks’ Bulls & Bears Tool

According to TipRanks’ Bulls Say, Bears Say tool, bullish analysts expect SOFI’s tech products and solutions, like Galileo and Technisys, to support the company’s performance. Nevertheless, bearish analysts are worried about the rise in SOFI’s personal loan net charge-offs (NCOs).

Options Traders Anticipate a Large Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry; the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 14.58% move in either direction.

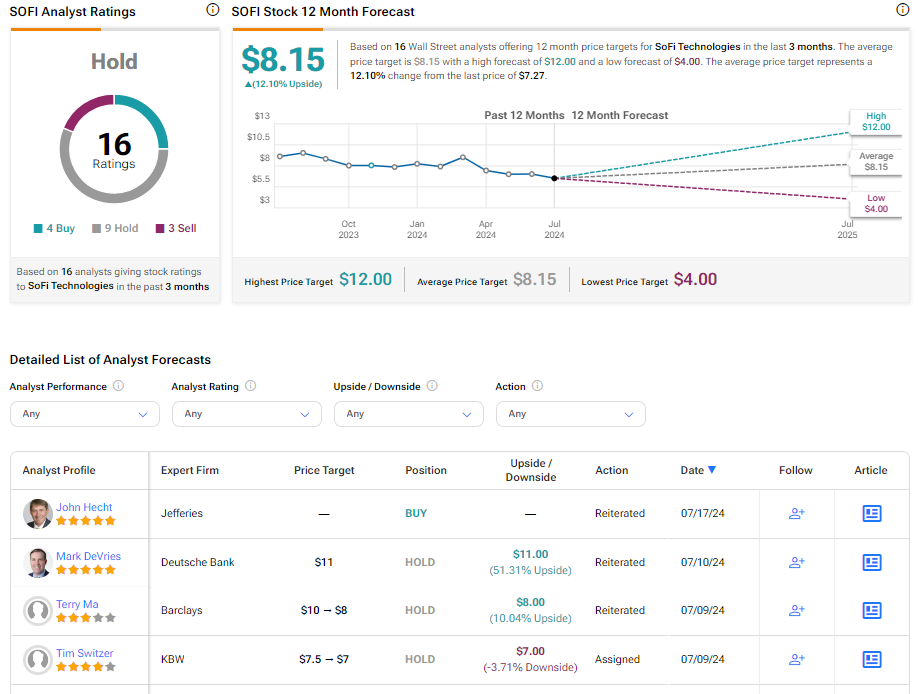

Is SoFi Technologies a Buy, Sell, or Hold?

Turning to Wall Street, analysts have a Hold consensus rating based on four Buys, nine Holds, and three Sells assigned in the past three months. After a year-to-date decline of 27%, the analysts’ average price target on SoFi stock of $8.15 implies an upside potential of 12.1%.