The stock of SoFi Technologies (SOFI) rose 3% on news that Donald Trump has scored a decisive win in the U.S. presidential election, and analysts see more gains ahead.

The online lender is expected to benefit along with the entire financial technology sector from less regulation under a Trump administration. Other fintech stocks such as Affirm Holdings (AFRM) and Block (SQ) each rose more than 6% on news of Trump’s electoral win.

Mizuho Securities (MFG) analyst Dan Dolev says that fintech stocks, including SoFi, should reap the rewards from deregulation in coming years, as well as less scrutiny from regulators and lawmakers in Washington, D.C.

Government Scrutiny

The Consumer Financial Protection Bureau has been investigating the online payments sector in recent, particularly the buy now, pay later space that is popular with consumers. At the same time, SoFi Technologies was impacted by the student loan forgiveness program undertaken by the current administration of President Joe Biden.

Less regulation and oversight is one of many potential tailwinds that are gathering around SOFI stock. Payment companies tend to be sensitive to interest rates, and SoFi is seen as benefitting as rates move lower in coming months.

Is SOFI Stock a Buy?

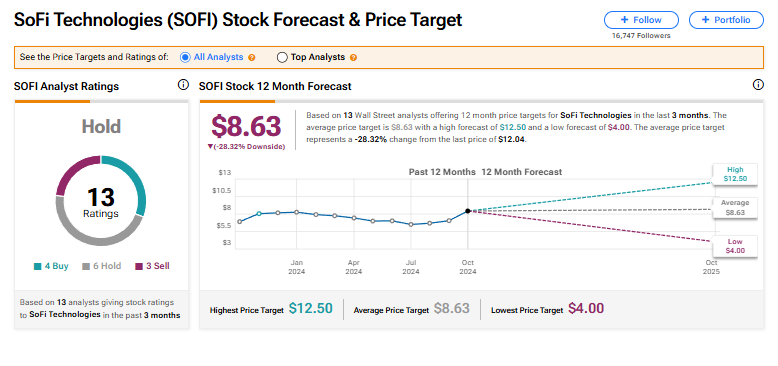

The stock of SoFi Technologies has a consensus Hold rating among 13 Wall Street analysts. That rating is based on four Buy, six Hold, and three Sell recommendations issued in the last three months. The average SOFI price target of $8.63 implies 28.32% downside risk from current levels.