Shares of Rocket Lab USA (RKLB) are up 23% after the aerospace company reported strong third-quarter revenue growth and announced a customer for its upcoming Neutron rocket.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Rocket Lab reported a Q3 earnings per share (EPS) loss of -$0.10. That was slightly worse than the loss of -$0.09 that was expected among analysts. However, revenue in the quarter totaled $104.8 million, up 55% from $67.6 million a year earlier.

Looking ahead, Rocket Lab forecast revenue in the current fourth quarter of $125 million to $135 million, which at the midpoint would see the company bring in about $430 million for all of this year. The company’s stock has increased 165% so far in 2024.

Neutron Rocket Customer

Along with its latest financial results, Rocket Lab USA announced its first launch deal for its upcoming Neutron rocket, which is a partially reusable rocket designed to send satellites into low Earth orbit. The company did not name the customer it has reached a deal with for use of the Neutron rocket.

However, Rocket Lab said that a “confidential commercial satellite constellation operator” signed for two missions in mid-2026, which Rocket Lab says were at a price “consistent with our target.” Previously, the company said it was aiming for a price of $50 million per Neutron rocket launch.

Is RKLB Stock a Buy?

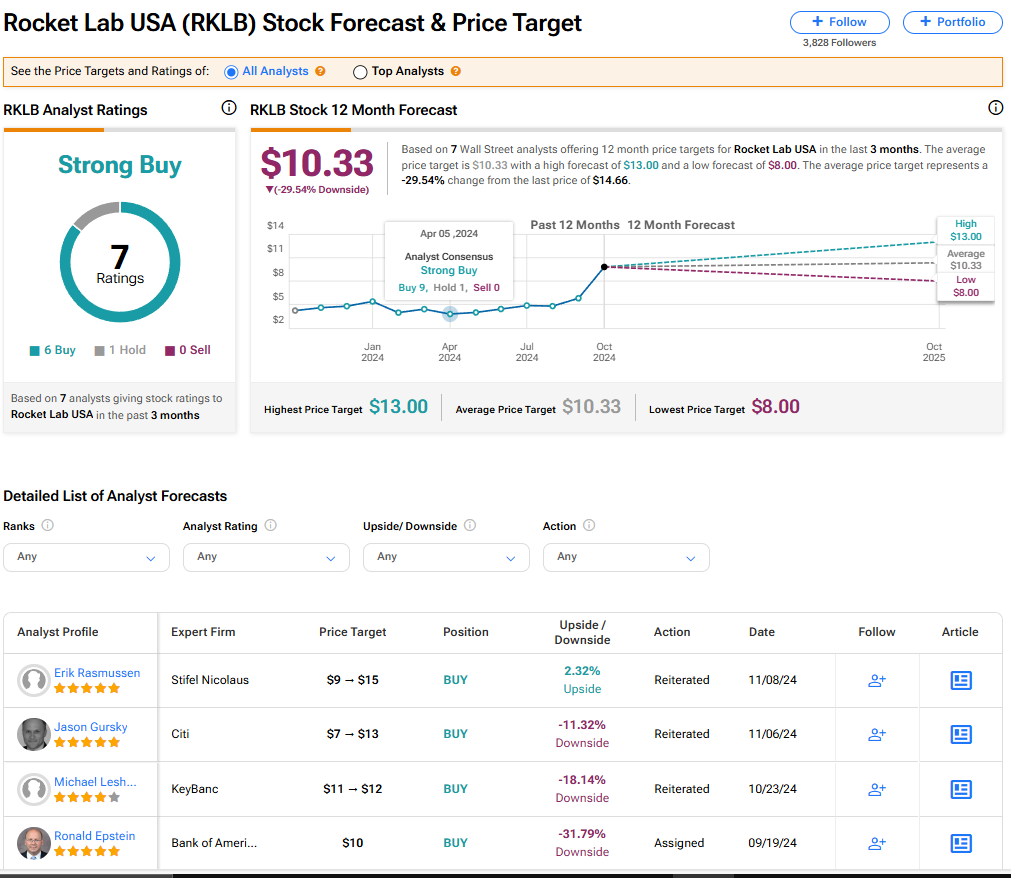

Rocket Lab USA stock has a consensus Strong Buy rating among seven Wall Street analysts. That rating is based on six Buy and one Hold recommendations made in the last three months. There are no Sell ratings on the stock. The average RKLB price target of $10.33 implies 29.54% downside risk from current levels.