Rocket Lab USA (RKLB) surged in trading on Monday after the company announced it had been awarded $23.9 million from the U.S. Department of Commerce. The funding will be used to expand its manufacturing capacity and capabilities at its Albuquerque, New Mexico facility, particularly for producing space-grade solar cells.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Earlier this year, the launch services and space systems company signed a preliminary term sheet for funding under the CHIPS and Science Act, marking a significant milestone for the company.

Why Has RKLB Received the Funding?

One reason RKLB was awarded the $23.9 million is that Rocket Lab’s space-grade solar cells, designed for extreme environments, are integral to satellites requiring high reliability and top-tier performance. Notably, Rocket Lab is one of only two U.S. companies specializing in the production of these highly efficient, radiation-hardened solar cells.

BAE Systems Could Also Be Awarded $35.5M

At the same time, the U.S. Commerce Department could be finalizing a $35.5 million award to BAE Systems (OTC:BAESF) to quadruple its semiconductor chip production in New Hampshire, according to Reuters. These chips are vital components in F-35 fighter jets and commercial satellites.

What Is the Future of RKLB Stock?

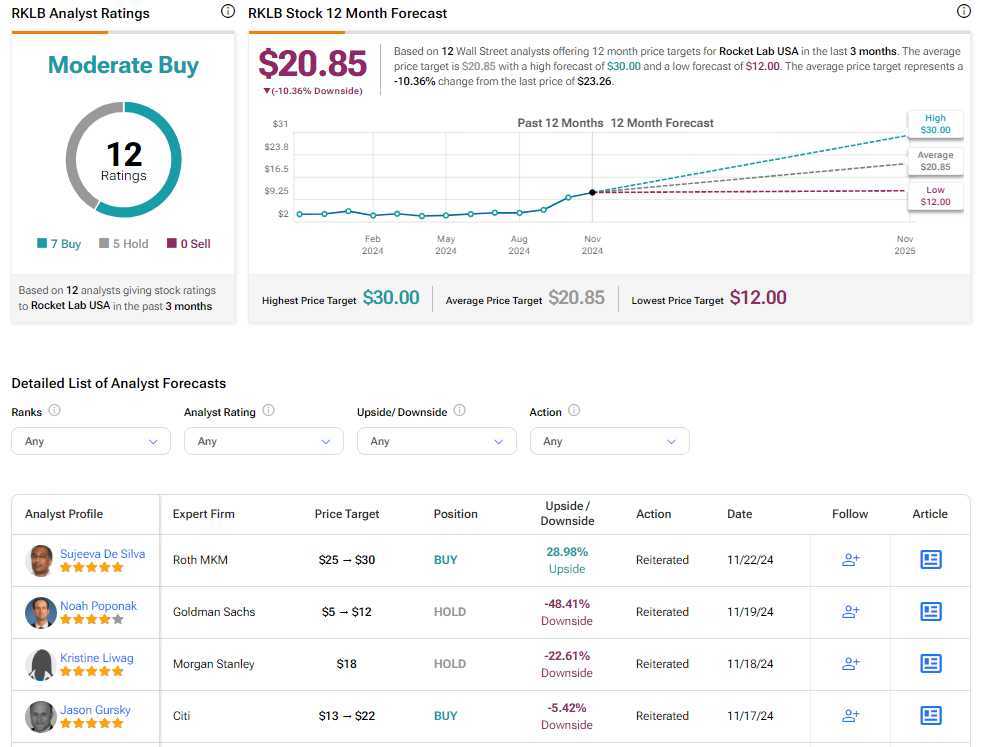

Analysts remain cautiously optimistic about RKLB stock, with a Moderate Buy consensus rating based on seven Buys and five Holds. Year-to-date, RKLB has soared by more than 300%, and the average RKLB price target of $20.85 implies a downside potential of 10.4% from current levels.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue