Shares of electric vehicle (EV) maker Rivian Automotive (RIVN) have advanced about 10% over the past month, fueled by the Q2 deliveries report and the news of a $5 billion deal with Volkswagen (DE:VOW) (VWAGY). However, the stock is still down about 31% year-to-date, indicating demand pressures in the EV space and profitability concerns. Analysts’ average price target indicates limited upside potential from current levels. However, Rivian’s upcoming Q2 results on August 6 could act as a catalyst if management provides a favorable commentary about the demand backdrop.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Concerns Over Rivian’s Financials Persist

Rivian stock rallied on June 26 following the announcement that Volkswagen will invest up to $5 billion, including an initial amount of $1 billion, in the U.S. EV maker as part of a new joint venture between the two companies to develop next-gen software.

Investors cheered the news as it addressed concerns about Rivian’s cash burn and huge losses to some extent. Another favorable development was the company’s announcement of better-than-expected Q2 deliveries. Rivian delivered 13,790 vehicles in the second quarter, beating its own guidance of 13,000 to 13,300 vehicles.

Despite these favorable developments, headwinds like macro uncertainty, a slowdown in EV demand, and price wars triggered by the intense competition in the EV space could continue to weigh on Rivian stock. Moreover, RIVN is not yet profitable and this continues to be a major cause of concern for investors.

To add to investors’ woes, last week a California state judge denied Rivian’s request to dismiss a lawsuit filed by Tesla (TSLA) in 2020. Tesla claimed that Rivian stole its trade secrets by hiring its former employees.

Expectations from RIVN’s Q2 Results

As discussed above, there are multiple near-term pressures that could impact investor sentiment on Rivian. However, any positive commentary by management while announcing the second quarter results on August 6 could boost the stock price.

Analysts expect the company to report a loss of $1.24 per share for Q2 2024 compared to a loss of $1.08 per share in the prior-year quarter. Revenue is expected to be almost flat year-over-year at $1.12 billion.

On July 18, Wells Fargo analyst Colin Langan raised the price target on Rivian Automotive stock to $18 from $10 while maintaining a Hold rating. The analyst raised the price target to reflect favorable updates related to deliveries, liquidity, and potential savings related to the Volkswagen joint venture.

For Q2 2024, Langan expects adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) of -$757 million, which is better than the consensus estimate of -$859 million and reflects higher-than-expected Q2 deliveries.

However, the analyst highlighted that his full-year adjusted EBITDA is about 7% below the consensus estimate, reflecting less raw material cost savings of the Gen2 R1 SUV, lower fixed costs leverage on the second half deliveries, and lackluster pricing. Overall, Langan is cautious about RIVN reaching breakeven gross profit by the fourth quarter.

Is Rivian Stock a Buy or Sell?

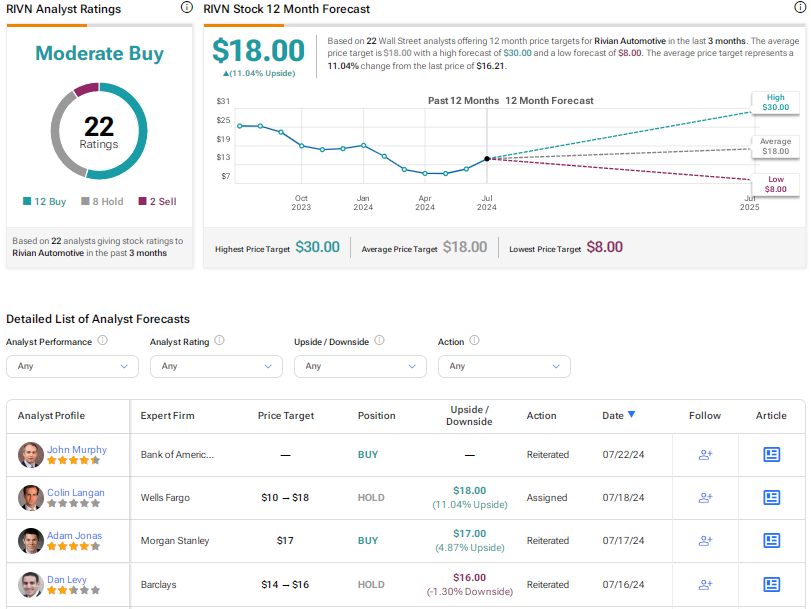

Wall Street is cautiously optimistic on Rivian stock based on 12 Buys, eight Holds, and two Sells. The average RIVN stock price target of $18 implies 11% upside potential from current levels.

Conclusion

Tesla’s recently reported Q2 results have reaffirmed investors’ worries about a slowdown in EV demand and the impact of price wars on margins. These pressures in the EV sector and macro challenges could impact RIVN stock’s movement. Investors are eagerly awaiting the company’s Q2 results to gain more insights into its financial position and the demand backdrop.