Vehicle protection company Xpel (XPEL) stock is rising today after reporting that it will be expanding its collaboration with Rivian (RIVN). The electric vehicle producer will now allow customers based in the U.S. and Canada to purchase Xpel’s Paint Protection Film (PPF) and Window Film products directly from its webpage. This could provide Xpel with valuable exposure as Rivian’s network of drivers continues to grow, creating more demand for protective vehicle technologies.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

What’s Happening with Xpel Stock?

News of this collaboration pushed Xpel stock up all afternoon, which led to it closing 1.72% higher on the day. The stock is still recovering from a difficult week, but this news could be exactly the positive catalyst it needs to continue trending upward and demonstrate sustainable growth. While shares have declined over the past two quarters, recent progress has pushed XPEL back into the green for the six-month period.

This news isn’t likely to have much of an impact on Rivian. While it probably won’t push shares down, there’s not much chance that it will directly benefit the stock either. However, it is likely a step forward for Xpel. With the exposure that Rivian provides to a growing network of EV drivers with expensive vehicles, the company will be in a great position to provide them with the protective products they need.

As a statement released today notes, “This is not the first collaboration between Rivian and XPEL, as Rivian already offers full-body XPEL PPF installed on select models at its factory.” Now, Xpel can continue to enjoy the benefits of the collaboration, further its reach into the fast-growing luxury EV market, and reach drivers who use Rivian’s trucks and SUVs for off-road purposes.

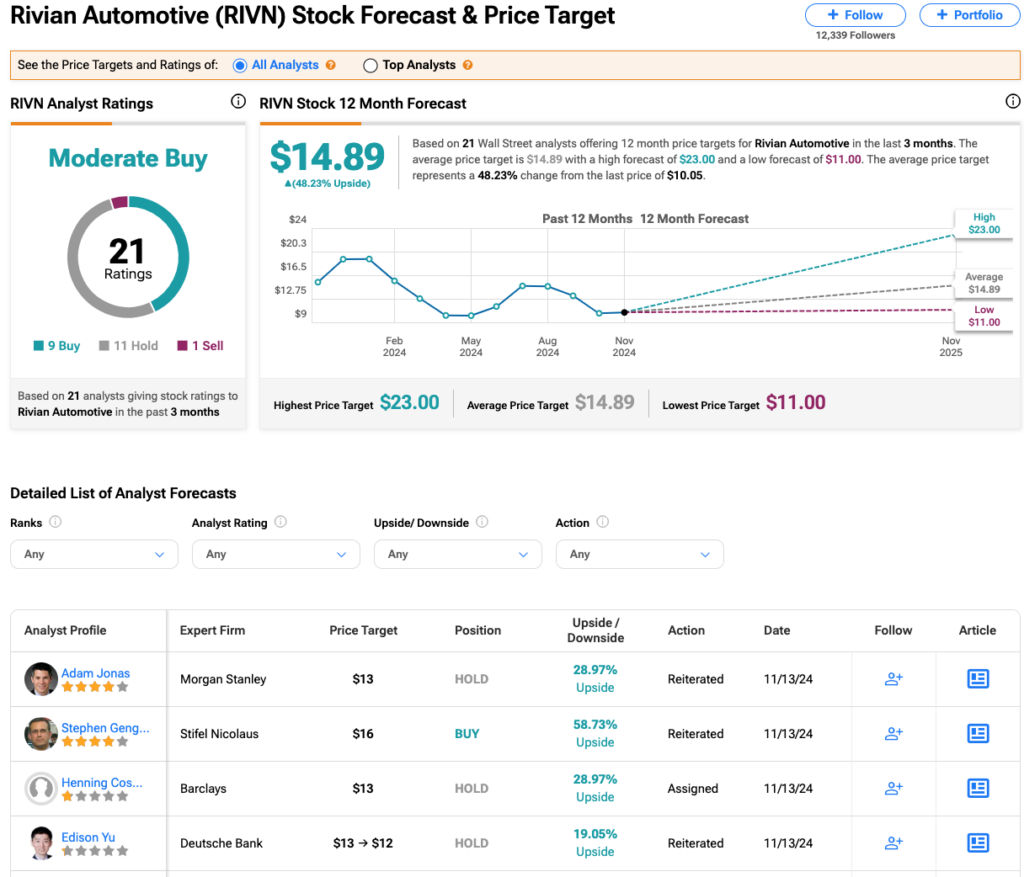

Wall Street Is Mostly Bullish on RIVN Stock

Most Wall Street institutions don’t follow XPel. However, analysts have a Moderate Buy consensus rating on RIVN stock based on nine Buys, 11 Holds, and one Sell assigned in the past three months, as indicated by the graphic below. While share prices have declined 36% over the past year, the average RIVN price target of $14.89 per share still implies 48% upside potential.