Electric vehicles (EVs) are at a critical juncture. While the industry enjoys strong backing from both governments and the public, the cars remain expensive, and some technological challenges persist.

However, with several EV companies launching new models and nearing profitability, EV stocks have caught the attention of Stifel wealth management.

Analyst Stephen Gengaro, writing for the firm, has taken a deep dive into both Rivian (NASDAQ:RIVN) and Lucid (NASDAQ:LCID), two of the pure-play EV makers that have brought cars to the market and attracted attention from customers.

Both companies recently reported their earnings, and Gengaro uses these financial results to assess which of the two stands out as the more promising EV stock to buy. Let’s take a closer look.

Rivian Automotive

The first stock we’ll look at is Rivian Automotive, an electric vehicle maker in business since 2009. The company survived its difficult pre-production development years, and its $14 billion market cap makes it the world’s fourth-largest EV firm. Rivian currently has two consumer-oriented models in production, the R1S and the R1T, which it describes as the ‘next generation’ of its flagship vehicles. It also has two new models, the R2 and R3, in development, with the R2 scheduled for launch in 2026.

All of Rivian’s vehicles are based on a novel concept, which the company has described as its ‘skateboard’ chassis. This is a vehicle platform, flat with customizable fittings pre-installed to handle a wide range of electric motors, battery packs, control systems, and seating and body styles. The system is designed for maximum flexibility during construction, and by giving each wheel its own independent electric motor, avoids some of the weight and complexity issues of traditional drivetrains while maintaining a high level of vehicle performance.

Rivian acquired its Normal, Illinois production facility in 2017 and has been expanding the factory and its capabilities ever since. Now operating on a regular production scale, the factory produced 9,612 vehicles during the second quarter of this year. During that period, Rivian also delivered 13,790 vehicles. In addition to its consumer-oriented vehicles for the general market, Rivian also produces an electric delivery van and has a long-term agreement with Amazon to deliver as many as 100,000 of these vans. Finally, Rivian and Volkswagen announced earlier this year the formation of a joint venture in electric vehicles. The agreement will bring Rivian a cash infusion from VW, of $1 billion initially and grow up to $5 billion in total. The companies are aiming to create the next generation in software-defined vehicle platform technology.

Earlier this month, Rivian released its financial results for 2Q24. The company announced a top line of $1.158 billion, supported mainly by vehicle deliveries, and had a bottom-line loss of $1.27 per share in GAAP measures. More importantly, Rivian management reaffirmed its expectation of realizing a modest profit by the end of this year.

That expectation of a turn toward profitability has Stifel’s Gengaro upbeat, as does the company’s liquidity prospects following the VW announcement. The analyst writes of Rivian, “We believe RIVN is making solid progress toward several key milestones including positive gross profit in 4Q24, positive gross profit in 2025, and launching the R2. Importantly, RIVN likely has sufficient liquidity to fund operations through the launch of R2 supported by its balance sheet, and pending the initial and planned investments from Volkswagen would have sufficient capital to fund the ramp of the midsize platform in Georgia. Lower-than-expected 3Q24 delivery guidance and a month of planned 2025 downtime in Normal likely weighed on the shares. We believe the story is intact…”

With this in mind, Gengaro rates RIVN shares as a Buy, and his $18 price target implies a one-year upside potential of 28%. (To watch Gengaro’s track record, click here)

Overall, Rivian gets a Moderate Buy rating from the Street’s analyst consensus, based on 22 reviews with a breakdown of 12 Buys, 8 Holds, and 2 Sells. The shares are priced at $13.95 and the $18 average price target matches the Stifel outlook of a 29% gain in the next 12 months. (See RIVN stock forecast)

Lucid Group

The second EV maker that Stifel looks at is Lucid Group, an EV company that has focused on high-end luxury vehicles. Based out of California’s Silicon Valley, the company’s vehicle line brings together luxurious body styling and interior design with the latest technology in electric vehicles, specifically to target the top end of the EV market.

Lucid currently has one model, the Lucid Air, in production, and another, the Lucid Gravity, in preparation for a launch later this year – in time for the 2025 model year. Both models are designed for maximal personalization in construction. Buyers can choose multiple options in body styling and accessories, as well as interior styling. At the same time, all of the vehicles feature high-visibility glass canopy design, electronic dashboards, plenty of legroom for driver and passengers, and a high range, estimated at 400-plus miles and complemented by large trunk space. Lucid also makes available a standard driver assistance package.

While the Air and Gravity are both luxury vehicles targeting a well-heeled customer base, Lucid boasts that it is also keeping prices down, for its niche, and that both models start for under $80,000 in the US markets.

In its recent release of the 2Q24 results, Lucid announced that its Q2 production was 2,110 vehicles, and that it is on track to reach a full-year production number of nearly 9,000. Deliveries in Q2 came to 2,394, for a 70.5% increase year-over-year.

On the financial side, Lucid’s Q2 revenue of $200.6 million was up almost 33% year-over-year – and beat the forecast by over $7.9 million. The company’s net loss, reported as a non-GAAP EPS, came to 29 cents per share – and was 2 cents per share deeper than had been expected.

On the same day as the earnings release, Lucid made another announcement, one that has high implications for the company’s cash position. This was the reveal that the Public Investment Fund (PIF) had committed to putting $1.5 billion into the EV maker, through a share purchase of $750 million and a delayed draw term loan also of $750 million.

Despite these developments, Stifel’s Stephen Gengaro advises caution, recommending a wait-and-see approach due to the uncertain near-term outlook for the company.

“Cash burn remains a concern, and execution on cost reductions and increasing volumes continues to be key to reaching profitability. We continue to believe LCID’s leading technology will drive long-term success, but we maintain our Hold rating based on uncertainty around timing of profitability,” Gengaro opined.

Along with that Hold rating, the Stifel analyst puts a $4 price target on Lucid shares, implying a one-year gain of over 25%.

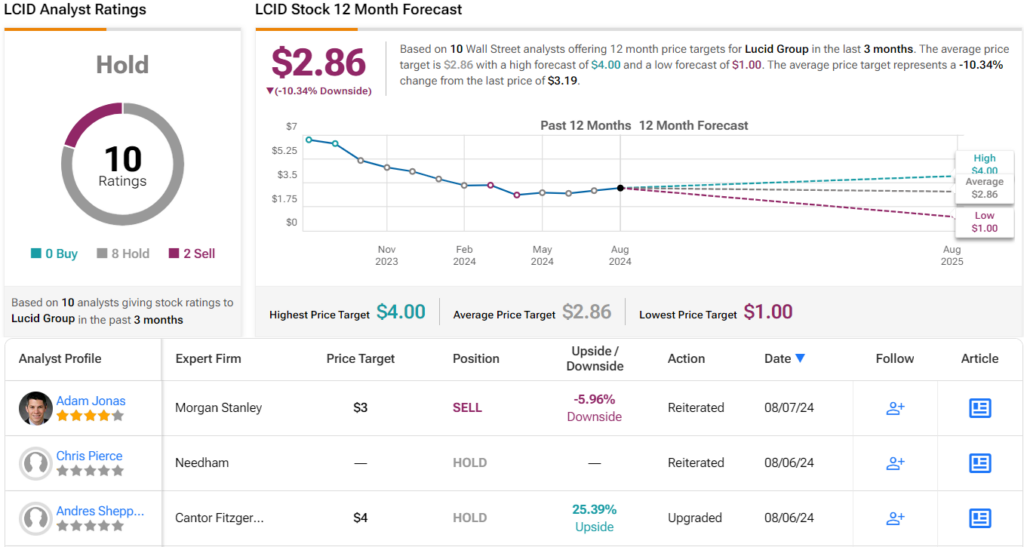

Overall, the Street has offered 10 analyst reviews of LCID shares in recent weeks, including 8 Holds and 2 Sells – making the consensus view a Hold. The stock is trading for $3.19, and its $2.86 average price target suggests that the shares will contract by almost 10% in the coming months. (See LCID stock forecast)

And there you have it – Stifel’s EV stock expert, along with Wall Street at large, has delivered the verdict: Rivian is the top EV stock to buy following the latest earnings report.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.