Shares of Lucid (LCID) jumped in after-hours trading after the EV company reported earnings for its third quarter of Fiscal Year 2024. Lucid produced 1,805 vehicles and delivered 2,781, which kept it on track to hit its yearly production goal of around 9,000 vehicles. It also brought in $200.4 million in revenue, up 45.4% and above estimates of $196.23 million, while its loss of -$0.28 per share beat analysts’ expectations of -$0.31.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Lucid ended Q3 with $5.16 billion in total liquidity but noted that it raised $1.75 billion in the current quarter, which will extend its financial runway into 2026. CEO Peter Rawlinson was upbeat about the firm’s momentum and record deliveries and opened the order book for the Lucid Gravity SUV. He also noted that cost-cutting efforts were leading to higher gross margins.

Risks Remain for Lucid

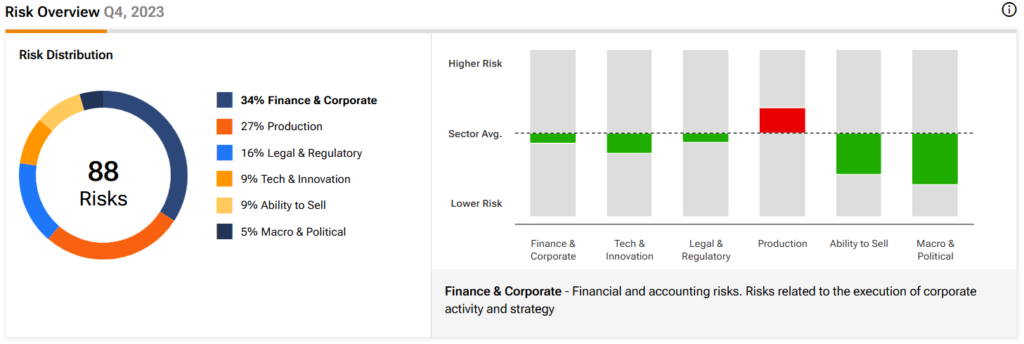

Nevertheless, risks remain for Lucid, as the firm will likely continue to burn cash for a while. In fact, the company discloses this as a risk in its filings, stating that it expects “to continue to incur substantial losses and increasing expenses in the foreseeable future.” Currently, Finance and Corporate is the category with the most risks for Lucid, as pictured below.

What Is a Good Price for LCID Stock?

Turning to Wall Street, analysts have a Hold consensus rating on LCID stock based on six Holds and two Sells assigned in the past three months, as indicated by the graphic below. After a 43% decline in its share price over the past year, the average LCID price target of $3.20 per share implies 42% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.